GREENSBORO, N.C. — It's not just you and it's not your imagination, everyone around you is thinking the same thing: certain bills are really going up.

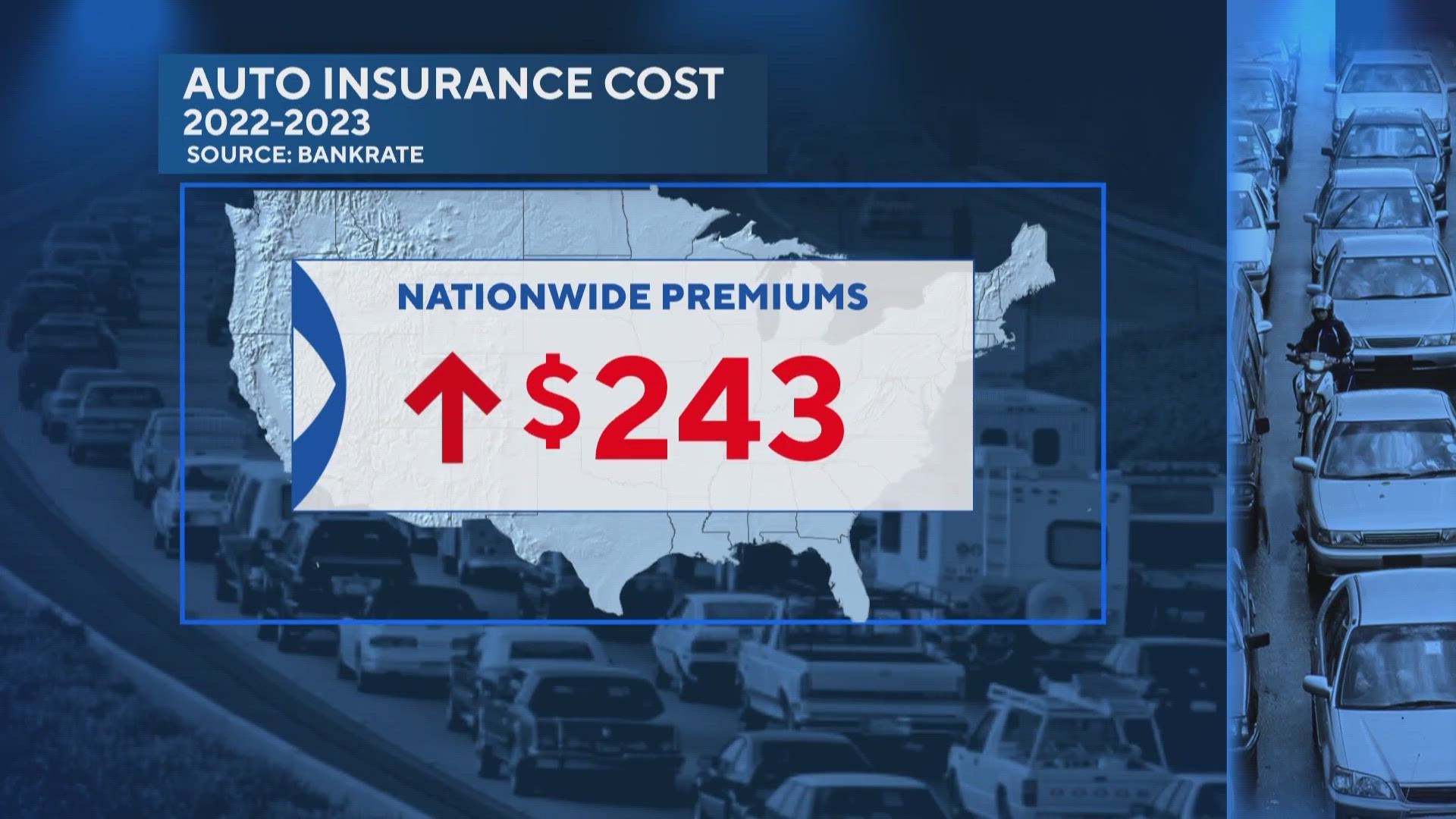

People nationwide are feeling the pinch when it comes to car insurance. According to Bankrate annual premiums have increased by about $243 to more than $2,000 a year.

For some drivers, insurance premiums cost more than the car loan.

"I'm paying $351 a month, which is more than I pay for my car every month," said one driver in Florida.

Cheaper insurance rates can often be found by calling around. Sometimes bundling car and home insurance together can lead to a better rate. People who work from home may qualify for a low mileage discount. Car owners might consider cutting parts of their policy.

"Do you need, for example, to have the cost of a car rental covered? Do you want to have essentially towing insurance," said Mark Hamric, Bankrate senior economic analyst.

Auto insurance has several components.

Liability. This is when you get into a crash.

Liability covers bodily injury or property damage to other drivers. It is required.

Collision. This covers the actual crash damage to the car that's required too.

Comprehensive. This covers which covers theft, damage to your auto due to theft, break-in, a falling tree, and ice. This is not required.

Comprehensive coverage is one of those areas that could you could say no to and it could save you on your monthly premium. But, if your car gets stolen, a tree falls and hit it, you'll be paying for it out of your own pocket.