GREENSBORO, N.C. — If you're asking where's my North Carolina refund, you are certainly not alone. And there's a reason for that.

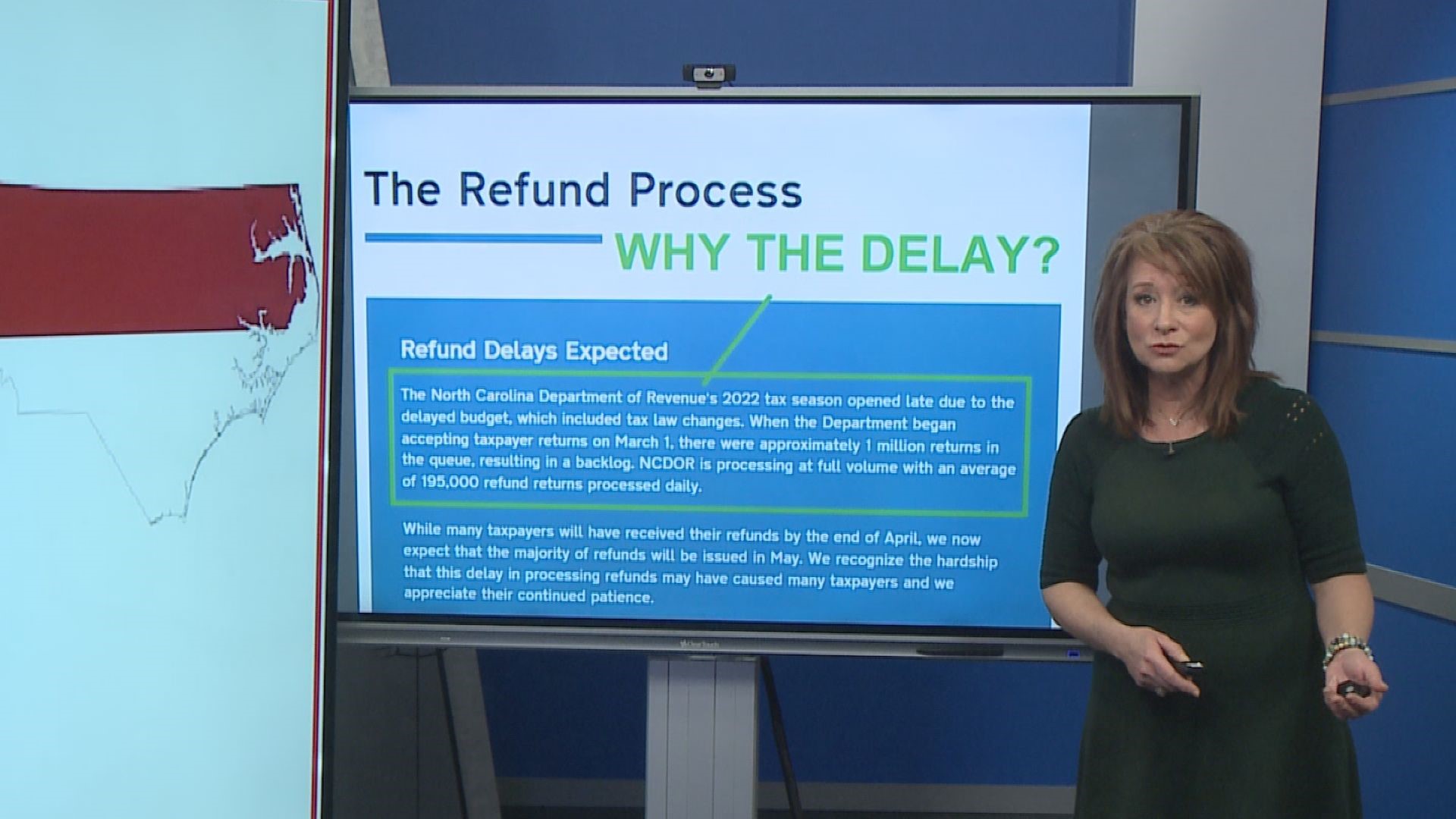

The NC Department of Revenue at first said most taxpayers would see their refunds in April, but when 2 Wants To Know asked about the status of returns as of May, the answer was not what most taxpayers were hoping for.

While many taxpayers will have received their refunds by the end of April, we now expect that the majority of refunds will be issued in May.

The state says they are processing at full volume, about 195,000 refund returns daily.

What is going on? The NC DOR references it on their site. Tax season opened late due to the delayed state budget, which included tax law changes. The state didn't begin accepting returns until March 1, 2022.

North Carolina has a Where Is My Refund tool. Before you submit your information, the site explains the different stages of which there are seven.

From Stage 1-- Return Received to Processing, Initial Review, Requires Further Examination.

More than 90 percent of returns go through three stages of processing before a refund is approved. This process typically takes less than three weeks after the electronic submittal date. The process will be longer for taxpayers who filed paper returns.

Less than 10 percent of returns may require up to seven stages of processing to protect your identity and refund from potential identity theft refund fraud. These additional measures are implemented to protect your identity and ensure you receive the appropriate refund. If your return requires the additional review, it will take longer to process - typically six weeks for electronically filed returns and 12 weeks for paper returns.

You’ll need the social security number of the person listed first on your tax return as well as the amount you’re supposed to get back.