GREENSBORO, N.C. — Do you qualify for a monthly payment of $250-$300 through the child tax credit payment advance? The payments are set to start July 15th and will go out every month through December.

Parents were due to get this money when they filed their 2021 taxes, it is a tax credit. Instead of waiting for tax time, the American Rescue Plan allows for advance payments. You'll get about half of the tax credit this year and claim the rest next year on your taxes.

In total, parents receive either $3,600 for each child under 6 years old or $3,000 for each child 6 years old to 17 years old.

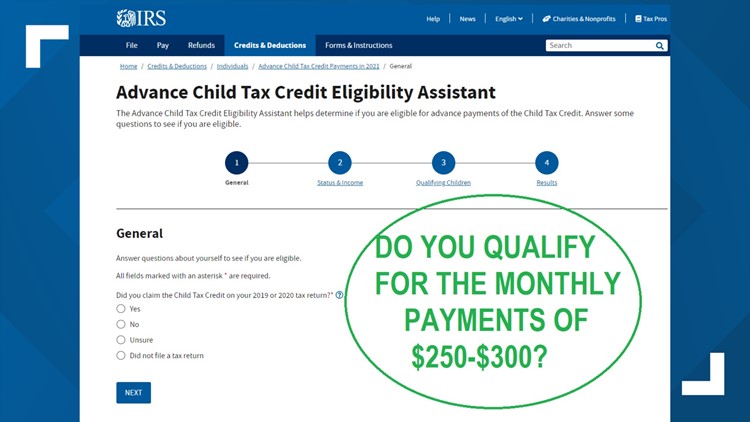

The new Child Tax Credit Eligibility Assistant allows families to answer a series of questions to quickly determine whether they qualify for the advance credit.

This is from the IRS:

Before filing a return or using the Non-filer Sign-up Tool, families unsure of whether they qualify for either the credit or the advance payments may want to check out another new tool — the Child Tax Credit Eligibility Assistant. By answering a series of questions, the tool helps people determine if they qualify for the credit and the payments.

The IRS emphasized that because the Child Tax Credit Eligibility Assistant requests no personalized information, it is not a registration tool, but merely an eligibility tool. Nevertheless, it can still help an eligible family determine whether they should take the next step and either file an income tax return or register using the Non-filer Sign-up Tool.

The new maximum credit is available to taxpayers with a modified adjusted gross income (AGI) of:

- $75,000 or less for singles,

- $112,500 or less for heads of household and

- $150,000 or less for married couples filing a joint return and qualified widows and widowers.

For most people, modified AGI is the amount shown on Line 11 of their 2020 Form 1040 or 1040-SR. Above these income thresholds, the extra amount above the original $2,000 credit — either $1,000 or $1,600 per child — is reduced by $50 for every $1,000 in modified AGI. In addition, the credit is fully refundable for 2021. This means that eligible families can get it, even if they owe no federal income tax. Before this year, the refundable portion was limited to $1,400 per child.

More features coming to the Update Portal soon

Coming soon, families will be able to use the Child Tax Credit Update Portal to check the status of their payments. In late June, people will be able to update their bank account information for payments starting in August. In early August, a feature is planned that will allow people to update their mailing address. Then, in future updates planned for this summer and fall, they will be able to use this tool for things like updating family status and changes in income.

For more information see the FAQs, which will continue to be updated.

Who is getting a monthly payment

In general, monthly payments will go to eligible families who:

- Filed either a 2019 or 2020 federal income tax return.

- Used the Non-Filers tool on IRS.gov in 2020 to register for an Economic Impact Payment.

- Registered for the advance Child Tax Credit this year using the new Non-Filer Sign-up Tool on IRS.gov.

An eligible family who took any of these steps does not need to do anything else to get their payments.

Normally, the IRS will calculate the advance payment based on the 2020 income tax return. If that return is not available, either because it has not yet been filed or it has not yet been processed, the IRS is instead determining the payment using the 2019 tax return.

Eligible families will receive advance payments, either by direct deposit or check. Each payment will be up to $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17. The IRS will issue advance Child Tax Credit payments on these dates: July 15, August 13, September 15, October 15, November 15 and December 15.

The IRS urges any family who hasn't yet filed their 2020 return – or 2019 return – to do so as soon as possible so they can receive any advance payment they're eligible for. At the same time, the agency cautions that tax returns must be processed by June 28 to be reflected in the first batch of monthly payments scheduled for July 15, so eligible families filing now will likely receive payments in the following months. Even if monthly payments begin after July, the IRS will adjust the monthly amounts upward to ensure that people still receive half of their total eligible Child Tax Credit benefit by the end of the year.

Filing soon will also ensure that the IRS has their most current bank account information, as well as key details about qualifying family members. This includes people who don't normally file a tax return, such as families experiencing homelessness and people in underserved groups.

For most people, the fastest and easiest way to file a return is by using IRS Free File, available only on IRS.gov. Besides qualifying them for these advance payments, using Free File will also enable them to claim other family-oriented tax benefits, if eligible, such as the Earned Income Tax Credit and the Recovery Rebate Credit/Economic Impact Payments.

New tool helps non-filers register

For families who don't normally file an income tax return, another easy option is to register for these advance payments using the new Non-filer Sign-up Tool, introduced recently, and available only on IRS.gov. Among other things, the tool asks users to supply current bank information, along with key details about themselves and their qualifying children. The tool then automatically fills in a very basic 2020 federal income tax return that is electronically sent to the IRS. The new tool was developed in partnership with Intuit and the Free File Alliance.

Update Portal allows people to unenroll

Instead of receiving these advance payments, some families may prefer to wait until the end of the year and receive the entire credit as a refund when they file their 2021 return. In this first release of the tool, the Child Tax Credit Update Portal now enables these families to quickly and easily unenroll from receiving monthly payments.