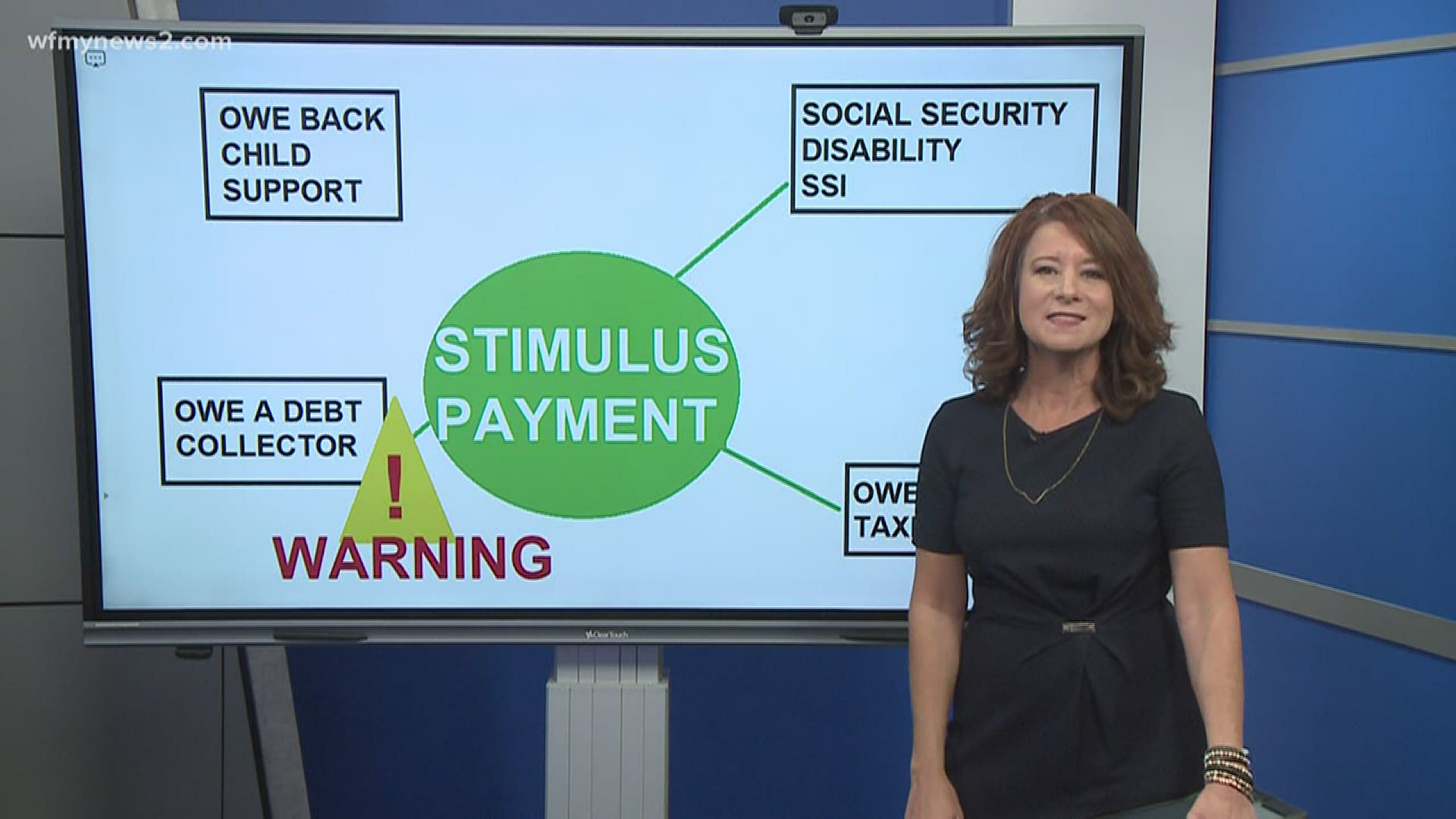

GREENSBORO, N.C. — If you get any kind of social security benefit, you're getting a stimulus payment.

If you owe back taxes, you will still get a stimulus payment.

If you owe back child support, your stimulus payment is being used for that support, so you don't get one.

BUT.....

If you owe a debt collector, you will get your stimulus payment, but that debt collector could take your stimulus payment right out of your account. Here's why; the CARES Act does not exempt economic impact payments from garnishment. This could be changed. The Treasury needs to issue a regulation designating cares act payments as “benefit payments” instead of “economic impact” money.

Twenty-five State Attorneys General are banding together and they've sent a letter to The Treasury. North Carolina Attorney General Josh Stein is one of the AG’s. The letter was sent last week, so far, there's been no response.

The states of Ohio and Massachusetts have banned financial institutions from taking stimulus payments. At this point, NC can't do that without changing a law.

“What we want is to clarify and strengthen the law to make it clear that payments like this should not be taken by a creditor,” explains Stein. “That's work we will do with the legislature this summer.”

Stein says the law that allows creditors to take money dates back to 1870.

And while a law change this summer doesn't help right now, it will in the future and in the meantime he'll calling out creditors.

“I want any creditor who is out there trying to take people's money, garnish people's bank account, don't do it. Realize people need this money to get by. That's what it is intended to do. Not to pay the debt, but to survive. There will be time to pay back what is owed.”

Is there a way to get around it? Experts say you could either request a paper check and simply cash it, but not deposit it or withdraw the direct deposit.