GREENSBORO, N.C. — With the first week of online Sports betting done in NC, this is a reminder, you have to report your winnings to the IRS. There's a line for gambling on your tax form, it is considered additional income.

"Their winnings are income. It's pure and simple. You need to report that income on your 1040 or you will get a letter from the IRS saying that you underreported your income and you might not like the results," said Shane Albrecht, Liberty Tax.

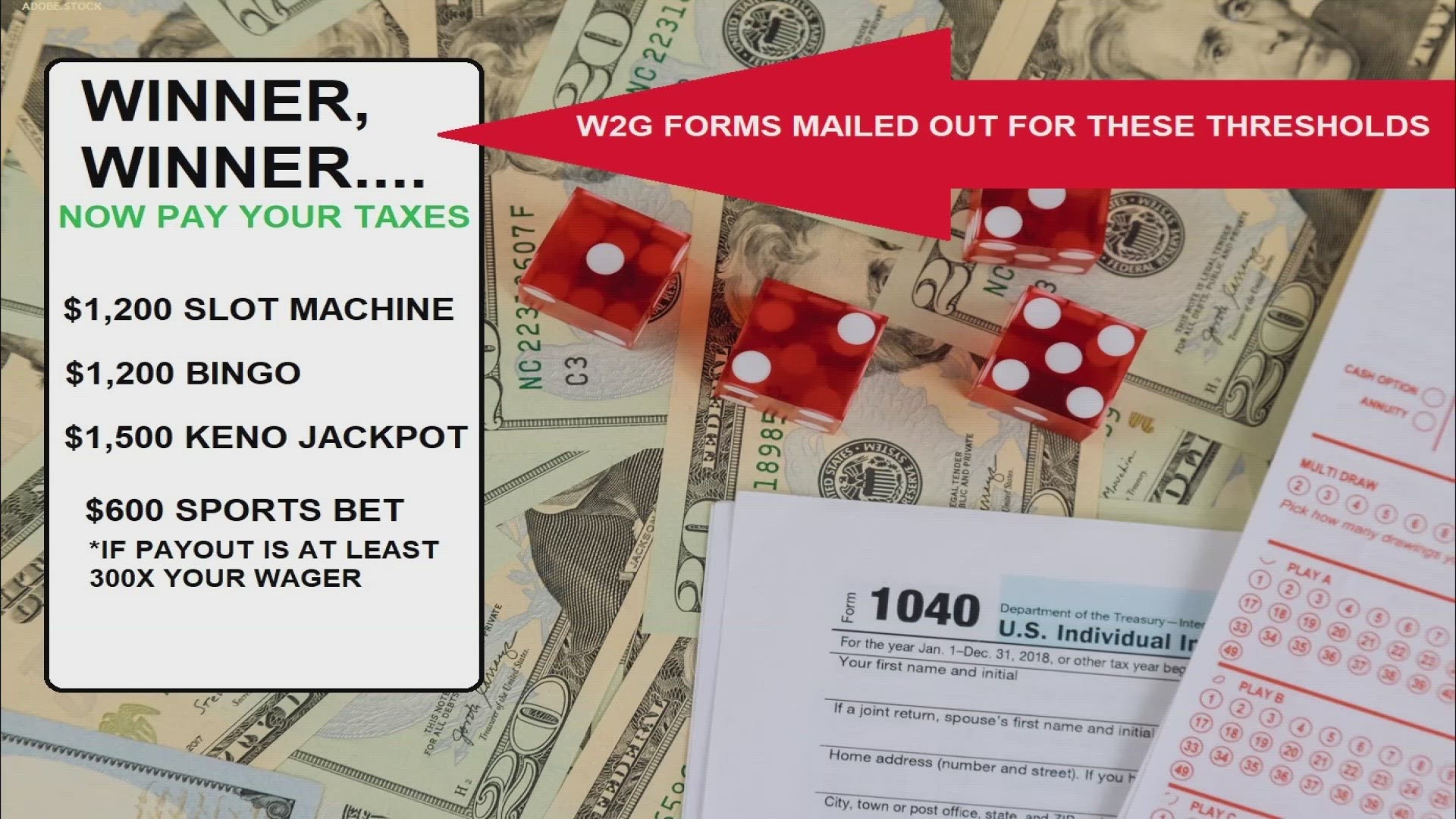

A W2-G form is sent to you by the gaming organizations if you win money. While there are thresholds that need to be reported:

$1,200 on a slot machine

$1,200 at Bingo

$1,500 in a Keno jackpot

$600 on a sports bet if your payout is at least 300 times your wager

The W2-G form mailed to you from the casino, the cruise ship, or the betting app is also mailed to the IRS as well. Even if you don't get a form in the mail, because the winnings didn't meet the form threshold, you still need to claim the money.

The IRS says this about gambling winnings: You must report all gambling winnings including winnings that aren't reported on a form W2-G.

MORE WAYS TO GET WFMY NEWS 2

Subscribe to our daily newsletter Let’s Get 2 It!

Download the WFMY News 2 APP from your Apple or Google Play store.

ADD THE WFMY+ APP TO YOUR STREAMING DEVICE

ROKU: Add the channel from the ROKU store or by searching for WFMY.

Amazon Fire TV: Search for WFMY to find the free app to add to your account. You can also add the app directly to your Fire TV through your Amazon account.