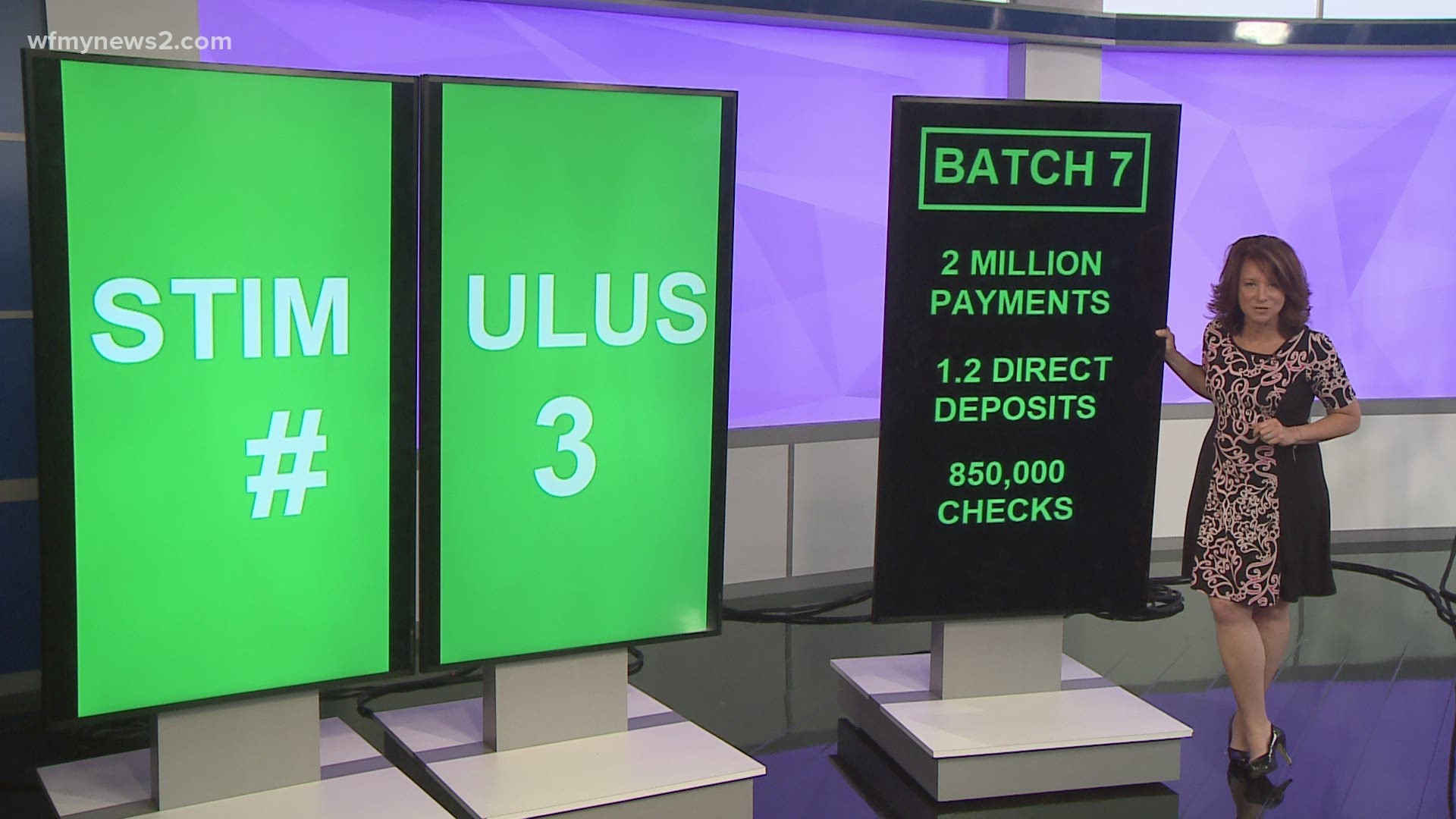

GREENSBORO, N.C. — It's another billion-dollar payday! Stimulus #3, the 7th batch of payments is out. Here is how the two million payments shake out:

1.2 million went directly into bank accounts

850,000 checks were mailed

The total: $ 4.3 Billion

The folks included in this payday all have one thing in common--- they recently filed a tax return which either gave the IRS the info to make the payment or it alerted the IRS they were owed money due to the return.

Remember, filing your taxes is free. The IRS has free software you can choose from. Even if you don't normally file, you should file to make sure you're getting all the stimulus money you're owed.

“In some cases, there may be people who didn't get one or both stimulus payments, but by filing the 2020 tax return and making sure line 30 is completed, they may be able to get a refundable credit,” said Kevin Robinson of Robinson Tax & Accounting Services.

The thought of doing taxes when you haven't done taxes in a while may seem overwhelming, but it doesn’t have to be.

The 1040-SR, it’s the seniors' tax form, is just three pages. On line 30 is the Recovery Rebate Credit, which is your stimulus payment. There is a worksheet to help you figure out what you need to put down on line 30.

The IRS has been making Stimulus #3 payments since March. The payments hit accounts on Wednesdays. The total so far is 163 million payments totaling $384 billion.

It's a lot of money For context, North Carolina Governor Roy Cooper proposed a state budget for next year of $27.3 billion. The stimulus payments are 14-times more than our state budget.