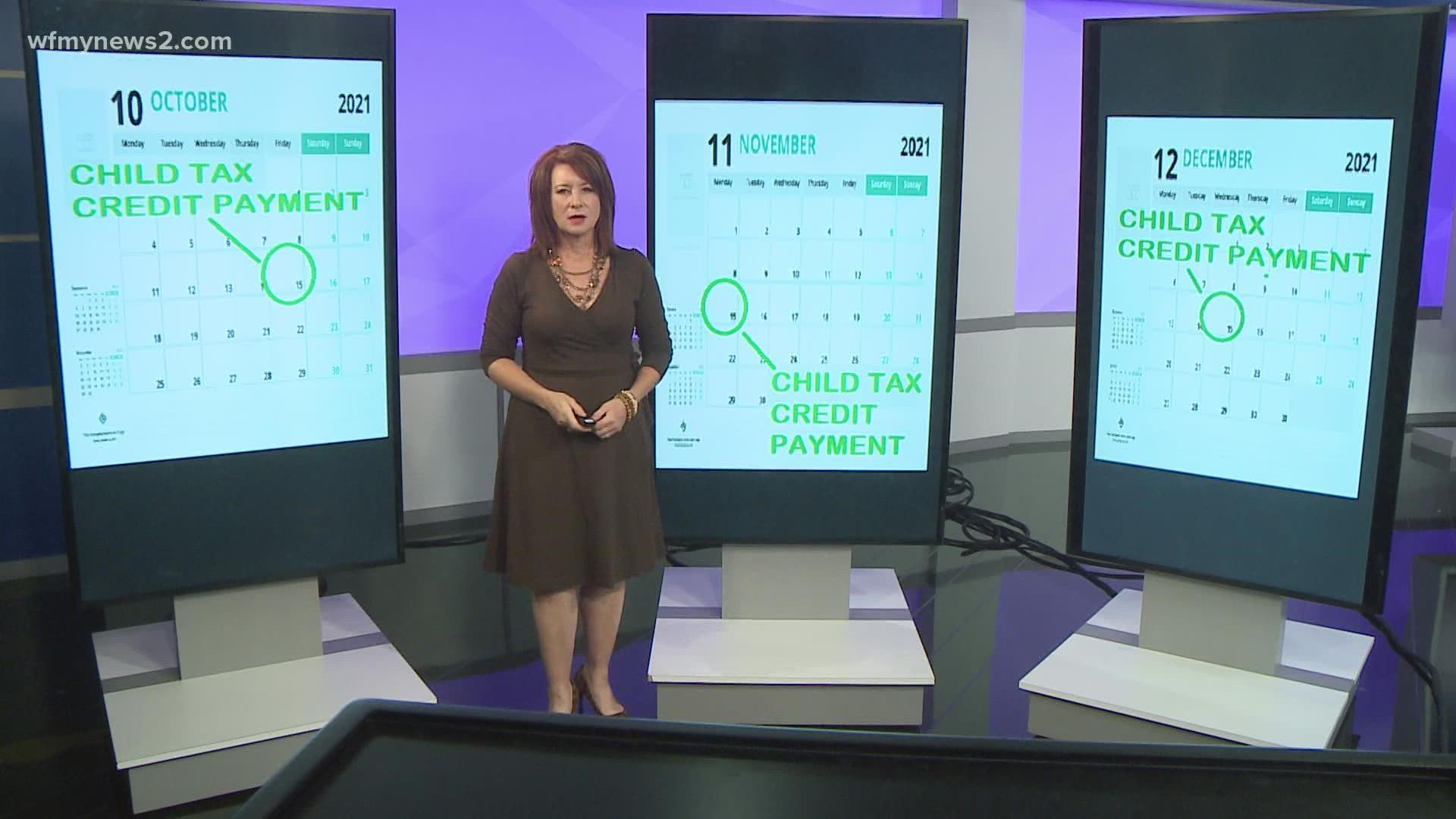

GREENSBORO, N.C. — There are three months left in the year and also, three Advanced Child Tax Credit payment dates. Each one of the pay dates is on the 15th of the month. That means another payment is coming in about a week on Oct. 15, 2021.

The payment is $250 for a child from 6 years old to 17 years old or $300 for a child under 6 years of age. These payments are advances on the tax credit. The full credit is $3,600 for each child under 6 years old and $3,000 for each child 6 to 17 years old.

Do you want a bigger refund at tax time?

To unenroll or opt-out of the advanced payments, go to the IRS web page. To unenroll for the November and December payments, you have to opt-out by November 1st. It’s currently too late to opt-out of the October payment.

Remember, both parents need to opt-out or you get partial payments.

What if you got payments earlier, but the September payment is still missing?

You can check your status with the child tax credit portal daily. It won't change hourly, so don't waste your time. Check it once a day.

You can track your IRS Advanced Child Tax Credit payment, but you have to wait a specific amount of time before you ask the IRS to trace your payment.

A9. You can request a payment trace to track your payment if you have not received it within the timeframes below. We will not be able to trace your payment unless it has been:

- 5 days since the deposit date and the bank says it hasn't received the payment

- 4 weeks since the payment was mailed by check to a standard address

- 6 weeks since the payment was mailed, and you have a forwarding address on file with the local post office

- 9 weeks since the payment was mailed, and you have a foreign address

To start a payment trace, mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund.

The bottom line here, there are no quick answers.

The bright spot, the money isn't gone forever. You can claim more on the Child Tax Credit when you file your taxes in 2022.

I had a child in 2021, how do I claim them for these payments?

The IRS is working on a portal tool for you to be able to fill in that information. From what we know, once that is done, you will be able to claim the 6-months of payments during the advanced child tax credit payment time.