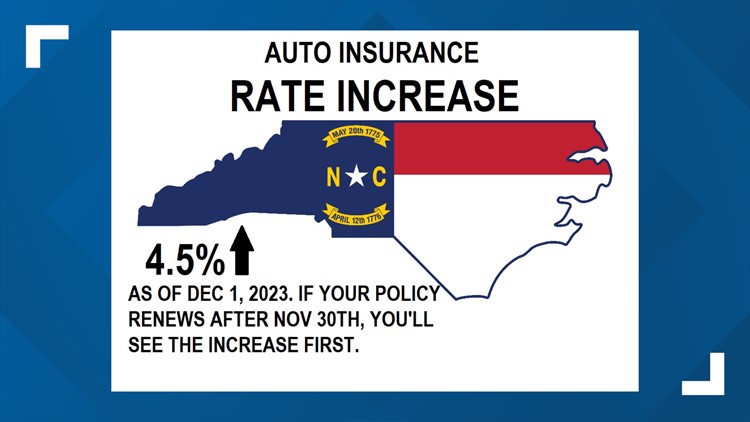

GREENSBORO, N.C. — The cost of covering your car, SUV, or truck is going up in North Carolina. Auto insurance carriers can add 4.5% before the end of this year and another 4.5% in 2024. In total, this is a 9% increase over two years. The insurance industry came to the state asking for a 28% increase.

"Inflation is hurting everyone and causing an increase in car repairs and unfortunately, people's driving habits are driving up the cost of insurance. We've had rings of car thefts all across NC and that plays into it. All of these things add pressure to auto insurance rates," said Mike Causey, NC Insurance Commissioner.

Causey doesn't set the rates, but he does have the authority to say yes or no to suggested rates and to work on negotiating settlements. The last increase was in 2019. Commissioner Causey approved a 1.6% increase. The insurance industry had asked for a 7.6% increase. Before NC, it was a 2017 increase of 2.2%.

"If you compare our insurance rates to Florida, Michigan, Louisiana, you'll see many times the rates in NC are just a fraction of what they are elsewhere," said Causey.

According to Bankrate.com, about 18 states have auto insurance rates below North Carolina's average leaving drivers in 31 states paying higher insurance rates than drivers in our state.

The insurance rate increase goes into effect this fall. So, if your policy renews after November 30, 2023, you'll see the increase first. Motorcycle rates will also be increasing by 2.3% annually.

When it comes to an increase in rates, your instinct may be to lower your bill by cutting some of your coverage. Commissioner Mike Causey says you need to make sure you have more than the minimum for liability and that you keep comprehensive and collision. Comprehensive coverage will pay when a tree or ice breaks a window in your vehicle or if someone tries to steal or vandalize your car.

"The best advice I have is to make sure you have Replacement Value on your car. If you have the Replacement Value Coverage and you get into an accident and your car is a total loss, your vehicle may be two or three years old, but with Replacement Value Coverage, they'll pay for a brand new car, that's a big deal," said Causey.

Without RVC, if you owe $7,000 on the car loan, but the car is only valued at $5,000, you're still on the hook for paying that $2,000 off the loan yourself.