GREENSBORO, N.C. – Can we agree that growing up isn’t as easy and fun as we think when we’re teens? Southeast Guilford High School has made it a point to teach students what being an adult implies. Hint: They rhyme with the words brent, waxes and dealth incurrence.

The ‘Reality of Money’ is an interactive financial literacy activity the students get to play once a year thanks to the Civics and CTE departments at Southeast.

“It’s intended to expose our people to post-secondary education and help them learn financial techniques through financial literacy,” said Haywood Stukes, Career Coordinator at SEHS, who coordinated this year’s Reality of Money event.

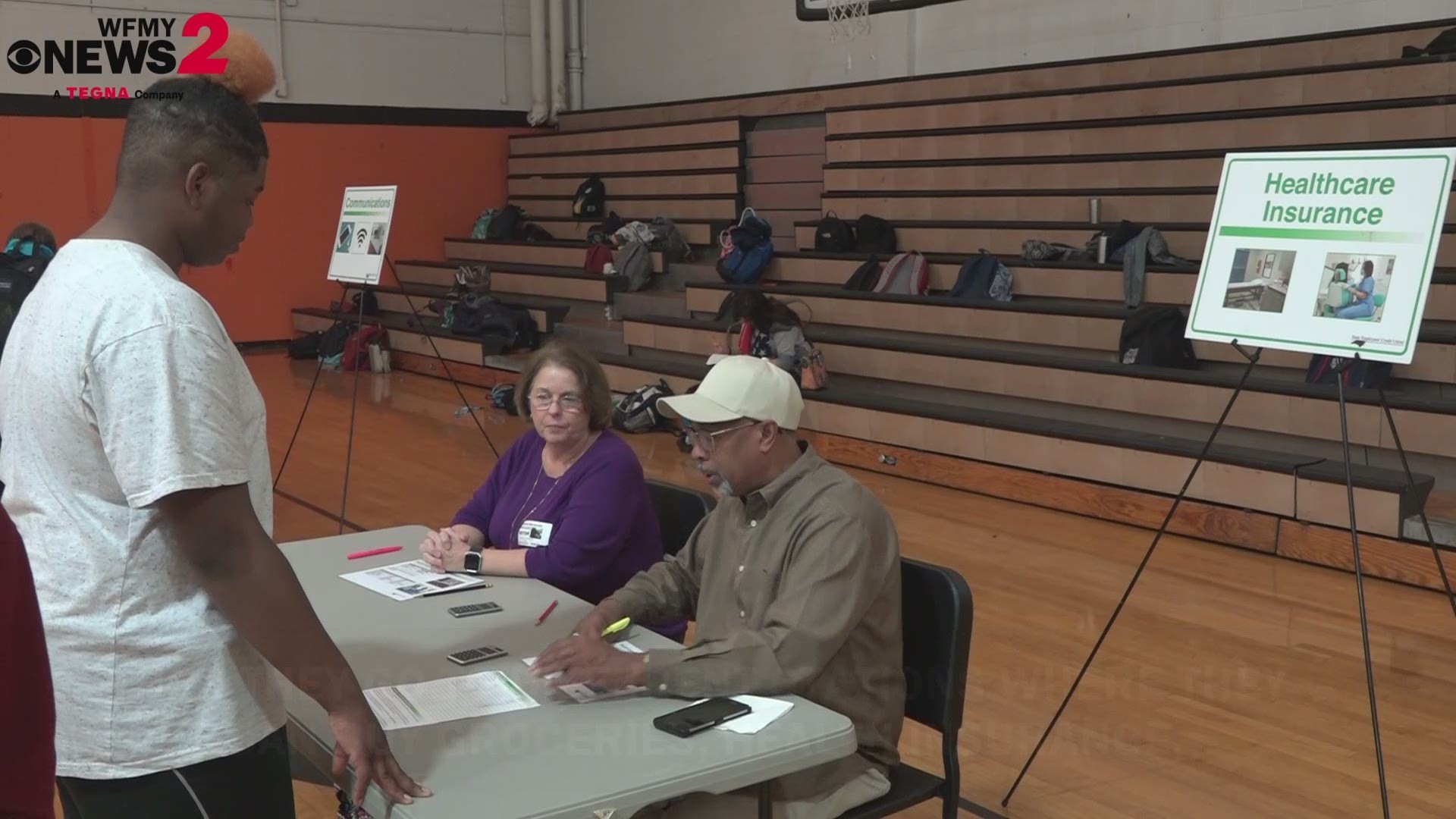

Here’s how it works: The students are randomly handed a sheet with their assigned job or profession, their income, credit score and other debts, like student loans. With that information, they head out to 12 different life stations where they can determine what kind of house, car, health insurance, grocery budget, and even vacation or entertainment they can afford. Their goal is to be able to complete them all and stay within their “monthly” budget. If you’ve played the game “Life,” this may sound familiar.

WFMY News 2 Digital Reporter Laura Brache followed 10th grader Montrell Walker throughout the activity, who was assigned to be a single Accountant with a four-year degree making $39,500 a year with no children.

After completing all the stations that applied to him, like opening credit cards, buying a house, a car, health insurance and buying a vacation package, Walker was still able to stay within budget and have money from his initial funds leftover.

“After I finished and I got back to ‘pay day,’ I ended up with more than what I started off with, so that’s a good thing. So that means that I budgeted well and I got to enjoy myself,” Walker said.

But this wasn’t the case for students like Ila Seamans who were assigned a completely different scenario.

“Personally, I was really struggling with money,” Seamans said. “I was a single mom with one kid and I almost went broke. So, it’s a real eye-opener for me because I didn’t realize how much money my parents spend, and they’re married with three kids.”

The Reality of Money has been a part of the Civics curriculum for financial literacy for the past 10 years, according to Stukes.

The event is a group effort from members of the community, such as former teachers, local business experts and banks like the State Employee’s Credit Union.

“We really believe that this activity enriches the lives of students’ way beyond just high school,” Stukes added, saying that former students have reached out to thank him for the opportunity to learn about taxes and health insurance.