GREENSBORO, N.C. — No one wants to talk about death or about life insurance, but it's better to know whether you need it or not.

To determine if you need life insurance, ask yourself: if I were to die now, would anyone endure financial hardship?

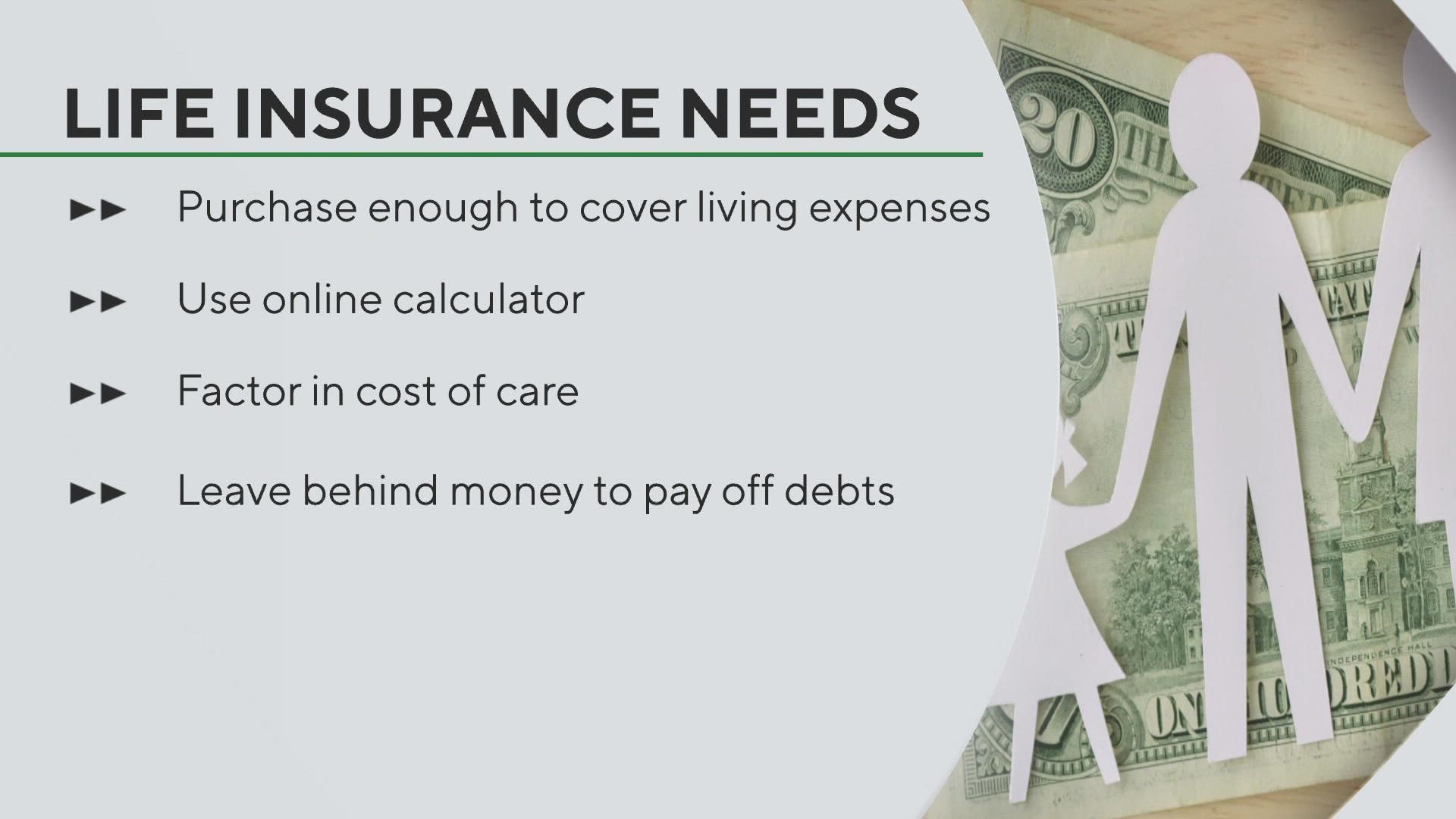

“If the answer is yes, you'll need to purchase enough coverage to help pay for their living expenses. There are online calculators that can help you figure that out -- and if you're the primary caretaker for your children or adult parents, factor in the additional cost of care for them. If you're a single parent or the primary wage earner, you may want to leave cash to pay off debts, like student loans or the mortgage,” said Jill Schlesinger, CBS News Business Analyst.

What kind of life insurance should you get? Your main choices are Term life insurance or Whole Life insurance.

Nerdwallet compares the two in an easy-row graphic.

In short, Term life gives you the choice of policy length.

For example, 20 years. You can pay for just the 20 years—like when the kids are in school and if you died-- they would be covered. Once the 20 years is up, no more coverage.

The premiums typically stay the same all 20 years and it's a lower premium payment.

Whole Life insurance is for life. No matter if you died a year or 50 years after you got the insurance, it pays out.

Also, Whole Life accumulates a cash value, meaning it's like a savings account you can borrow against or stop the policy and use the money. The downside of Whole life is the cost.

Nerdwallet has a few examples of costs for different age groups when it comes to Term or Whole. The difference is hundreds of dollars a year versus thousands of dollars.