GREENSBORO, N.C. — The IRS gave you a hard deadline for taxes but when it comes to your refund, you may be waiting for weeks.

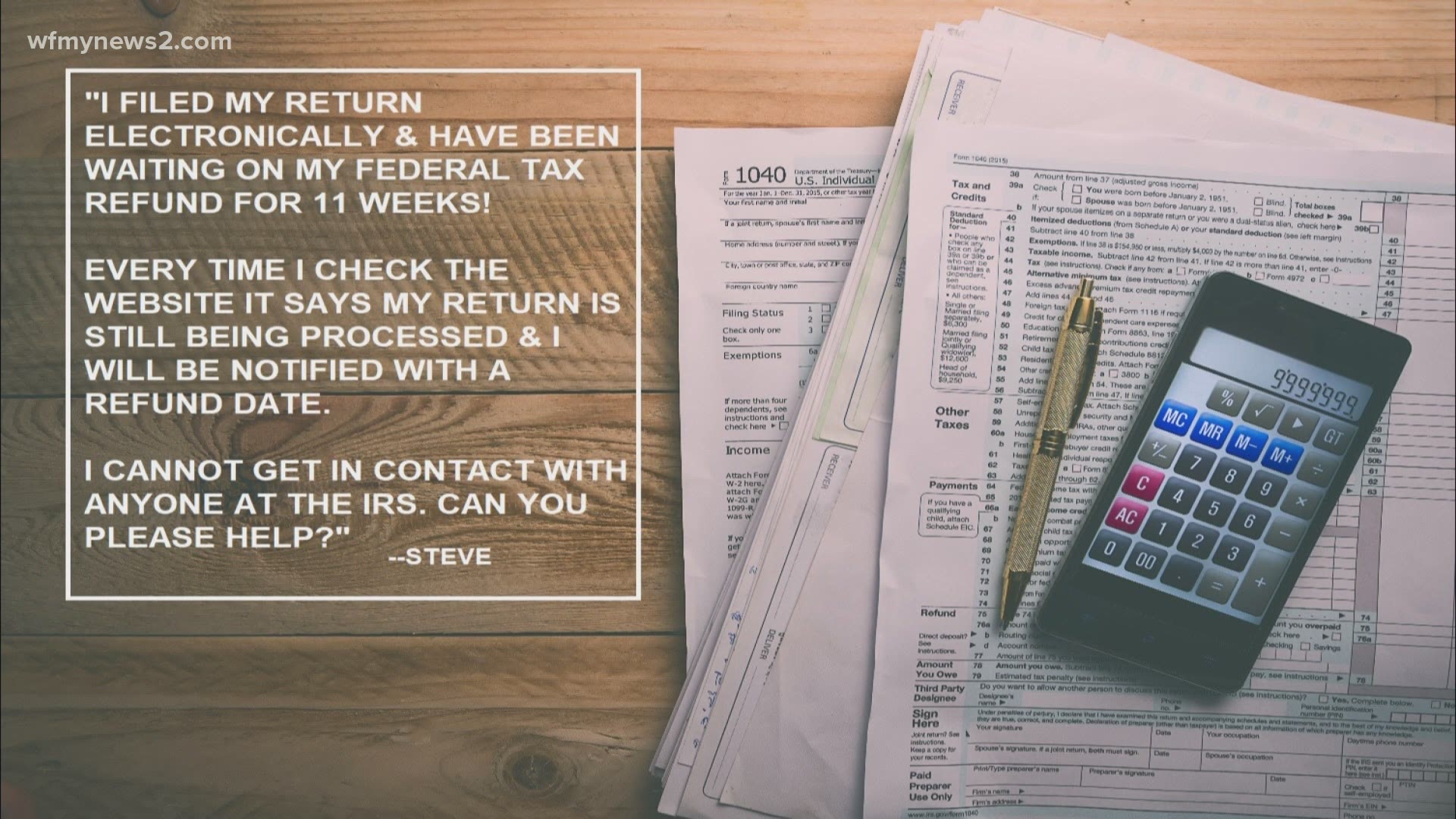

Steve emailed 2WTK:

I filed my return electronically and have been waiting on my federal tax refund for 11 weeks! Every time I check their website it says my return is still being processed and I will be notified with a refund date.

I cannot get in contact with anyone at the IRS. Can you please help?

Unfortunately, getting someone who can help you on the IRS phone line is nearly impossible, but there is another way to find out information about your money.

“Another option is to create an account with the IRS. It's on their website, it's easy to do and this will show you what has been accepted, processed, you can ask for transcripts,” said JR Cecil of Liberty Tax Services.

This is the IRS's cheat sheet for setting up an online account to access tax information. It takes you through the steps to create that account. Once you have it, you can check your economic impact statement amounts and if you're waiting on your refund there is an entire tax return section including:

Key information from their most recent tax return

Digital copies of notices or letters from the IRS

Is it that a one on one with an IRS worker who can tell you the exact date of your refund? No. Is it the best option at the moment? Looks like it.

You can always check the IRS Where’s My Refund page for your federal return.

NC TAX REFUNDS

Now, when it comes to North Carolina, the state has received about 4.4 million returns and processed about 4.3 million.

According to the NC DOR, there are about 8,600 refunds pending over 60 days due to enhanced identity theft measures. If you're one of them, it's simply a matter of time. You can call 1-877-252-4052 to check on your refund, but you probably won’t get the details of why your refund is pending.