GREENSBORO, N.C. — Uh-oh. The first stimulus payments hit a few snags with customers of tax preparers like Turbo Tax and H&R Block and now it appears it is happening again.

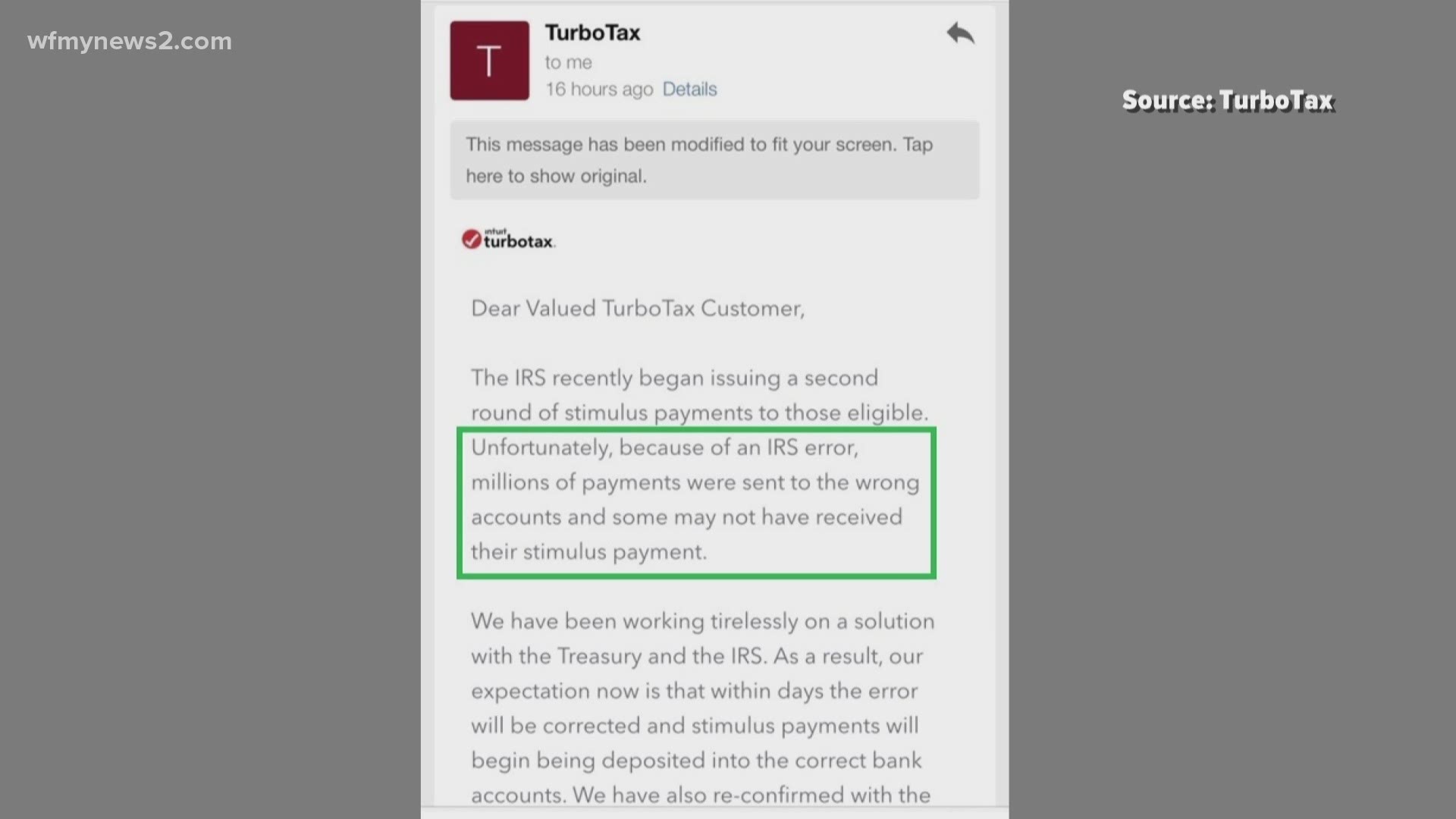

Turbo Tax sent emails to customers telling them the IRS made an error and millions of payments were sent to the wrong accounts. At this time, the company said it is working with the IRS to correct this and the expectation is it will take a few days to get into your account.

H&R Block said that it “understands stimulus checks are vitally important for millions of Americans" and said if the IRS Get My Payment website displays an account number a customer doesn't recognize, then its customer service agents are ready to help by phone or online.

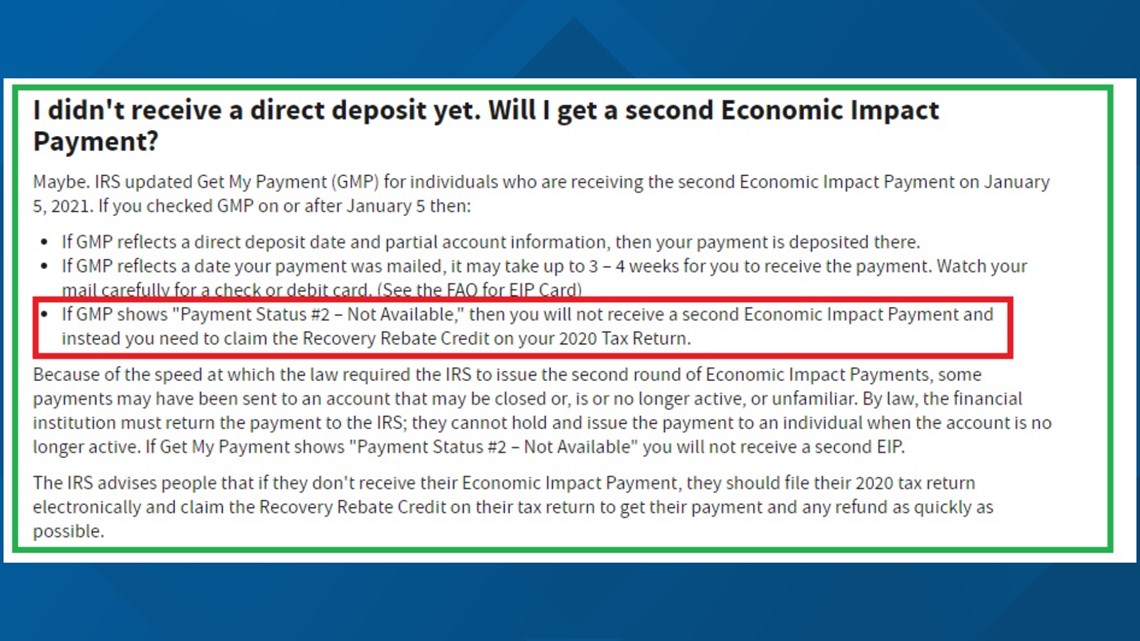

Taxpayers can use the Get My Payment tool on the IRS website to find out about the status of their payment.

However, many people who used the tax preparers said that they checked the IRS site and found their payments were sent to an account they did not recognize.

Now, if you didn't use these tax preparers, and you get a "not available" status, chances are you will need to apply for the Recovery Rebate on your 2020 tax return.

The IRS is not giving any reason as to why but what they are doing is giving you the information on how to apply for the stimulus money. Remember, the first and second stimulus payments were all advances on a tax credit on your 2020 tax return.

You need to file your 2020 tax return electronically and claim the Recovery Rebate Credit on the return to get your payment and any refund you may be due.

HOW TO FILE FOR THE RECOVERY REBATE CREDIT

When you file a 2020 Form 1040 or 1040SR you may be eligible for the Recovery Rebate Credit. Save your IRS letter - Notice 1444 Your Economic Impact Payment - with your 2020 tax records. You’ll need the amount of the payment in the letter when you file in 2021.

Eligible individuals can claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR. These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit.

The Recovery Rebate Credit is authorized by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Generally, this credit will increase the amount of your tax refund or lower the amount of the tax you owe.

You do not need to complete any information about the Recovery Rebate Credit on your 2020 Form 1040 or 1040-SR if your Economic Impact Payment in 2020 was $1,200 ($2,400 if married filing jointly for 2020) plus $500 for each qualifying child you had in 2020. You received all your recovery rebate in 2020.