GREENSBORO, N.C. — Just recently a Greensboro apartment fire left 14 people without a home and without all their stuff.

Whenever something like this happens, folks ask, “Does the landlord or the apartment complex company pay to replace my stuff? Is my landlord liable? Why doesn't their insurance cover me?”

“They're not responsible for your stuff and they can't insure something they don't own, so they can't insure your stuff. You're responsible for taking care of your own items,” said Christopher Cook of Alliance Insurance Services.

The landlord's insurance pays for the building itself, but your clothes, furniture, belongings, that are all covered by your renter's insurance.

Renter's insurance isn't required by law although many landlords or apartment complexes require it. They are private businesses and they can do that.

Not only can it protect whatever you have inside the home, but renters insurance can also cover items that are stolen out of your car and can even provide for living expenses if you're displaced.

"Renters insurance is fairly standardized, though coverage can vary based on the insurer and where you live. Bottom line: make sure you understand your policy—what’s covered and what’s not,” said Penny wang, Consumer Reports Money Editor

Renter's insurance can cover the damage from fire or tornado, a broken pipe that floods your place.

“You don't know when you're going to need it until you need it. And then once you need it, you're glad that you have it,” said Amani Elsawah, a flood victim.

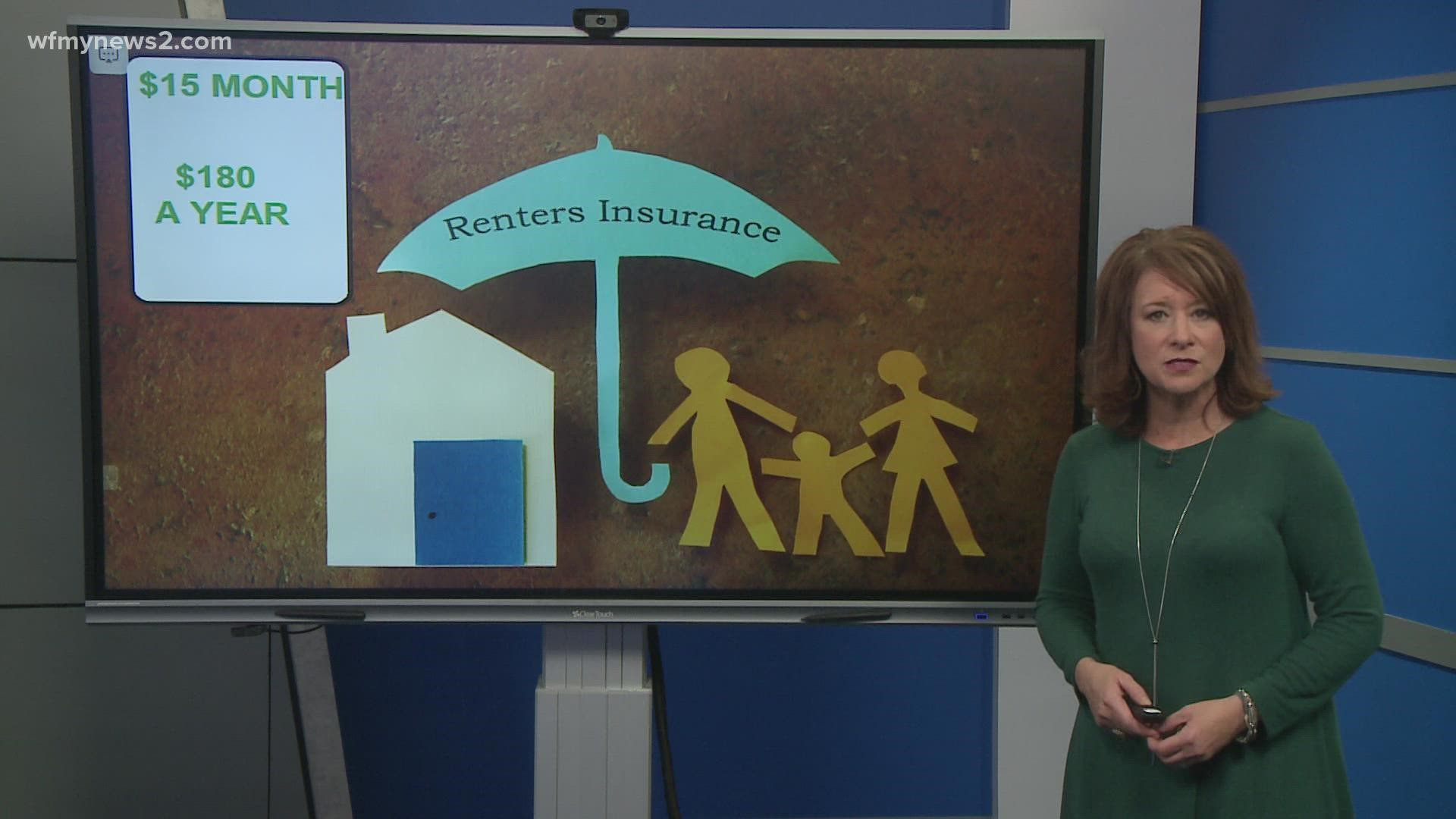

Renters insurance is relatively inexpensive, usually no more than $15 a month, that’s $180 a year to protect all your things.