GREENSBORO, N.C. — North Carolina recently became the 20th state to require a financial literacy class in order to graduate high school.

Money expert, Ja'Net Adams says in order for the requirement to be successful, the state should create a curriculum that works for today's social media savvy students.

"Over the past eight years I have spoken in front of 70,000 students around financial literacy and I know many of them came from states with this requirement. Many of them are part of the $1.6 trillion dollar student loan debt, so we need to look at ways North Carolina can make sure financial literacy works for their students," said Adams, who wrote the book, The Money Attractor.

Adams says while financial literacy is important for all children, there is a reason to be cautious.

She offered these three tips to make sure the financial literacy courses cover the topics students should know.

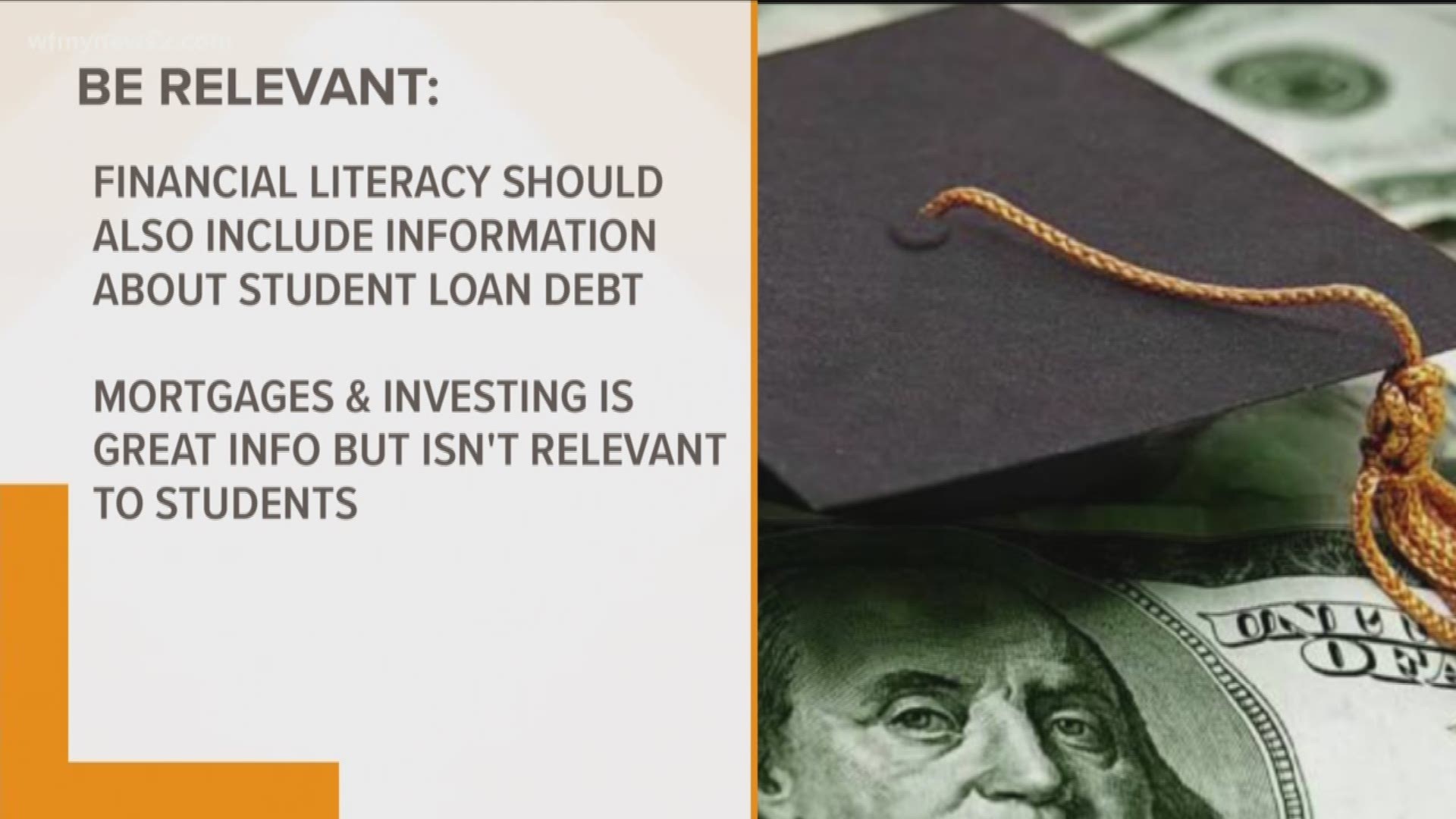

1. Be relevant:

"Many people blame colleges for the student loan debt and maybe some blame goes there, but in the 19 states where financial literacy what is being taught, students are still struggling with student loan debt," she said. "Instead they are being taught about credit, mortgages, investing and other topics that are not relevant to them right now. Show students how to get scholarships and attend colleges they can afford," said Adams.

2. Be In The Now:

"With this financial literacy requirement, you not only have the opportunity to improve the financial wellbeing of high school students, but also the wellbeing of their households. In order to do that the curriculum must have material covering strategies on how the student can help bring money into a household. Not by getting a job, but by cutting back and using social media to their advantage," said Adams.

3. The Future of NC Depends On It:

"Half of the college graduates plan to move back home. This means if the new financial literacy requirement is not effective, North Carolina can expect more residents deep in debt and not contributing to the state or their local economies. They will not be buying homes, cars, furniture, goods, and luxury items and the future North Carolina economy will suffer," said Adams.

Adams says financial literacy is vital for future generations and North Carolina could be the state leading the way.

"North Carolina has the opportunity to show the rest of the country how to make financial literacy not only work but create financial freedom for its residents for generations to come," said Adams.