GREENSBORO, N.C. — It's Tax Day. For you, it may be 'Been there, done that. Bought the T-shirt and paid for it with a refund'. That's great, but no matter where you are in the tax return process, there are people out there who are working on a way to trick you.

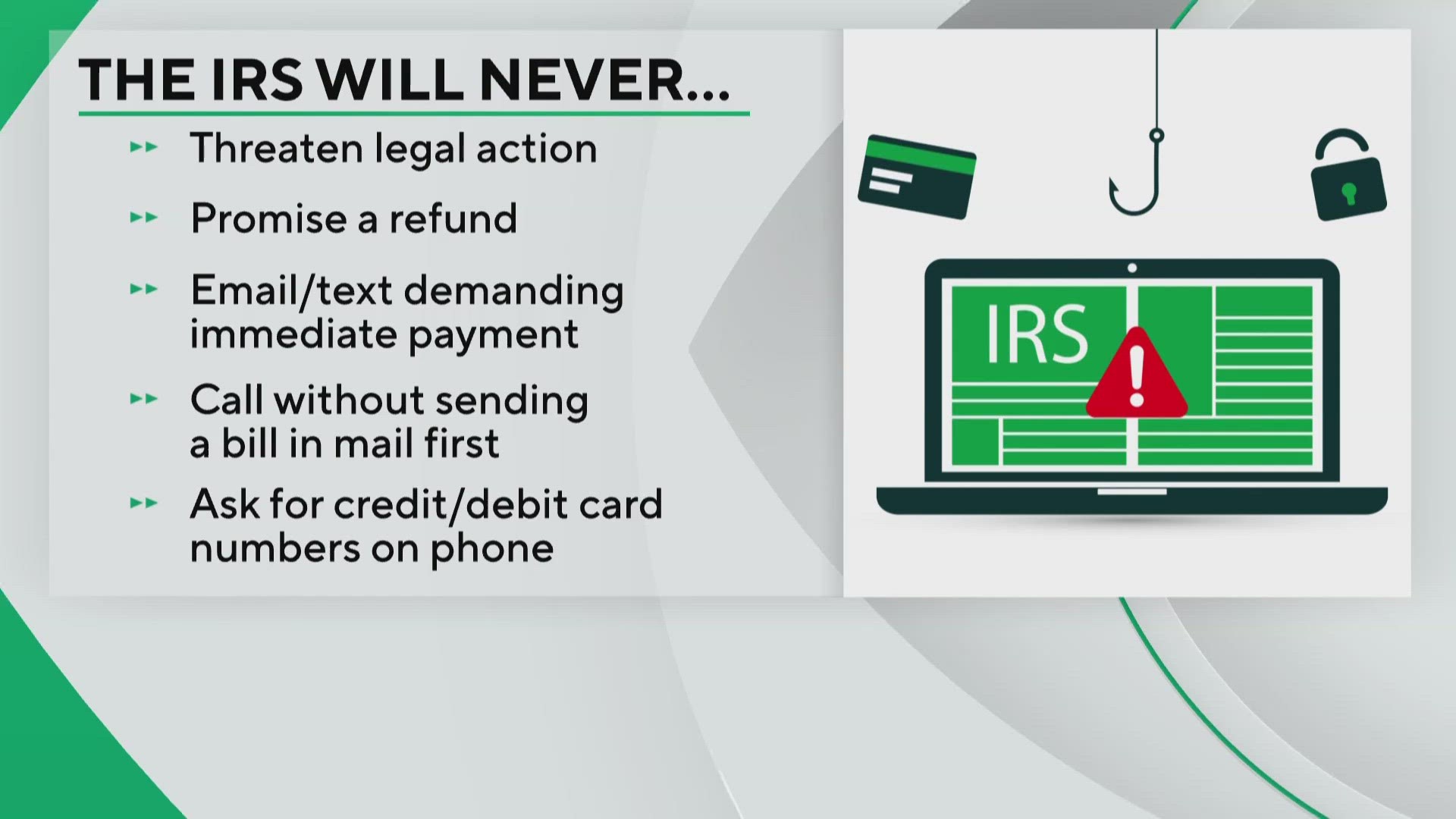

THE IRS WILL NEVER:

Threaten legal action, promise a refund, or send an email or text demanding immediate payment

Call you out of the blue & tell you that you owe money. The IRS sends bills through the mail.

Ask for a credit card, debit card, or gift card number over the phone.

Now, you may be thinking that only people in certain age groups are targeted or only people with a whole lot of money.

"Criminals will steal money from anyone. It doesn't matter if you're 15 or 95. They will steal your money whether it's $5 or $500 or $500,000, they don't care," said Amy Nofziger, AARP's Fraud Expert.

She says scammers often claim back taxes are owed or there's a problem with your return.

"We hear a lot of people being requested for prepaid gift cards or even Cryptocurrency," said Nofziger.

When you want to verify if something is true about your tax return or refund, you go to the source, IRS.gov. You can register as a verified user and you can check on your status.

The IRS released these stats about the 2024 tax filing season:

- This Filing Season, taxpayers benefitted from important updates to the “Where’s My Refund?” tool, which is the most popular IRS customer service tool. Taxpayers have used “Where’s My Refund” 275 million times this Filing Season, with around 31 million views of the new and improved status updates as of April 6.