CHARLOTTE, N.C. — Every year, drivers in North Carolina have to renew their car registration, and every year, many people complain about having to pay personal property taxes on their vehicles.

No one likes to pay more to have their registration renewed, but is this tax legal? A WCNC Charlotte viewer contacted the VERIFY team claiming the state's personal property tax on vehicles is unconstitutional.

"I would like to know how the state charges you for personal property tax on your vehicle every year. It is unconstitutional. I paid taxes on my vehicle when I bought it, and I get hammered every year with taxes on my vehicle, and others pay almost nothing because they drive older junk vehicles. This is not only fair but unconstitutional."

THE QUESTION:

Is it unconstitutional for North Carolina to make you pay personal property taxes on your vehicle every year?

OUR SOURCES:

THE ANSWER:

No, It is not unconstitutional or illegal to require vehicle owners to pay personal property taxes on their cars in North Carolina.

WHAT WE FOUND

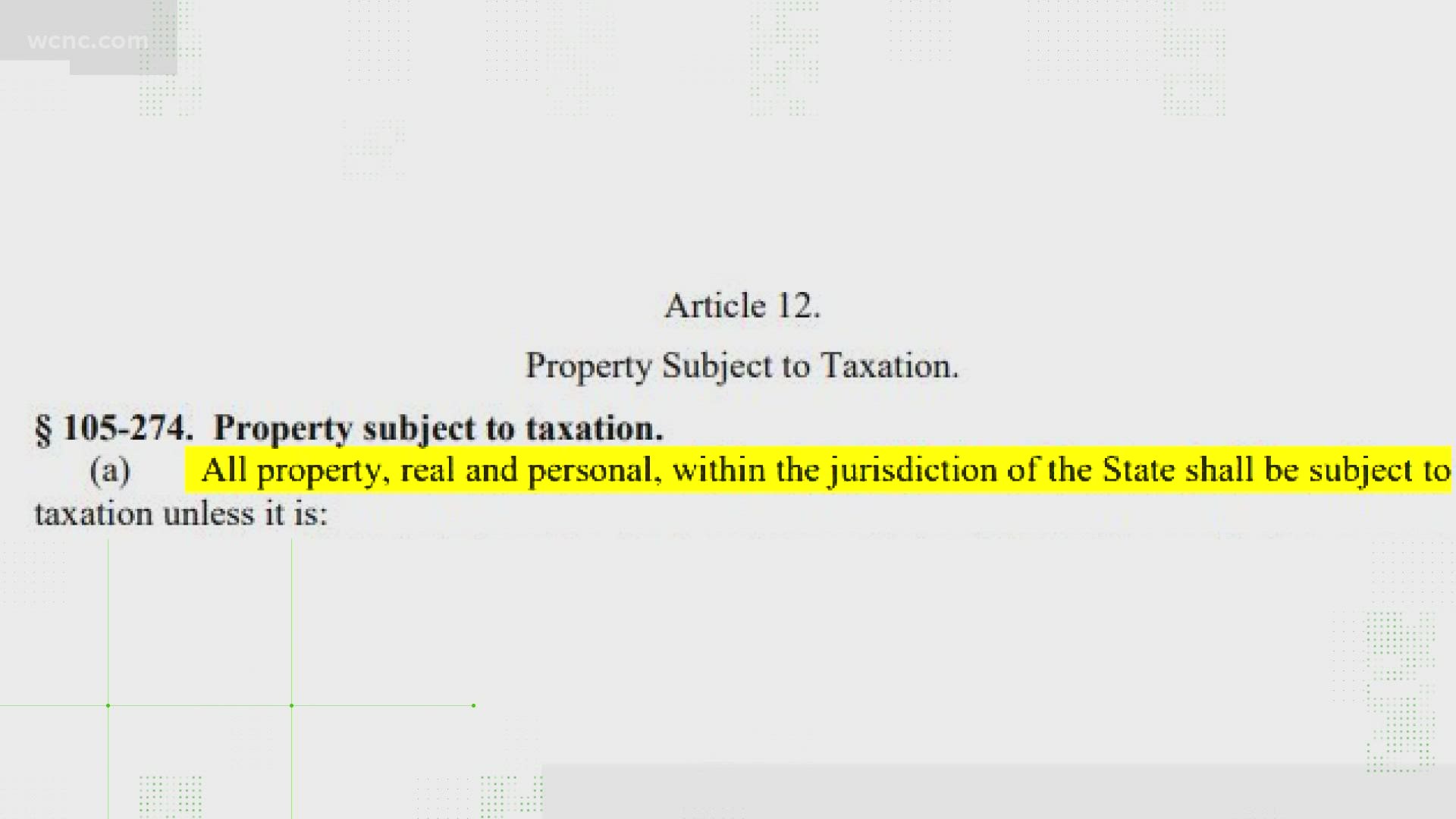

According to North Carolina Law, "All property real and personal within the jurisdiction of the state shall be subject to taxation."

That includes your car.

"Most forms of taxation that you and I might think about are constitutional they have been repeatedly upheld by state court," Mauney said.

The North Carolina DMV allows the counties to assess the value of motor vehicles registered statewide. That tax is paid at the same time as the vehicle's registration renewal fee.

"There is no question as to whether or not the tax is legal and lawful, and if you don't pay the tax, you could be subject to fines and things even worse than a fine if you are willfully not paying your taxes," Mauney said.

The DMV adds there is an interest charge on late vehicle property tax payments. The amount depends on the value of the car. Mauney said a vehicle that is worth less would carry a smaller property tax.

VERIFY is dedicated to helping the public distinguish between true and false information. The VERIFY team, with help from questions submitted by the audience, tracks the spread of stories or claims that need clarification or correction. Have something you want VERIFIED? Text us at 704-329-3600 or visit /verify.