GREENSBORO, N.C. — Tax filing began Monday, and you have a little less than three months to complete it.

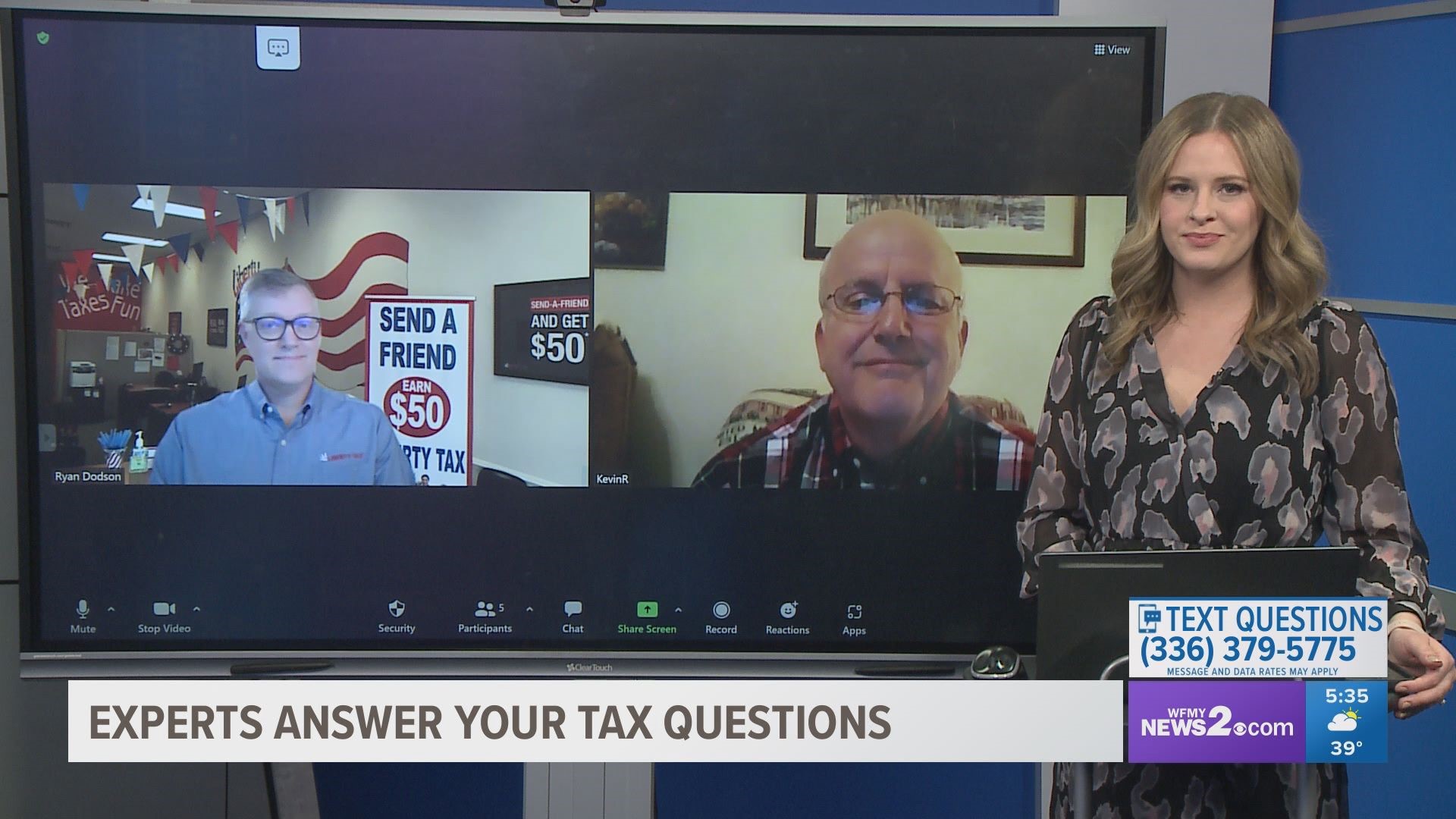

2 Wants to Know spoke with tax experts Kevin Robinson of Robinson Tax Services and Ryan Dodson of Liberty Tax Service to answer your questions.

Deadlines

You have until April 18 to either complete your tax filing or apply for an extension. If your extension request gets approved, the deadline moves to Oct. 17.

Dodson and Robinson encouraged people to file as soon as possible.

NCDOR Delays

The North Carolina Department of Revenue said they won't process state returns until mid-February.

The state approved a budget in Nov. 2021. It included several changes to tax laws, and now the agency is ensuring their software is updated for tax season.

NCDOR encouraged people to file online for the quickest return time.

Federal returns aren't impacted. You can still expect those in a timely manner.

Charitable donations

This year, the CARES Act expanded the charitable tax deduction. Anyone can get this deduction. You don't have to itemize it.

People filing as single, MFS or HOH can donate up to $300 to charity then write off the entire amount.

Married couples can double that if they file jointly. They can each donate $300 then both get it back for a total of $600.