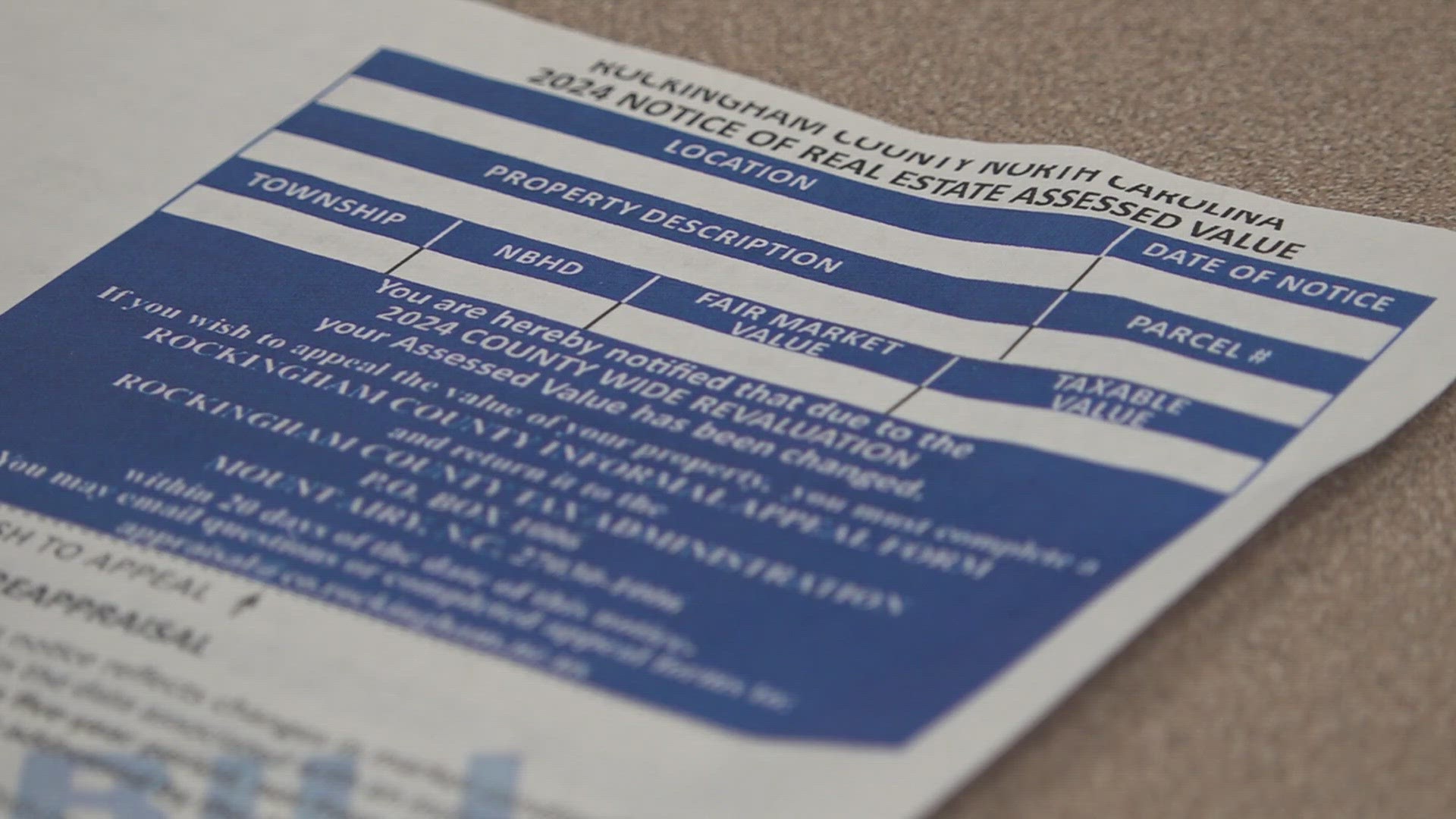

ROCKINGHAM COUNTY, N.C. — Rockingham County property owners got a rather surprising letter in the mail recently. The letter was on behalf of the county, stating their new property value following an appraisal.

The Matter family found themselves in that very situation. They claim they got a letter in the mail last week stating their property value increased 66% from five years ago.

"We bought the house, not quite five years ago, for $290,000, and the latest data that came in across the form is just shy of $480,000, which is a drastic increase," said Rockingham County resident Ethan Mattern.

Todd Hurst is the county's tax administrator. He said state law requires counties to reappraise at least every eight years. However, he says, due to the county's sales ratio, the state-mandated them to reappraise sooner.

"I have never seen this before. Since 07' I've been here, we've never seen a market, we've seen a decline, but we've never seen an increase like this," Hurst exclaimed.

Hurst explained how appraisal values increased so much over the years.

"If you don't deal with sales everyday like we do, you're not going to notice it. You've been in your house for 30, 40 years, you're not going to know that the one beside you sold for $170,000 it was valued at $100,000 four years ago. So, we take all the sales in the area, we have 500 neighborhoods in our county, and we look at all the total sales amount for each area and that is how we value our land."

Hurst recalled with more people moving in and bidding wars happening, it makes the market more competitive. While a higher tax value is good for sellers, those with no intentions to sell fear an increase is property tax.

Mattern said it's something they can budget for, but concern comes for those on fixed incomes.

"Especially to the retired people that are on fixed incomes, there are the exemptions that we have and then if they could reduce the tax rate it should help them to where it shouldn't be much of a change," said Hurst.

The county said property owners can appeal reevaluations but must do so by May 8th. There are also exemptions for senior citizens and disabled veterans. The Rockingham County tax rate hasn't been approved yet. Therefore, as of current, it is not clear how property taxes will be impacted. Commissioners will make that decision by July 1st.

RELATED: When are taxes due in 2024?