GREENSBORO, N.C. — “We started last week with a hurricane and we ended the week with an earthquake. I don't think people have a clue as to what is not in their insurance policy,” said Christopher Cook with Alliance Insurance Services.

What is not in your standard homeowners insurance policy? Flooding, earthquake damage, and wind damage. For example, damage from Sunday’s earthquake would not be covered unless the homeowner had earthquake coverage. Most folks don’t have this extra coverage.

Cook says only two of his 4,000 customers have earthquake coverage. And right now, even if you had the money to buy coverage, you can’t get it.

“We've already had companies come out to us and say do not issue insurance for seven days, they need to see what is going to happen before there are policies issued. Then there is a two-week waiting period before we do that. You have to be cognizant that if the ground is still shaking, companies aren't going to let you add coverage," added Cook.

The earliest you could get earthquake insurance is September. It's not all that expensive, to cover a $200,000 house, the estimate is about $200 dollars a year (break it down, even more, it’s $16 a month). Something to note: earthquake insurance doesn’t have a flat deductible if something happens, it is a percentage of your policy. This means you could have a $4,000 deductible versus a flat $500 like when you file a fire claim.

Cook says it's worth having your insurance agent run the numbers for you-- so you can decide if you think the risk is worth it.

Much like earthquake insurance, you can’t get flood insurance right before a storm is coming.

Christopher Cook said, "I get this question all the time, it starts like, ‘Hey there is a massive storm in the Bahamas and it looks like it is coming to us. I need to add flood insurance’. My answer is, ‘I'll be happy to add flood insurance for you, today is August 10, you'll have coverage September 11’.” There is a 30 day waiting period for flood coverage to go into effect.

Even if you don’t think you need earthquake or flood coverage, if you haven't really looked at it in a couple of years, you should and ask your insurance agent questions, because you might think you're covered when you're not.

COMMON MISCONCEPTIONS ABOUT INSURANCE:

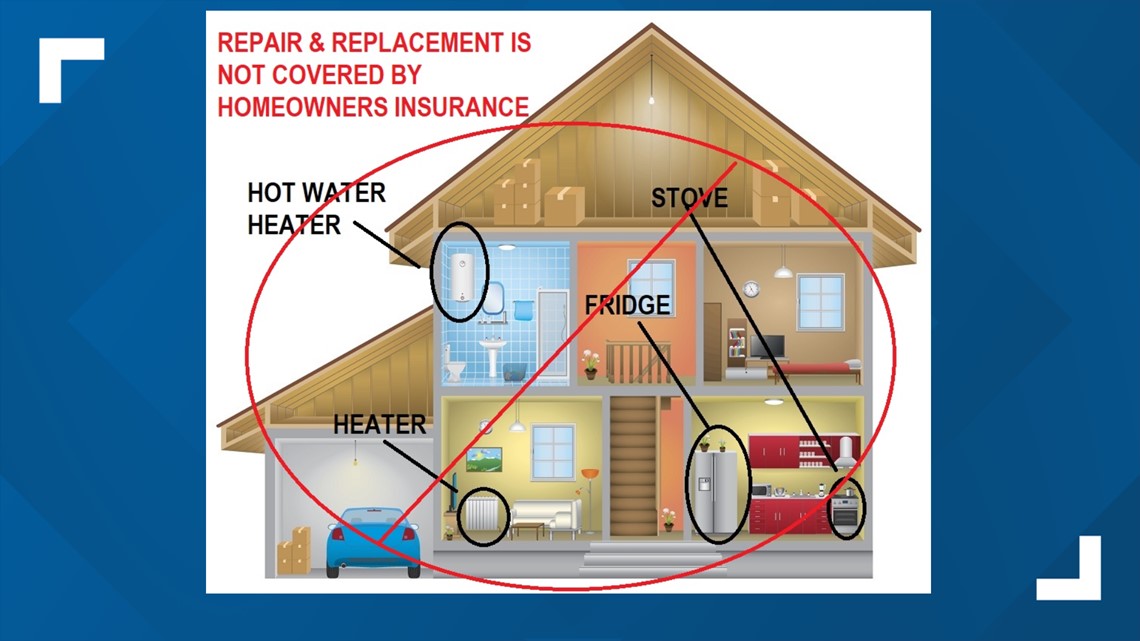

“Insurance pays for things that were sudden and accidental by nature but if you've had a leak in your shower for five years and now you have mold in your wall and your subfloor is collapsing into your crawl space, that happened over a long, long, long period of time, it wasn’t sudden and accidental, your insurance company is not going to pay for it," said Cook.

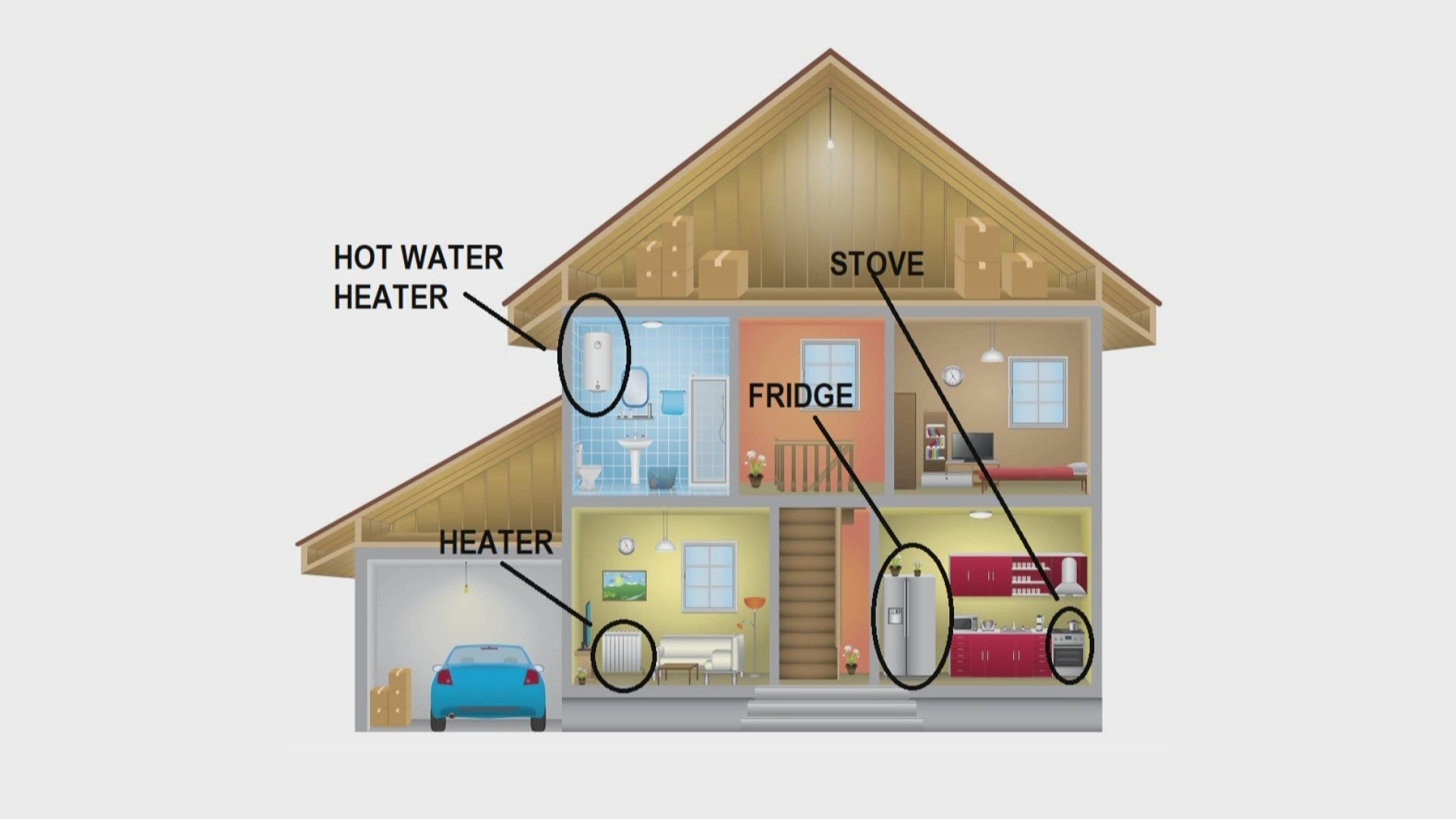

Your hot water heater isn’t working anymore. Doesn’t your policy pay for that?

Christopher Cook explained a common misconception. “Something that is common that people reach out to us about is maintenance items. If your hot water heater is 20 years old and it fails, it was built to last 20 years. It's part of homeownership, it stinks but your insurance doesn’t cover mechanical failures of systems in your home.”