GREENSBORO, N.C. — Do you remember when there was a line at the post office on Tax Day? People could drop off their return and get that postmark up until midnight.

Yeah, that doesn't happen anymore. Your post office closes at a regular time, even on Tax Day (which by the way is July 15).

Why? That's because so many people file their taxes online. You can even get free help to file online.

“If you make less than $69,000 a year you are entitled to the IRS free file program,” said CBS Business Analyst Jill Schlesinger. That's right, free. All the options are here on the IRS website.

The IRS owes you money?

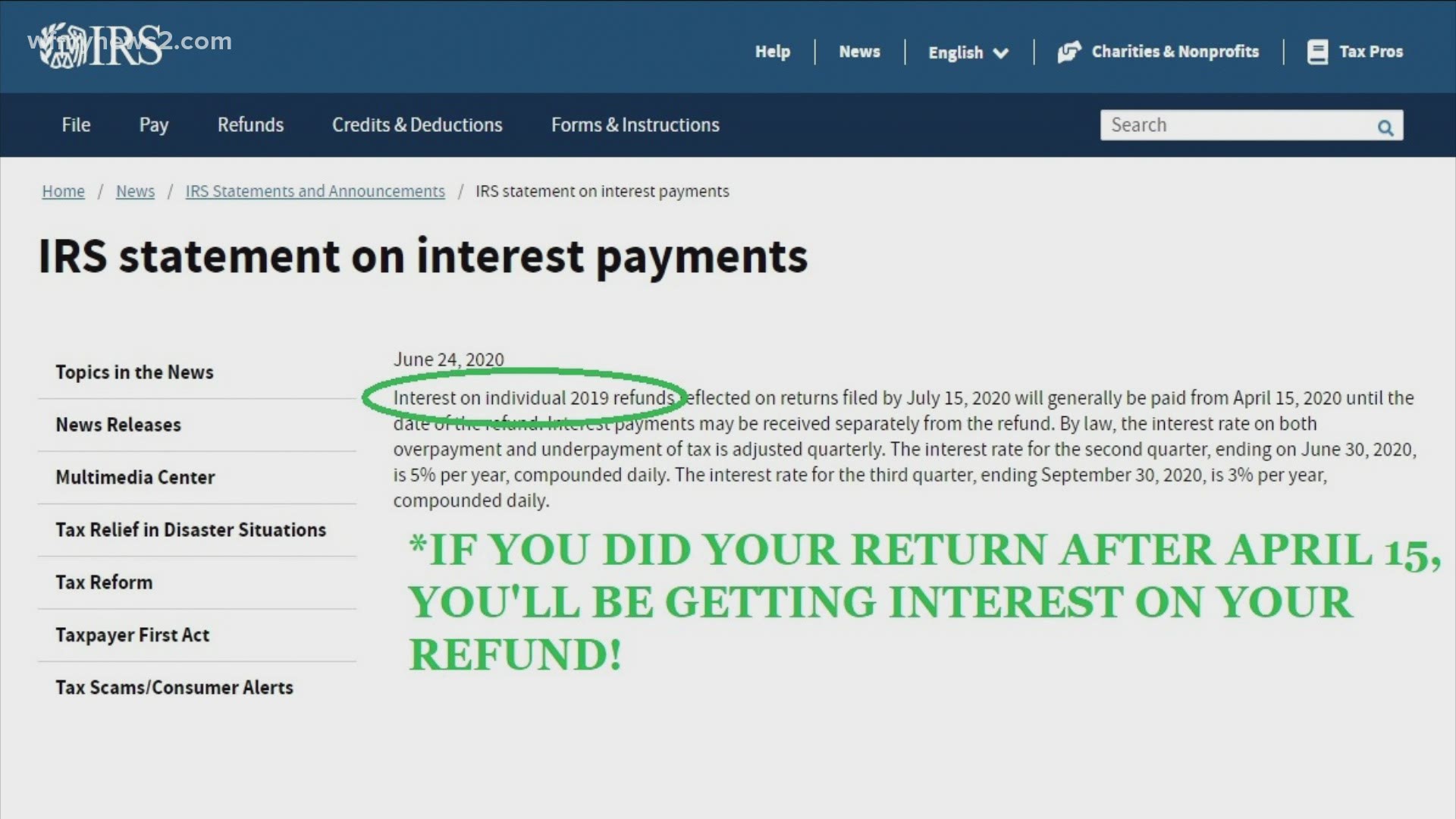

Your refund maybe a little more than last year because the IRS is paying you interest. The IRS is paying interest on refunds on any returns after April 15. The rate is between 3%-5% annually.

Why? Technically, the IRS has been holding your return money since April 15. The Motley Fool ran the numbers to see what that could look like.

EXAMPLE: Let's say you were owed the average refund, $ 2,881. You could get an extra $34 in interest money.

It's not a lot, but it's more than you had. Here's the confusing part, you could get the interest along with your refund or the IRS may send it separately.

In case you needed another reminder, Wednesday, July 15 is Tax Day.