GREENSBORO, N.C. — Time is ticking away! Have you decided to take the advance child tax credit payment? If you want the money on July 15, 2021, that's fine,

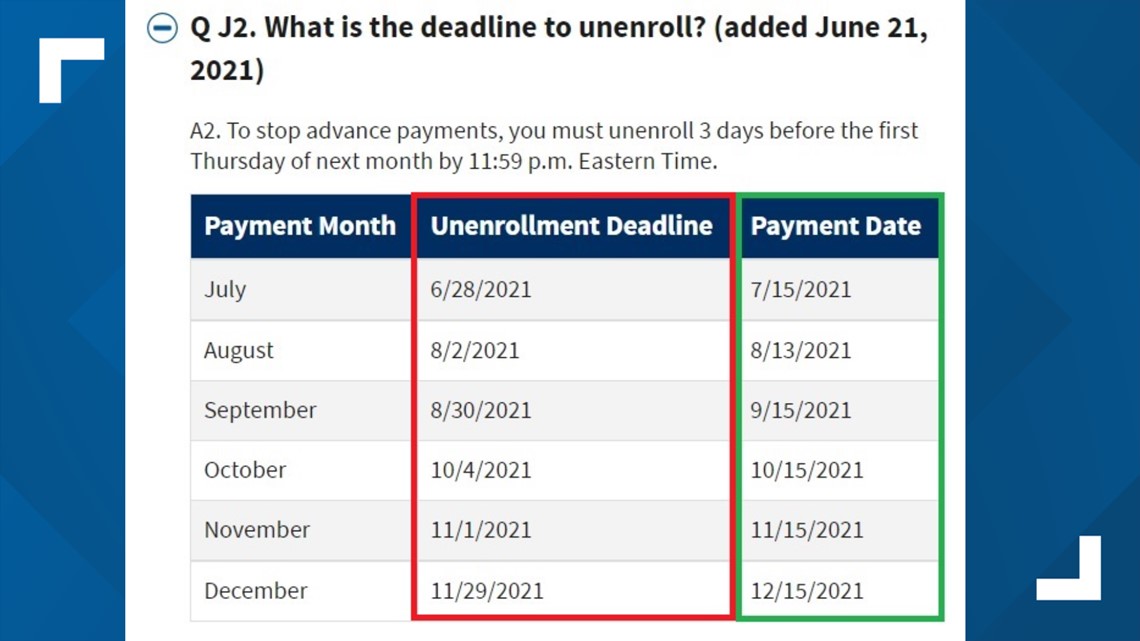

but if you don't, you have to tell the IRS that by June 28. This is the deadline to unenroll for the first payment in July.

MONTHLY DEADLINES TO UNENROLL

The IRS has a timeline of payments and unenroll dates. You can unenroll at any time during the payment schedule, but you only need to unenroll once.

If you unenroll in June, no payments will be made and no more action is needed. You can choose to get some payments and unenroll for the rest of the time.

CAN YOU RE-ENROLL?

As of right now, if you unenroll in June, you would have to wait until September to re-enroll.

ADVANCE CHILD TAX CREDIT PAYMENTS

The advance payments on the child tax credit begin July 15 and go through December. This will be half of the total tax credit, you'll claim the other half in 2022.

The total credit is $3,600 for children under 6 years old and $3,000 for kids 6 to 17 years old. The monthly payments will be either $250 or $300 per child.

“The vast majority of people don't have to do anything. This is predicated on what has happened in the past. If your income is about the same as what it was last year if you have the same number of kids, your address, your bank account info, you really don't need to do anything, the IRS is proactively going to take action,” said Jill Schlesinger, CBS News Business Analyst.

The IRS has designed three portals:

Advance Child Tax Credit Eligibility Assistant -- this can help you figure out if you're able to get the credit

The Non-Filer Tool—this helps those who don't file taxes put in their information for the IRS

Update Portal—this allows you to opt-out or unenroll from the payments.

The portal to change your information, banking info, child status is not up yet.