GREENSBORO, N.C. — The timing couldn't be more convenient for the bad guys.

There is a deadline for stimulus check information that is real, and a

fake text promising a second stimulus you need to register for.

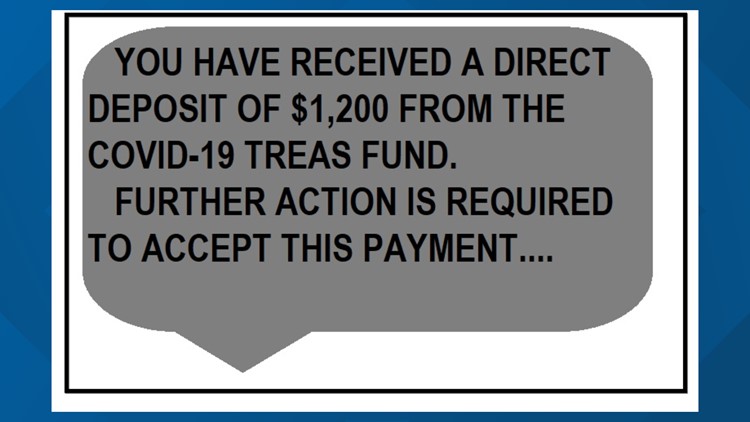

FAKE TEXT

The fake text reads:

You have received a direct deposit of $1,200 from the COVID-19 TREAS FUND. Further action is required to accept this payment....

There is a link to click to “accept the payment”. It takes you to a fake IRS page that looks like it is the GET MY PAYMENT page. The fake page will be asking you for your bank account and social security number. In the end, you will not get $1,200 and there is no COVID-19 TREASURY FUND.

The IRS will never send texts or email consumers out of the blue.

"Criminals are relentlessly using COVID-19 and Economic Impact Payments as cover to try to trick taxpayers out of their money or identities," said IRS Commissioner Chuck Rettig in a statement to CBS News. "This scam is a new twist on those we've been seeing much of this year. We urge people to remain alert to these types of scams."

If you've received one of these texts, the IRS said you should report it to phishing@irs.gov, along with a screenshot and information about the day and time you received the message, the number that appeared on caller ID, and the number that received the message.

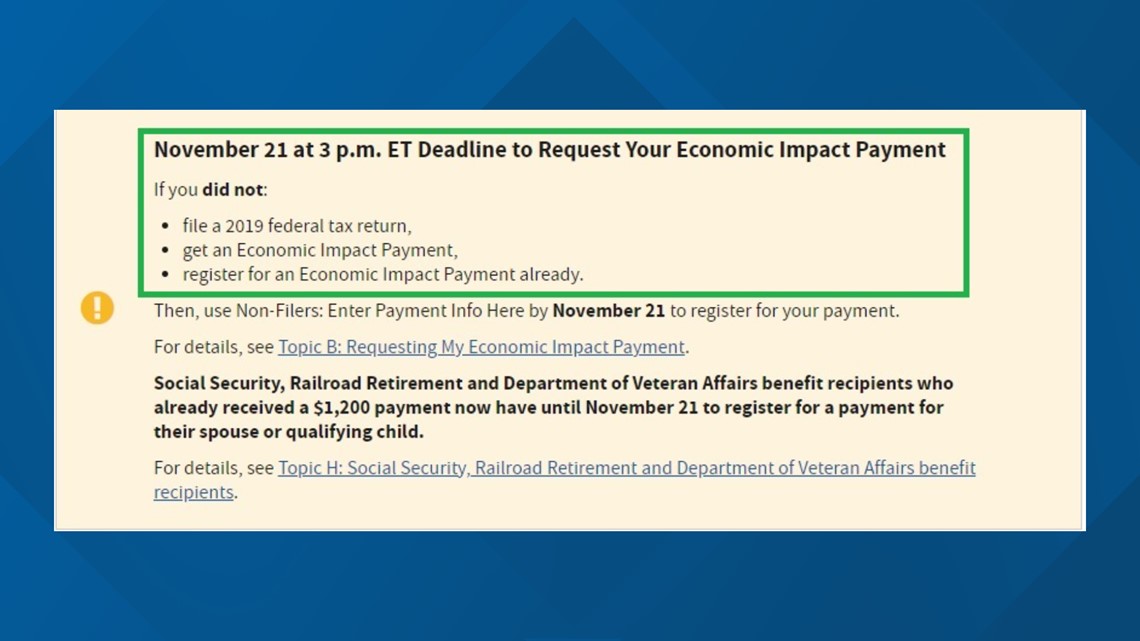

THE REAL DEADLINE

Consumers who have not yet received a stimulus payment have until 3 PM on November 21 to register for one of the checks. This is for folks who do not file taxes, have not received a payment, and have not registered. You will use the IRS Non-Filers Tool.

If you are on SS, Railroad Retirement, or get VA benefits and received your payment but did not get the additional $500 for a qualifying child, you also have a deadline of November 21 to get that information in. Use the IRS Non-Filers Tool.