GREENSBORO, N.C. — Your bank account could have another $300 in it, in less than 48 hours.

The third Advanced Child Tax Credit payment goes out on September 15, 2021.

I want you to be very clear on this, this is not a stimulus payment, this is an advanced payment on a tax credit. Whatever you get ahead of time, you'll deduct from your tax credit when you file taxes.

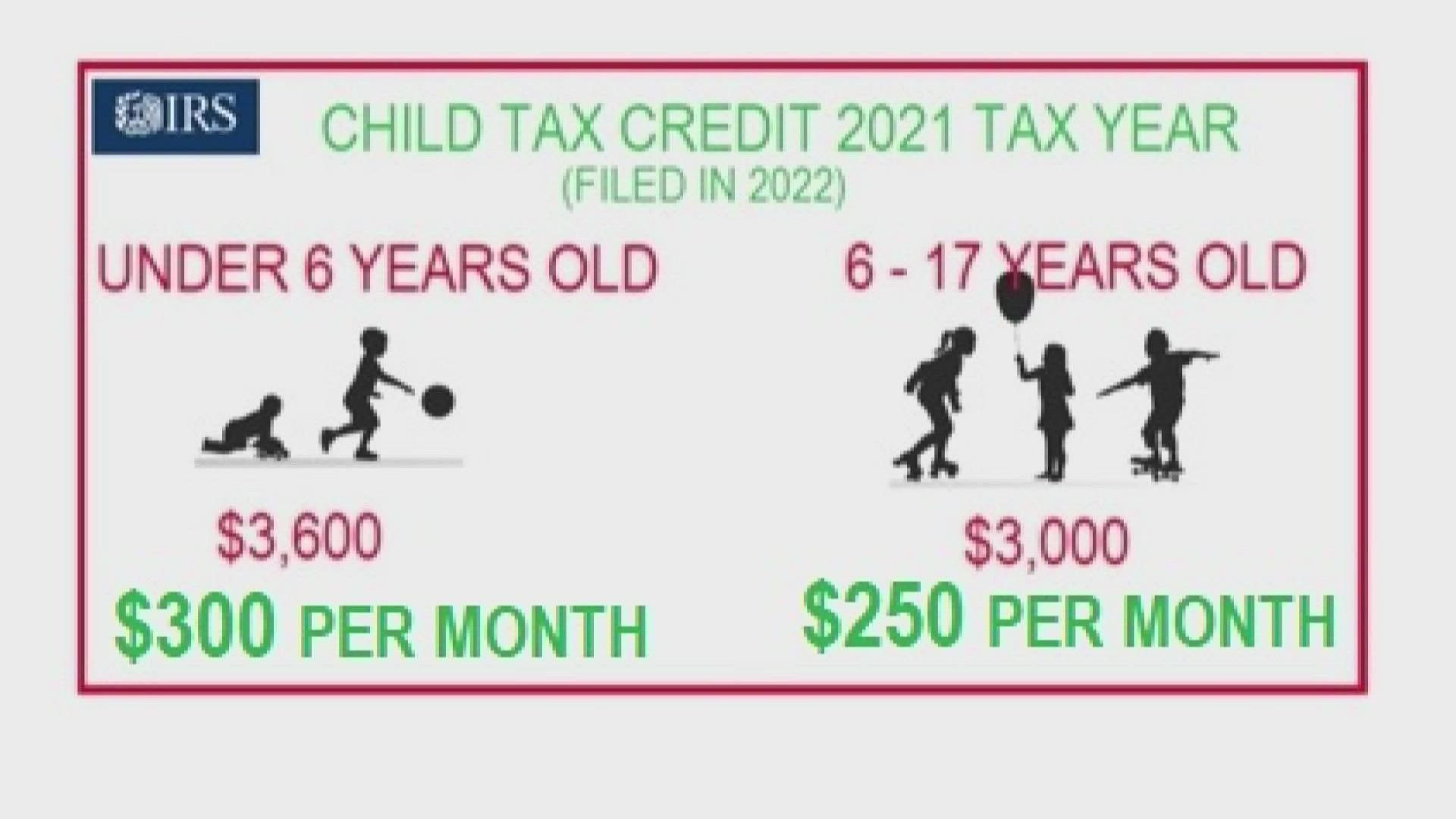

The total Child Tax Credit for 2021 is $3,600 for each child under 6 years old and $3,000 for each child 6 to 17 years old. Each month, you either get $300 or $250 for each child. Half of the amount of the tax credit will be split up between all of the payment dates from July through December, with payments made on the 15th of each month. The rest will be deducted when you do your taxes in 2022.

You get your monthly payment automatically by direct deposit or check.

While it's too late to stop the check for the September payment,

you can unroll for the rest of the payments by going to the IRS website and using the child tax credit update portal. If you like the option of having big tax deductions and possibly getting a bigger refund, you’ll want to unenroll.

If you're waiting to let the IRS know you had a child this year and want the advanced payments, you need to change your marital status or income, We're still waiting for that portal to be done.

The benefits begin to phase out at incomes of $75,000 for individuals, $112,500 for heads of household, and $150,000 for married couples. Families with incomes up to $200,000 for individuals and $400,000 for married couples can still receive the previous $2,000 credit.

The expanded child tax credit, which was passed as part of the American Rescue Plan COVID relief bill in March, is set to lapse after a year, though President Joe Biden has proposed extending it through 2025 and would like it to be made permanent.