GREENSBORO, N.C. — February 14, yes, it's Valentine's Day, but it's also the mid-point of February and back in January, the North Carolina Department of Revenue announced mid-February would be the starting time to process state returns.

So, it’s mid-February. What’s the deal? 2 Wants To Know asked the NCDOR for an update. This just in:

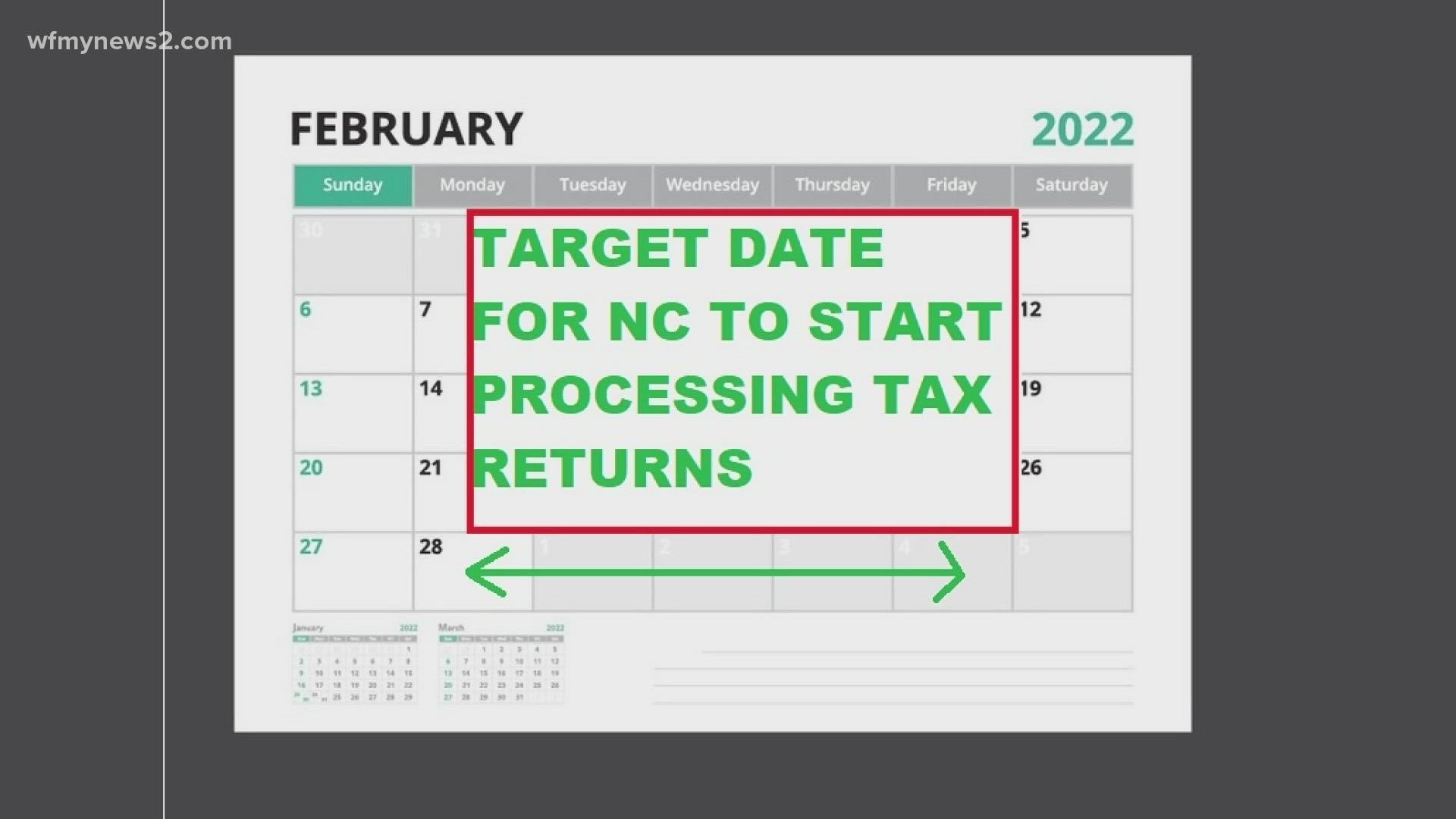

The new target date is the Week of February 28, 2022, which is the last day of the month and we're into March. We'll see if as we get closer, we get a specific date.

If you've already done your taxes and you're waiting for the state to begin processing, know that “the early submissions will be considered as filed on the date transmitted even though there will be a delay in processing”.

What's the deal with the delay anyway? The state budget was approved late and signed into law on November 18, 2021. Because of that, the NC Department of Revenue needed to change things in the tax code and they needed more time to do that.

WHAT ABOUT REFUNDS?

Taxpayers can expect to begin to receive refunds in early April. We continue to encourage taxpayers to file electronically.

Specifically, in regards to certifying tax preparation software, our staff is working diligently to approve these requests. Tax software providers are notified by DOR once their software is approved, thus allowing taxpayers to begin filing their tax returns. Some software products have already been approved. The list of approved tax preparation software products for businesses can be found at this link. The list of approved tax software products for individual income tax can be found at this link. Other products are being approved on a daily basis. Taxpayers should routinely check to confirm if their tax preparation software has been approved