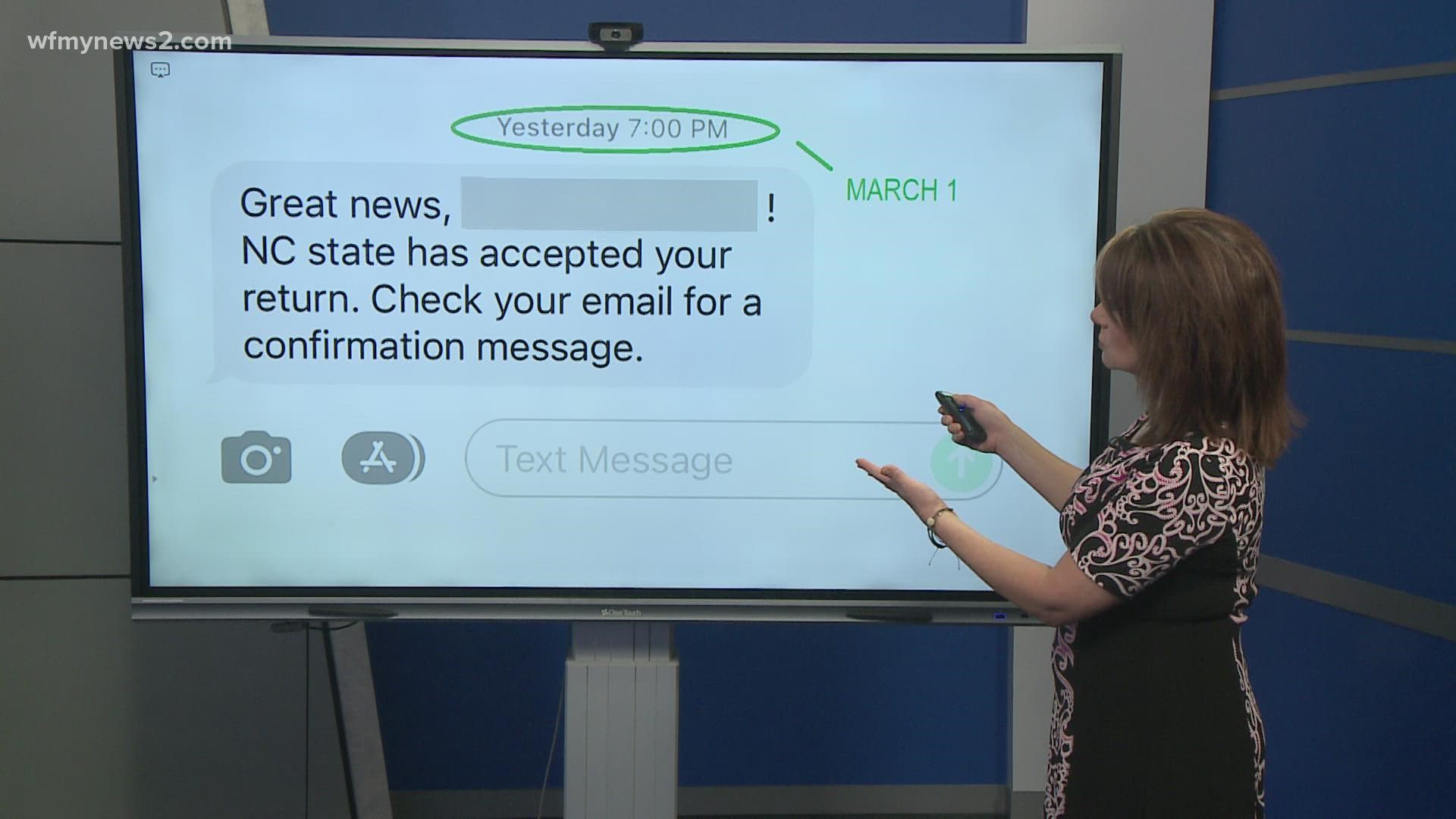

GREENSBORO, N.C. — A co-worker got a text saying: Great news, NC state has accepted your return. The date was March 1, 2022. Was it for real? Yes!

The North Carolina Department of Revenue site confirms the state started processing returns as of March 1. If you filed your taxes already, the tax software will just automatically push to the North Carolina site. Easy enough.

Now, when will you get your refund? That really is what you want to know, right? When does the money get to your bank account?

The NC State Department of Revenue is already saying refund delays are expected. So, basically, April. The state will spend most of March processing all the returns and the backlog of returns and refunds are expected in April.

Why is there a delay?

This delay is due to the late approval of the state budget, which included multiple tax law changes. The later start date allows NCDOR time to complete the testing of system updates and approve updates in commercial tax preparation software, which are required to implement changes made by the final budget enacted in late November 2021.

While that may seem like a long time to wait, there are still people waiting to get last year's federal tax refunds.

“They're frustrated and they're still waiting on the refunds from last filing season. Taxpayers who called the IRS toll free line last year were only able to reach an IRS employee 11% of the time. Thousands of businesses are still waiting to receive the employee retention credit and other benefits that congress has provided. And although the IRS' "where's my refund tool" received more than 632 million hits, it often was unable to answer the question,“ said Erin Collins, National Taxpayer Advocate.

Unfortunately, getting someone who can help you on the IRS phone line is nearly impossible, but there is another way to find out information about your money.

“Another option is to create an account with the IRS. It's on their website, it's easy to do and this will show you what has been accepted, processed, you can ask for transcripts,” said JR Cecil of Liberty Tax Services.

This is the IRS's cheat sheet for setting up an online account to access tax information. It takes you through the steps to create that account. Once you have it, you can check your economic impact statement amounts and if you're waiting on your refund there is an entire tax return section including:

Key information from their most recent tax return

Digital copies of notices or letters from the IRS