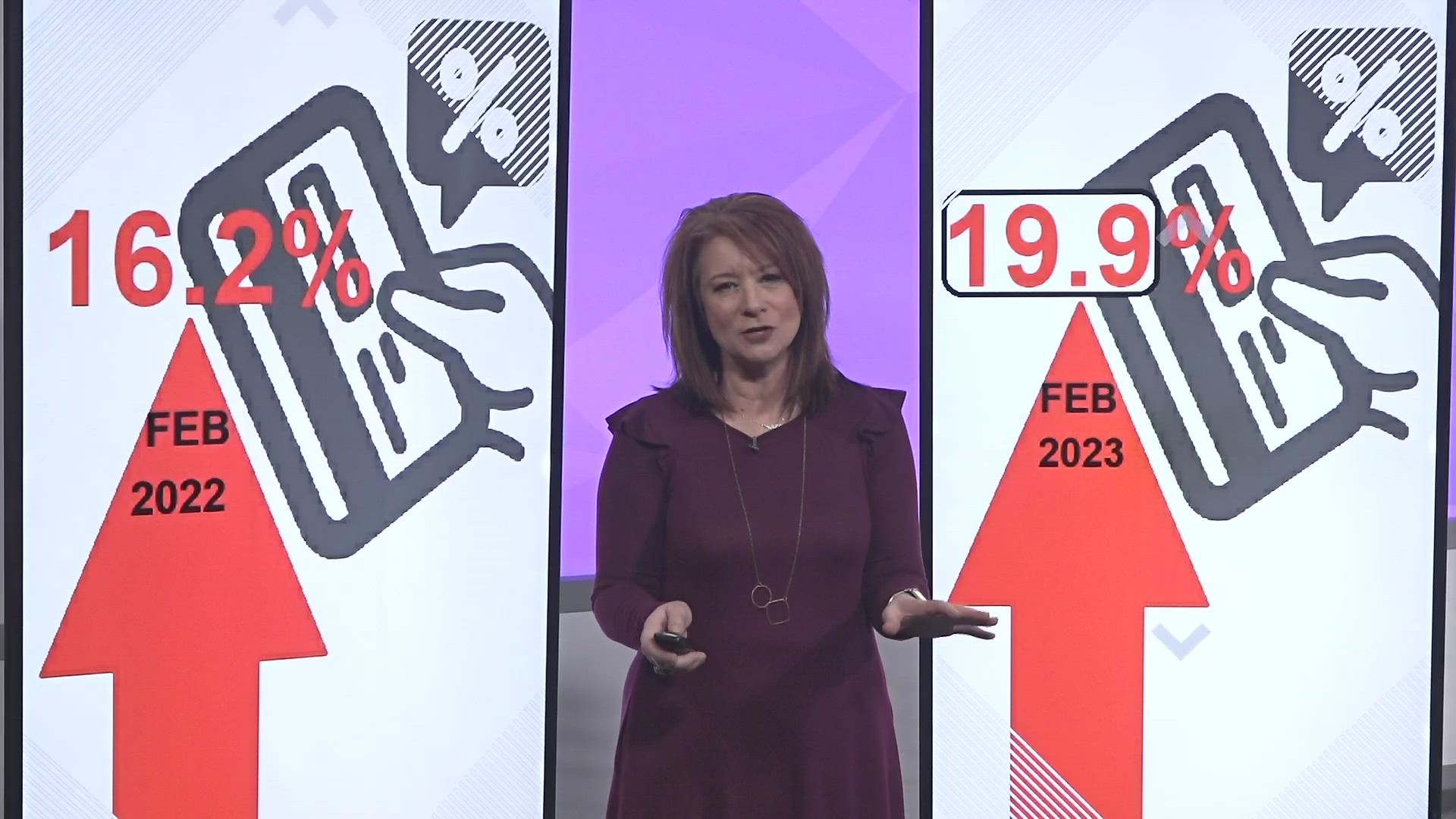

GREENSBORO, N.C. — I know, the Federal Reserve and the constant interest rate hikes may seem like white noise to you. This time last year, the average interest rate on a credit card balance was 16.2 %, now it's 19.9%. Almost 20%!

The difference between $16 to $20 isn't much. The difference from 16% to 20% interest on a balance, really is.

We put the percentages into the Credit Card Calculator.

If you have a balance of $5,000, which is about average, and you're paying the minimum payment at 16% interest, it's going to take you 24 years to pay off the balance and you’re going to pay $15,000 in interest.

Yet, when we change the calculator to reflect the 20% interest, not only does your minimum payment have to increase by $16 a month, but the interest you'll pay overtime increases too---- now you're looking at almost $20,000 in interest.

So, whatever you can pay over the minimum payment, is going to help you, because your payment isn't going to get better any time soon.

“What you need to know is the Federal Reserve said they are not going to stop the hikes and they're not cutting interest rates in 2023. That means right now this is the lowest you'll ever see in your payment it is going to go higher,” said Ja’Net Adams, money expert, and Debt Sucks University.

Her advice? Get credit card debt off your plate. Pay more than the minimum payment and focus on the card with the lowest balance and pay it off.