HIGH POINT, N.C. - The rush is on to get in your end-of-year tax deductible donations.

2019 is right around the corner. You might want to consider donating to Triad Goodwill.

It's a private, nonprofit organization that has been serving the community since 1963.

Triad Goodwill operates more than 20 donation centers in Alamance, Caswell, Guilford, Randolph, and Rockingham Counties.

When you donate to Triad Goodwill, you are doing more than giving your gently-used items a second life.

Triad Goodwill sells donated goods in stores to help provide the public with free and low-cost job training and placement services.

In their last fiscal year, Triad Goodwill served 13,931 job seekers and helped place 2,731 people in jobs.

In fact, 85 cents of every dollar earned in Triad Goodwill stores supports the organization's mission to restore dignity through the power of work.

When you donate to Triad Goodwill, you are also helping the environment.

Triad Goodwill works to keep more than 9 million pounds of product out of local landfills each year.

That includes clothing, household items, computers, electronics, furniture, and more.

The week between Christmas and New Year's Eve is the busiest time of year at Goodwill donation centers.

The rush is prompted in part by people cleaning out their closets, attics, and garages to make room for holiday gifts.

But, many donors are also seeking last-minute tax deductions.

You can avoid the long line and wait time by donating to Triad Goodwill before Christmas.

Here are a few things to keep in mind when donating to Goodwill:

- When decluttering your home, consider the "One-Year Rule:" If you haven't worn it, used it or played with it in one year, it is probably time to donate it.

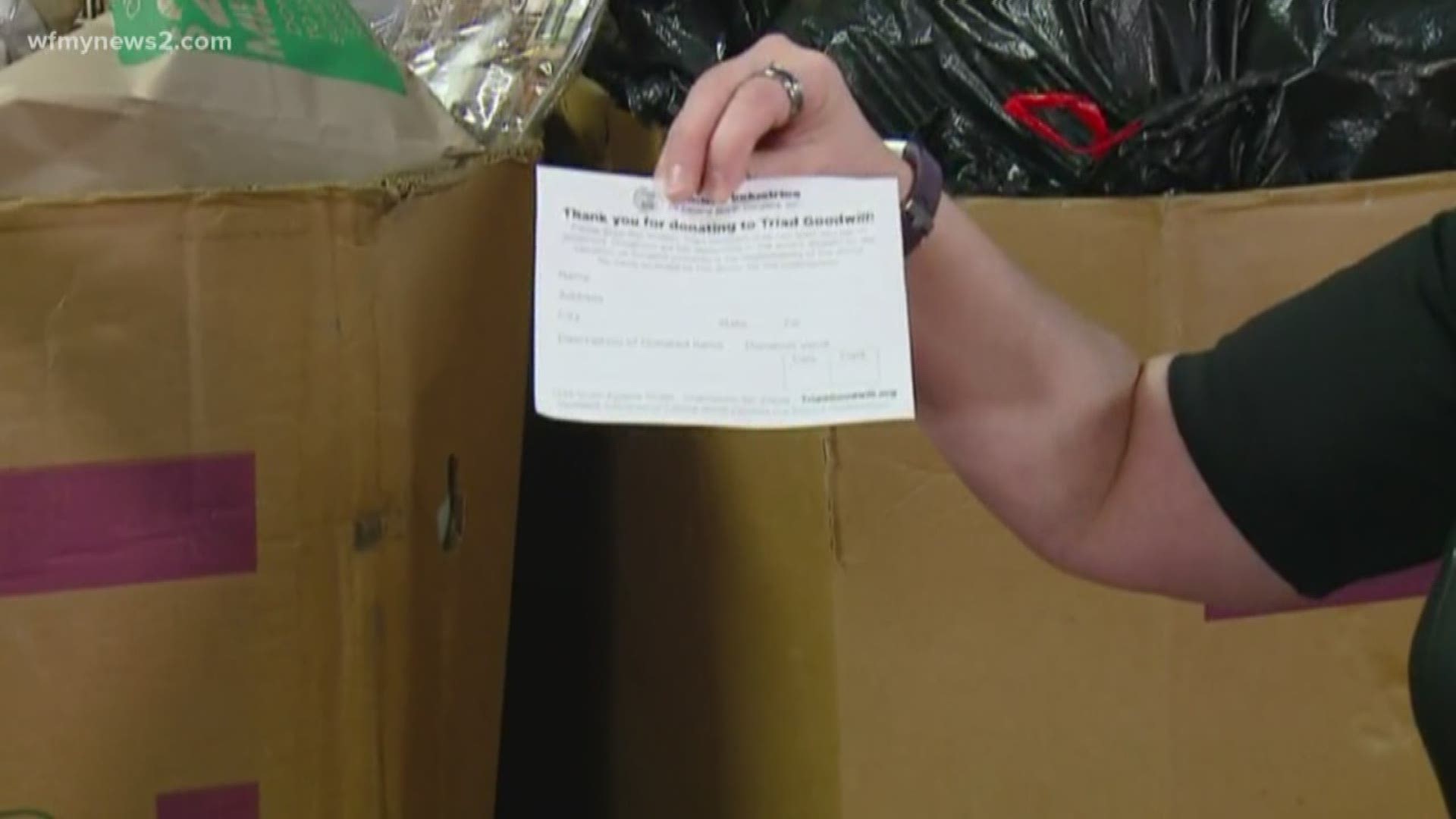

- Donors wishing to claim a tax deduction should request a receipt from the attendant when dropping off their donations. The IRS allows a deduction for each item, but it is up to the donor to estimate each item's value.

- Prepare an inventory of your items before going to Goodwill.

- Remove hangers from clothing.

- If you have a single donation worth more than $500, you will need to complete IRS Form 8283. You will also need a qualified written appraisal.

- Be certain you are donating to a legitimate charity. You can spot fake charities using charity-rating agencies, such as Charity Navigator. Be cautious of donation bins that don't clearly state the organization's mission and contact information.

To learn more about Triad Goodwill or to find a donation center near you , click here.