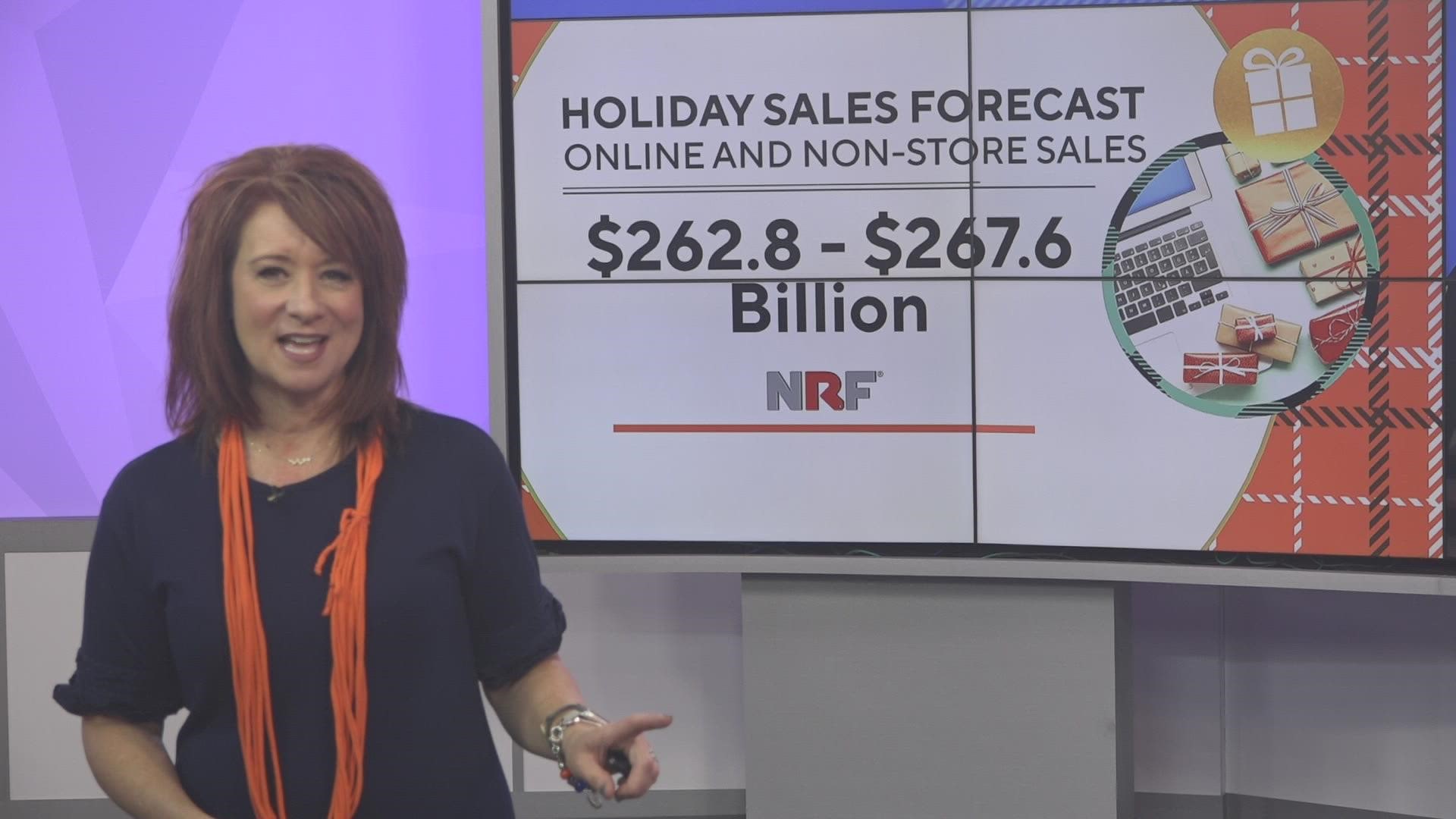

GREENSBORO, N.C. — The holiday sales forecast is out and the National Retail Federation estimates Americans will spend between $262 and $267 billion online alone. That doesn't include the money folks will spend in-store. While in-store shopping has been going down, this year, experts believe inflation will drive more folks to the stores.

How you shop for what ends up under the tree may not be as important as how you pay for it. For example:

CASH

Helps you not overspend, I mean, once it's gone, it's gone.

Refunds may not always be in cash, so beware.

Keep those receipts, cash is traceless.

CREDIT CARD

Overspending is easy. Have a budget, keep to it and pay it off in full.

Easy refunds or credits. Especially if it's a fraud issue or an item has not been delivered.

Rewards. Price protection is one of the key rewards if you can get it!

“Not every credit card has this, but you need to look at what your credit card agreement says and see if this is a reward. But a lot of cards have price protection which means if you bought an item for a gift and it went on sale right afterward or the price was discounted, and you're like, I just spent so much more on it! If the card you used had price protection, you may be able to get the money back on that difference,” said Nathan Grant, a senior credit industry analyst at Money Tips.

How many of us have our agreement? Yeah, none of us. It is probably worth making a call to your card company and asking what protections and perks you have.