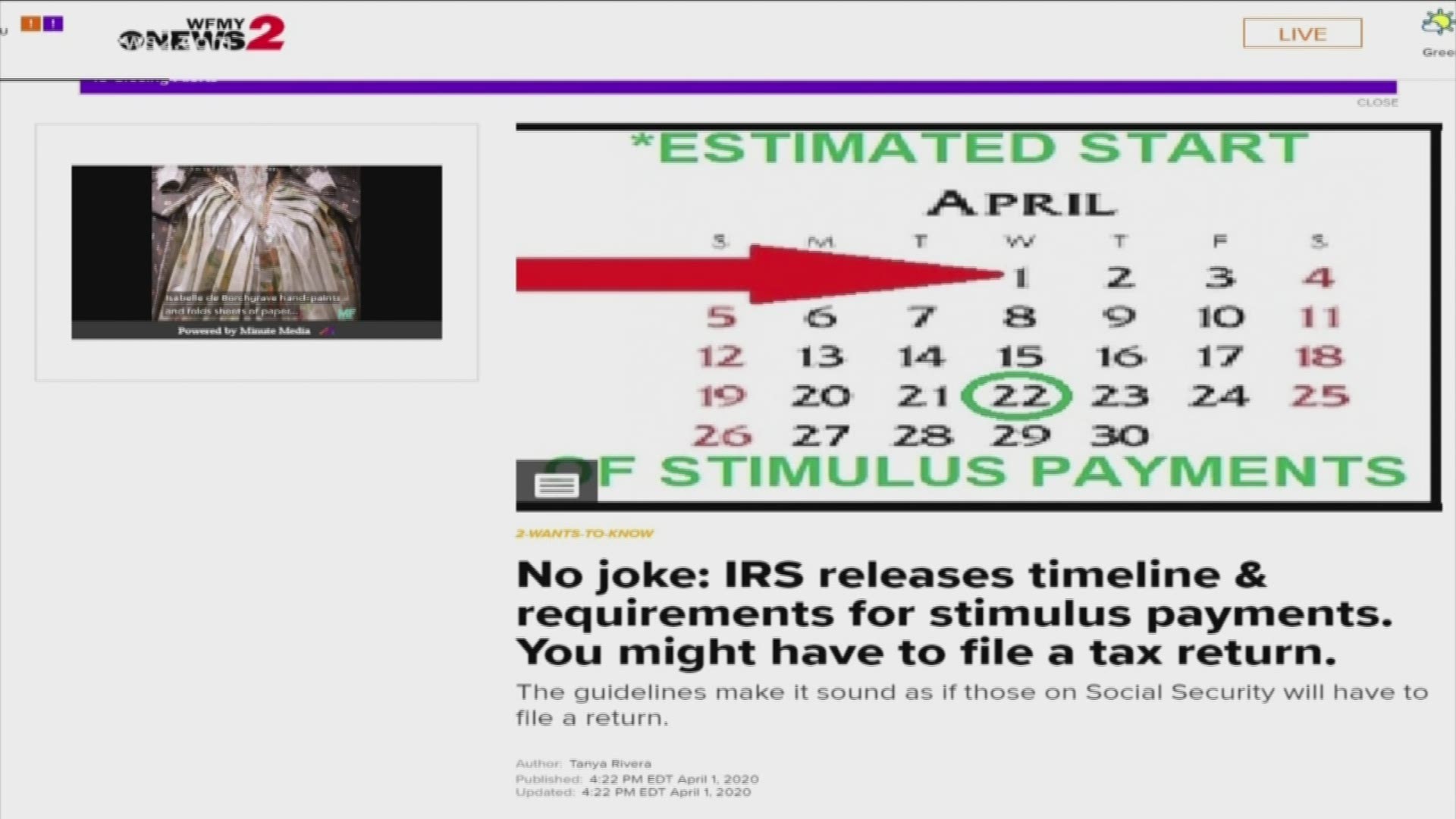

GREENSBORO, N.C. — The Treasury Department and the IRS confirmed stimulus money payments will begin in the next three weeks. That's an estimated start time of April 22. READ the entire FAQ from the IRS.

#1 How will I get the stimulus payment?

Direct deposit or check. If the IRS already has your direct deposit information from previous tax returns, you will get a deposit into your account. If not, the IRS will send you a check.

*But get this, the IRS is working on an online portal. So, if you have direct deposit, but have never used it with the IRS, you will be able to give the info to them and not wait for a paper check. This is in the works, it's not up yet.

I repeat it's not up yet, DON’T BE SCAMMED! Don't give your information until you see WFMY News 2 show you what the portal looks like!

#2 How much will I get?

The IRS will calculate the amount. The agency will use your 2019 tax returns if you've already filed. If not, the payment will be calculated on your 2018 return.

#3 What if I don’t file taxes?

The IRS announced Wednesday that those who receive Social Security benefits and are not typically required to file tax returns will also not need to file one to get their stimulus check from the record $2.2 trillion coronavirus aid package. That's a reversal from a previously announced policy.

Instead of having to file a "simple tax return," payments will be automatically deposited into their bank accounts, according to Treasury Secretary Steven Mnuchin.

#4 Will I miss out on the stimulus?

There is no immediate deadline for stimulus payments. The IRS confirms these payments will be available through the rest of 2020.

So even if you have to file taxes, you have plenty of time.