GREENSBORO, N.C. — Inflation is known for shrinking your money, but there is a way to cash in - thanks to inflation. It’s a government-backed bond, the Series I bond.

“The I-bond is gaining a lot of attention right now, because it does something unique and different than other bonds that are out there - it has an inflation rate factored in,” said Scott Braddock of Scott Braddock Financial.

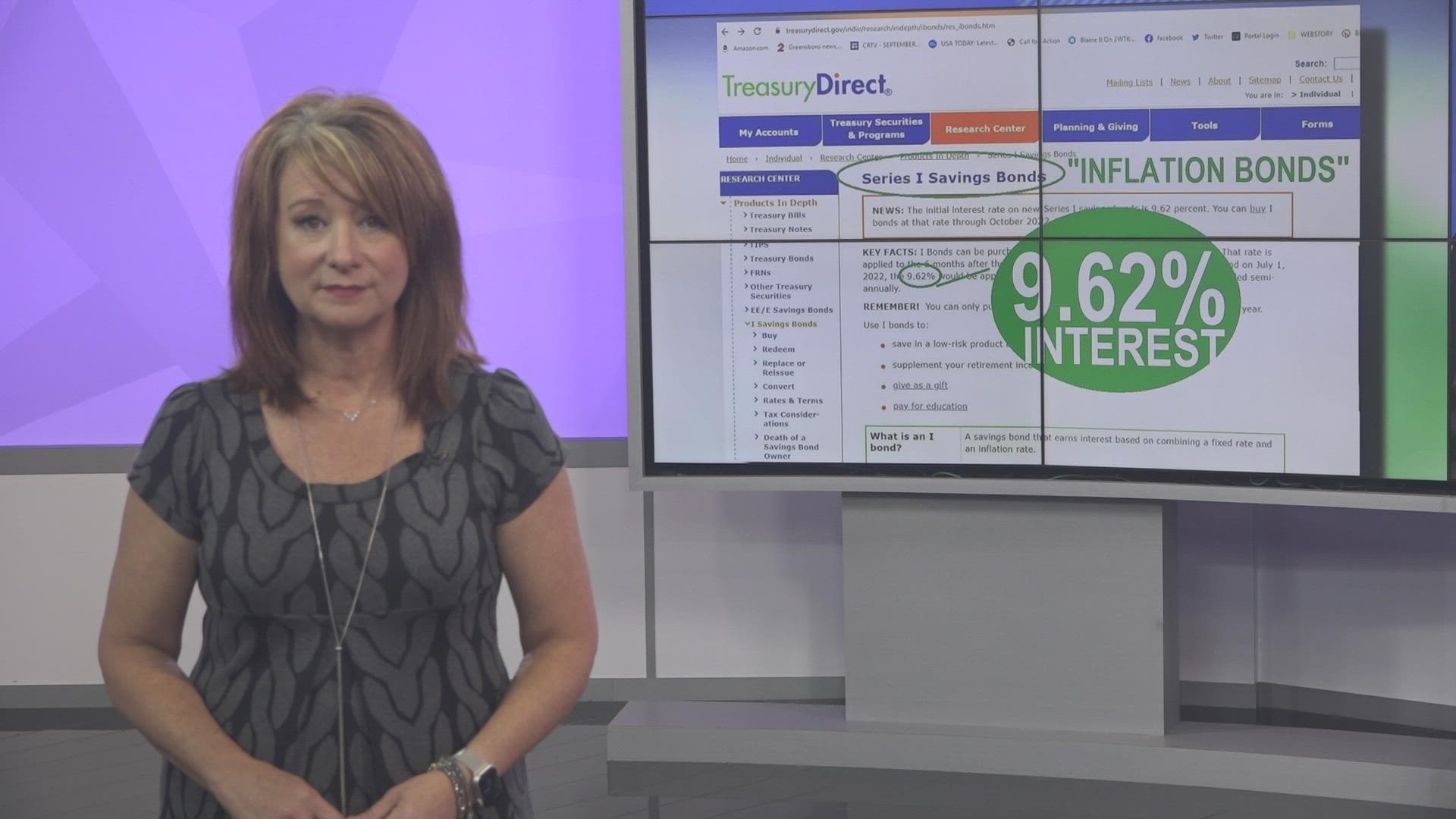

Series I savings bonds are inflation bonds. The interest rate on the I bond is 9.62%. Whoa! You just don't see those kinds of numbers.

Let me give you some context here on how the I bond compares to other savings products. According to Bankrate.com, right now, the best CDs (Certificate of Deposit rate) are offering 3.25%. Chances are, your bank is giving you .01% for your savings account.

Is there a catch?

“We definitely want to make sure we're not putting in our emergency money into the I bonds because again, we can’t get out of it for the first 12 months.

This is a short-term fix for hedging inflation and only for a small portion of your overall portfolio,” said Braddock.

Fast facts:

- You can put in as little as $25 or as much as $10,000 into I bonds yearly.

- You have to leave the money there for a full year to get the interest.

- If you leave the money there for five years, you never pay a penalty for cashing out.

- If you take it out before five years, the penalty is just three months of interest.

The percentage changes every six months, so you'll want to buy I-bonds before the rate changes in November. (If you buy anytime before November, you get a full six months at the 9.62% rate)

You can only buy I bonds online from the US Treasury. These are not paper bonds, they are online only. You can, however, get paper bonds if you buy them with your tax return refund.

To look at the bond rate history, click here and scroll down to the composite rate. This is the interest rate you'll receive after the calculations between the fixed rate and the inflation rate are done.