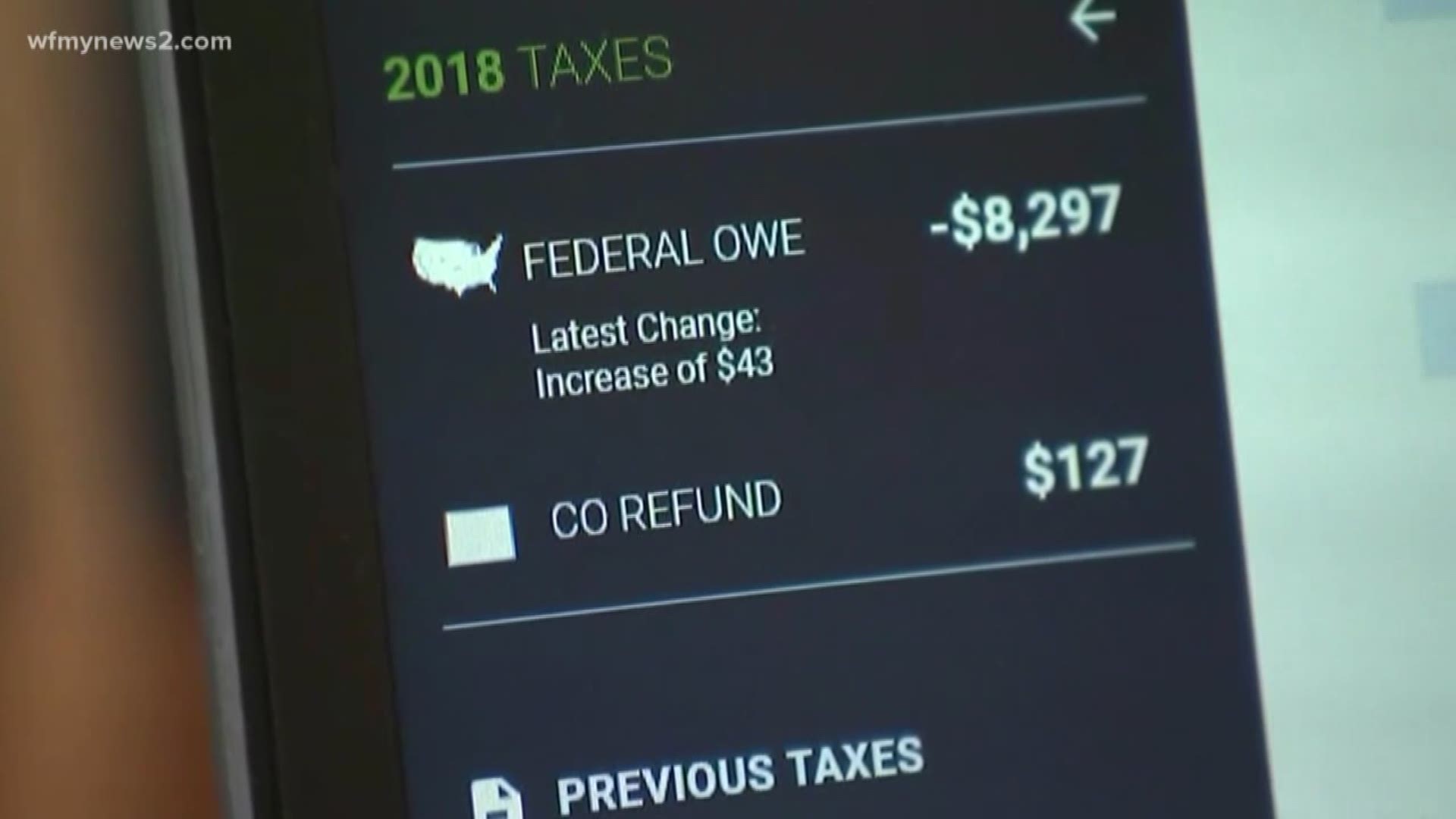

GREENSBORO, N.C. — Numerous taxpayers have noticed smaller refunds and bigger penalties this year thanks to the new tax law. But now the IRS is taking action and relaxing some of those penalties.

Before the tax law changed, if you didn't have your employer withhold enough taxes, you would pay an underpayment penalty. That threshold was 85% or less. But in the last few days, the IRS dropped the threshold to 80% so you could get out of paying that underpayment penalty.

Here's what you need to do depending on your scenario:

If you already electronically filed: print out IRS form 843, Claim for Refund and Request for Abatement, and fill it out. Include the statment "80% waiver of estimated tax penalty" on line 7 and then mail it in. You can find the address for your area at the end of the instructions for Form 1040.

If you filed on paper: Check the instructions on form 2210 for details on what to do next.

If you paid a tax preparer: Ask them how much it would cost to revisit your taxes and make those changes. You'll have to decide if paying that fee is worth getting your potential refund.