GREENSBORO, NC -We're way past Christmas. We are into the New Year and yet we are still talking about the GRINCH! This time, the little green fella is stealing money from you!

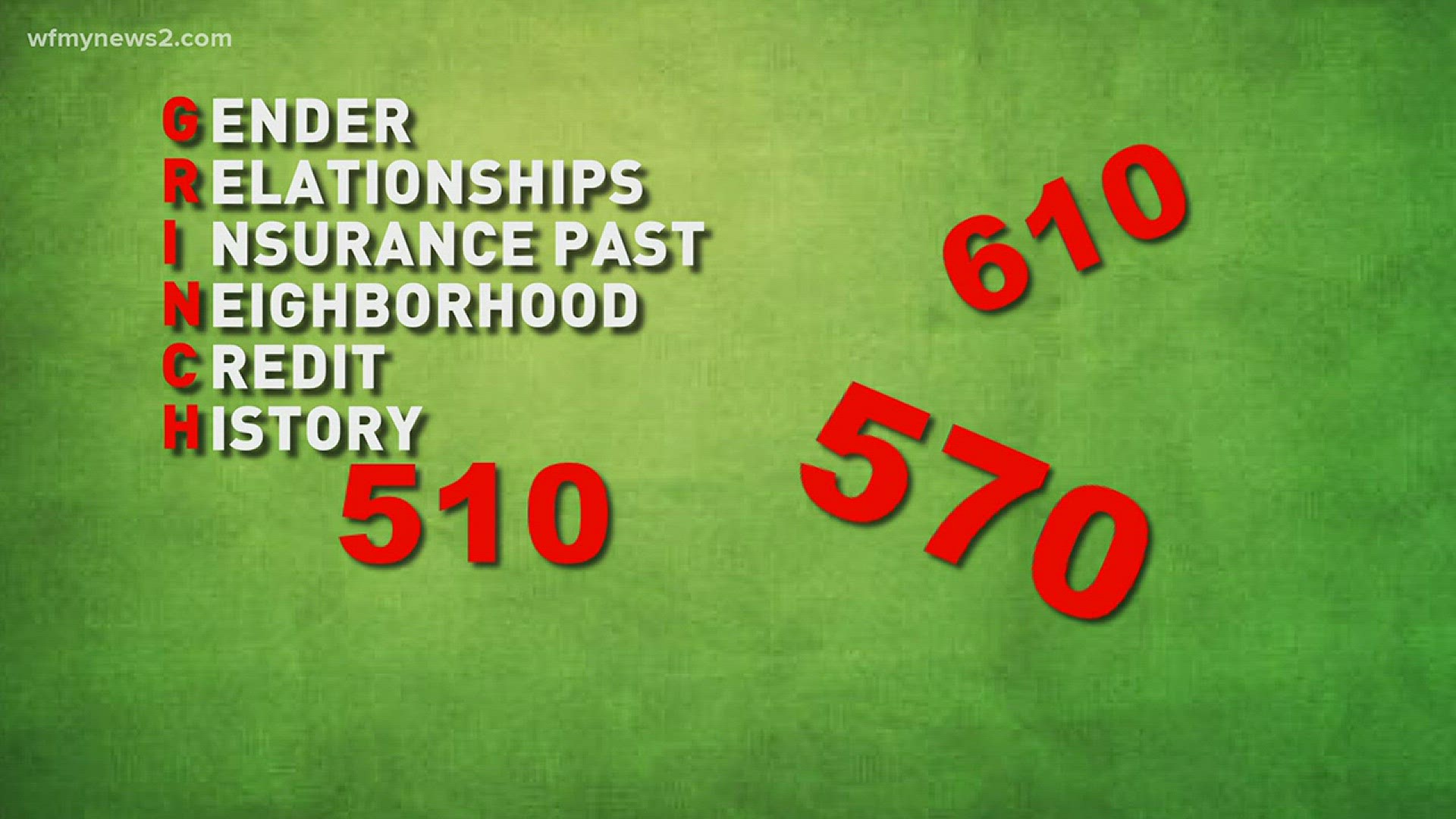

Turns out there's five surprising factors that may affect your insurance rates. Gender, Relationships, Insurance past, Neighborhoods and Credit History. (G.R.I.N.C.H)

According to NerdWallet, a recent report show men and women, with a perfect driving record, show disparities when it comes to insurance quotes. Women ages 40 to 60 received higher insurance quotes than men. Apparently, there isn't enough data to back up a claim that women in this age group are riskier to insure.

CFA director of insurance J. Robert Hunter, who led the study, told NerdWallet, “I would assume they have data showing this shift, but I have never seen such data.”

Meanwhile, if you're single, you'll pay more than a married person. Single people get in more accidents making their rates higher (even with a perfect driving record.)

The ghost of insurance past can haunt you. Turns out if you ever had insurance with a company that covers lots of high-risk driver, it could mean you'll pay more at your next company (again, if with a great driving record.)

Living in a city means you'll pay more than if you live in a rural area. And if your neighborhood has lots of crime, you'll pay more as well.

Finally, bad credit means higher insurance rates. In North Carolina, on average, a driver with bad credit will pay over $360 more than a driver with good credit.

Insurance prices are complex, we get it! But, you're in control. Make sure you shop around and get several quotes before you commit. The folks at NerdWallet make it easier to start comparing. Just click here -> https://www.nerdwallet.com/blog/insurance/cheapest-car-insurance-in-north-carolina-nc/