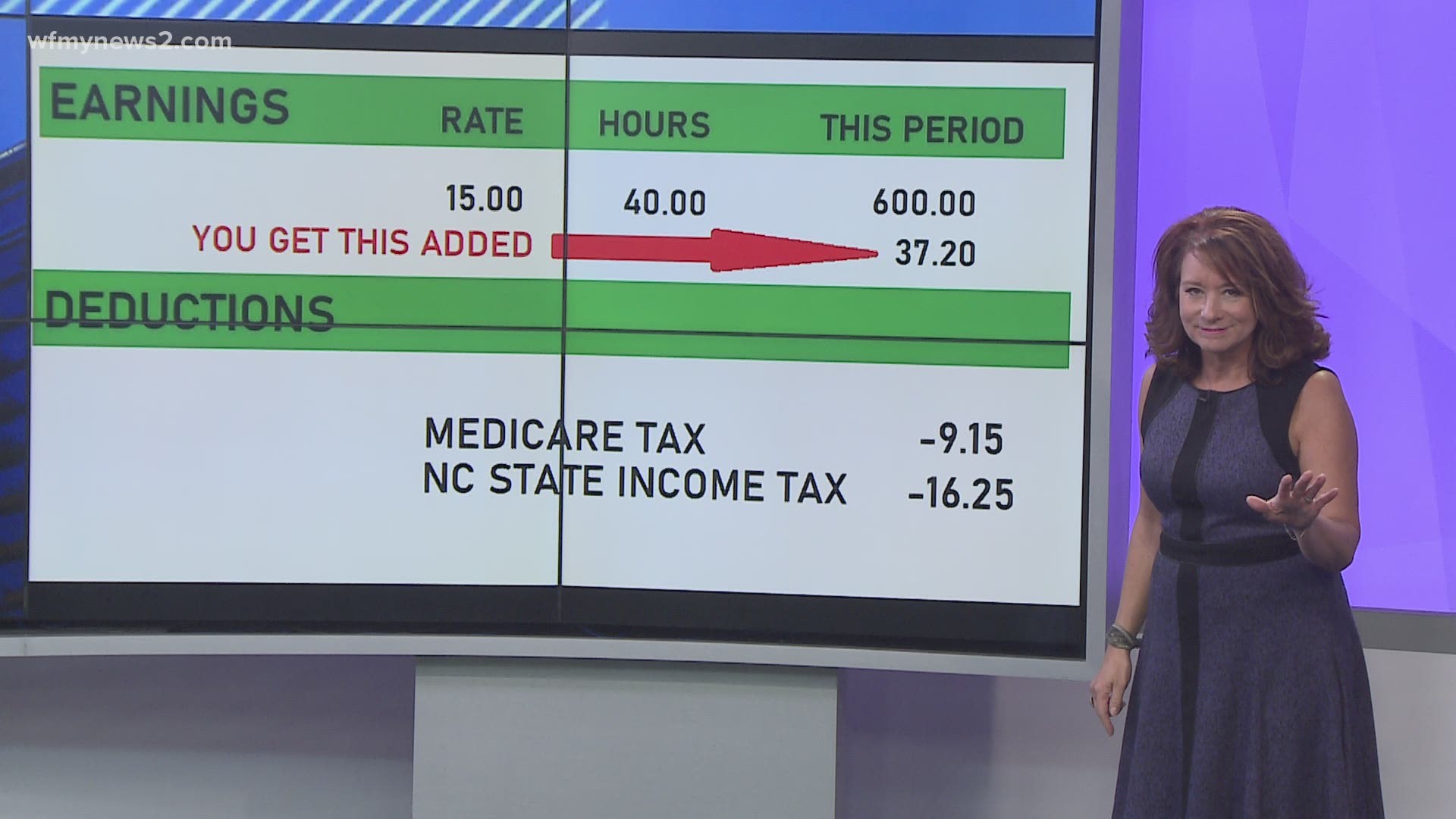

GREENSBORO, N.C. — There has been a lot of talk about the payroll tax holiday. For some of you, your paychecks might be bigger because of President Donald Trump's new payroll tax deferment, which began Sept. 1. Before you get excited, money expert Ja'Net Adams says you should know this is not free money.

If your employer participates in this White House executive order you will have a bigger paycheck for the rest of the year. Starting January 2021, you will have to begin paying it back.

Adams talked about the three things should know about the deferral.

1. What is it?

"It is not a holiday, but a deferral," said Adams, who wrote the book, The Money Attractor. "Through December 31, 2020, the 6.2% that is usually taken out for social security and the 1.45% that goes into Medicare will stay in your check because of this White House executive order. That means each check will have more money in it."

If your employer participates, you will not pay those payroll taxes for the last four months of the year.

2. Do I have a choice?

Every employer can choose whether to participate in the payroll tax holiday.

"If your employer decides to participate then you should already see the extra money in your check since the tax deferral started at the beginning of September. If you are not seeing extra money in your check then more than likely your employer has decided not to participate," Adams said.

3. You have to pay it back

Come January, the regular payroll taxes will be reinstated and on top of it, you will pay back the last four months of missed tax payments.

"It is not a holiday; it is a deferral. If you don't want any part of this then you should ask your employer to opt out. If that is not an option, you need to save the extra money so that when you have pay it back in 2021 you already have it," Adams said. "You will have to pay it back unless Congress passes a bill that says you don't and that's not likely."

You can get more money tips from Ja'Net Adams at www.debtsucksuniversity.com.