GREENSBORO, N.C. — Tax Day is Tuesday, April 18, 2023. It’s a little more than a month away and if you’re thinking there’s no way you’re going to make the deadline, maybe filing an extension with the IRS is in your future.

“An extension is an extension to file your taxes, not pay your taxes. It's interesting, to file an extension you have to know what you're going to owe, and what your taxes are going to be. You still have to pay that amount on that deadline day,” said John-Walsh DeGance, Jackson Hewitt.

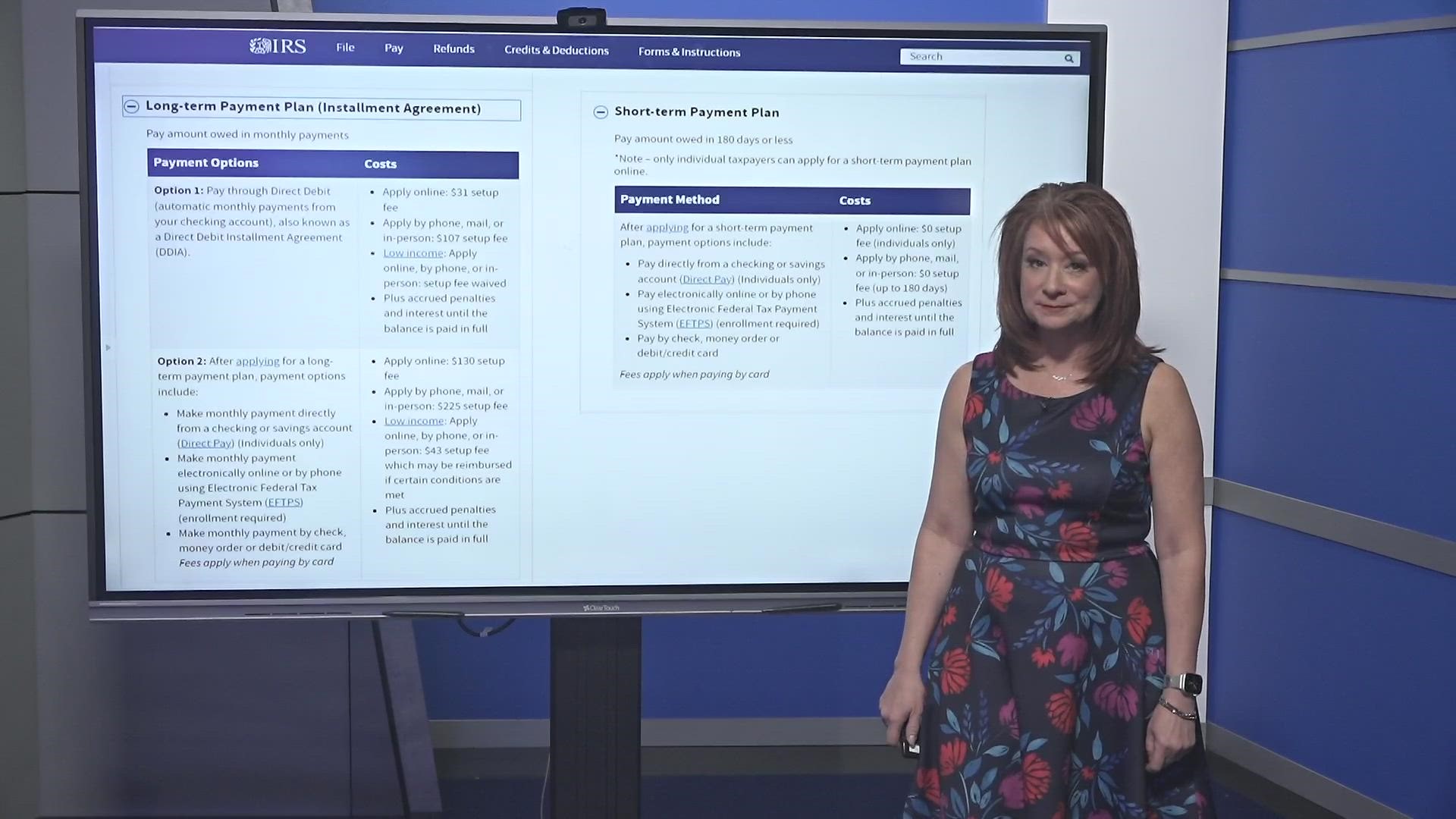

If you owe taxes, you have two options, either pay in full or set up a payment plan with the IRS.

You can pay by direct deposit from your bank account, you can do it online, or by credit card, but all of the options mean you'll pay interest.

“You can set up a payment agreement with the IRS, but there are penalties and fees associated with that. You do owe the interest for the installment agreement,” said DeGance.

The IRS lays out the options for plans and all the costs including the cost to set it up, which could be as much as $225.

What are the benefits of paying my taxes on time?

By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline.

If you're not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. There's also a penalty for failure to file a tax return, so you should file timely even if you can't pay your balance in full. It's always in your best interest to pay in full as soon as you can to minimize the additional charges.