GREENSBORO, N.C. — When it comes to stimulus payments and taxes, there isn't an end to the questions. We're working to get as many questions answered for you at one time, in one place.

Mark Hensley AARP NC Region Assistant Director and Kevin Robinson of Robinson Tax and Accounting are answering your questions.

Here are some of the most frequently asked questions:

WHY DON'T YOU HAVE IT? There are several likely scenarios:

- You don't normally file taxes.

- Your banking information the IRS has on file is wrong.

- The Post Office couldn't deliver your check.

- Your payment was wrong.

If you don't normally file taxes:

And you're not claimed as a dependent by anyone you don't receive social security then you need to use the non-filers tool to give the IRS your info.

This portal is open until October 15.

If your banking info was wrong:

The payment goes back to the IRS and you will get a paper check. It takes up to 14 days after all that happens to get a check.

If the Post Office can't deliver the check to a listed address:

The check goes back to the IRS. The agency will update your payment status on the Get My Payment site to need more information and you can enter it in.

If your payment was wrong:

For example, if you didn't get the $500 for a child under 17-- at this point you'll have to wait until you file your 2020 taxes and you'll get the tax credit then.

RELATED: Where is your stimulus payment?

WILL I HAVE TO PAY MY STIMULUS MONEY BACK ON MY TAXES NEXT YEAR?

No. This is actually what would have been a tax credit on next year's taxes, so you're just getting it early. You will not have to pay back any of the stimulus payments back to the IRS.

YOUR DEAD LOVED ONE GOT A CHECK, NOW WHAT?

If you got a stimulus check or debit card and ---it's to a loved one passed away, you need to send it back.

MEMPHIS REFUND

INQUIRY UNIT 5333

GETWELL RD MAIL STOP 8422

MEMPHIS, TN 38118

The IRS hotline is automated. We have heard folks getting through to a human, but know it is a process.

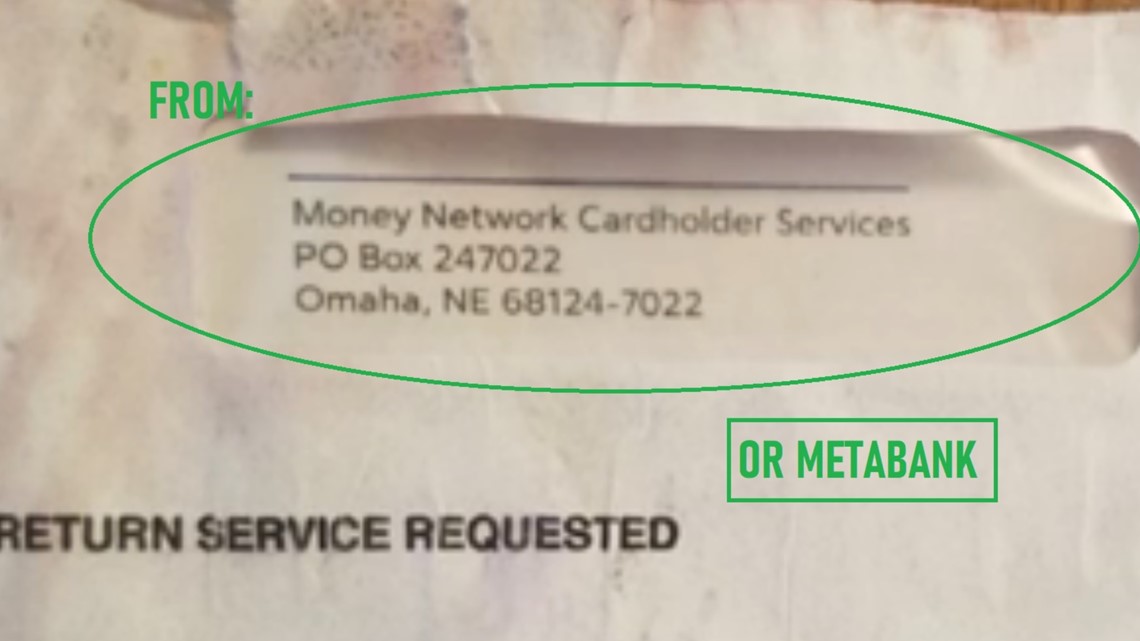

DON'T THROW IT OUT! STIMULUS DEBIT CARDS COME IN PLAIN WHITE ENVELOPES.

The IRS contracted out with a third party to send out the debit payments. The return address will say “Money Network Card Holder Services or Metabank”. The card doesn't have any stimulus or IRS or US Treasury markings on it. But the letter it is attached to does in fact tell you it's your stimulus payment.

When you activate the stimulus card, you will have to give the last six digits of your social security number. It's safe to do that as long as you use the phone number or website listed on the card itself.

The Money Network says a person may replace a lost or stolen card by calling 1-800-240-8100. Information on card replacement fees can be found here. If you need to get a hold of them by mail at 5565 Glenridge Connector NE, Mail Stop GH-52, Atlanta, GA 30342, or visit EIPCard.com.

TRACKING YOUR STIMULUS CHECK IN THE MAIL.

The USPS has a free mail tracking app. It's called Informed Delivery.

It's a quick 3-step process to sign up for it. Informed Delivery takes pictures of the letters as they go through the automated sorting machines. Those pictures are then sent to your phone or computer.

The service is available to many residential and personal P.O. box addresses but not businesses. It also won't work for some multi-unit buildings where the postal service hasn't yet identified each unit.

NURSING HOMES ARE NOT ENTITLED TO YOUR PAYMENT

NC Attorney General Stein says if you or loved one is in a nursing home or assisted living facility and Medicaid is involved, the facility might try to convince you they should get the stimulus check.

Nope. No. Not true.

The Federal Trade Commission is making sure everyone has this tax law so they can reference it if need be. It is under Title 26 Code 6409 Refunds disregarded in the administration of Federal programs and federally assisted programs.

he stimulus payment is a tax credit, it does not count as income for federal programs. Anyone who tries to tell you something different is on the wrong side of the law.

So, what if you or your loved one already signed over the check?

The attorney general can help make it right.

“The key is it was meant for you. It's not some kind of resource from the Medicaid program that your health care facility has any kind of claim to. And if they're trying to convince you to sign it over, they're wrong and let my office know.”

The FTC advises you to make a complaint with the agency as well as a complaint to the NCAG’s office in order for work to be done to get your money back.

WHEN WHERE THERE BE A SECOND ROUND OF STIMULUS PAYMENTS?

The House has passed the HEROES ACT, which provides for all kinds of funding, including stimulus. But the Senate is not on board.

Even still, here's what financial experts are saying,” From what we are hearing from the White House, there will be a second round of stimulus. But don’t look for it soon, it's likely not to be passed until July 20, so you’re looking at the end of July.”

What could the second round of stimulus look like in your bank account?

If the Heroes ACT holds up ---which it probably won't fully-- but if it did,

each member of a household would receive $1,200.

Age doesn't play a part. Kids get the $1,200 too.

But the household cap is $6,000.