GREENSBORO, N.C. — Stimulus number 3 could be passed by the end of the week or early next week. And as of now, you could be getting a lot more stimulus money than the last two times. It’s all about dependents.

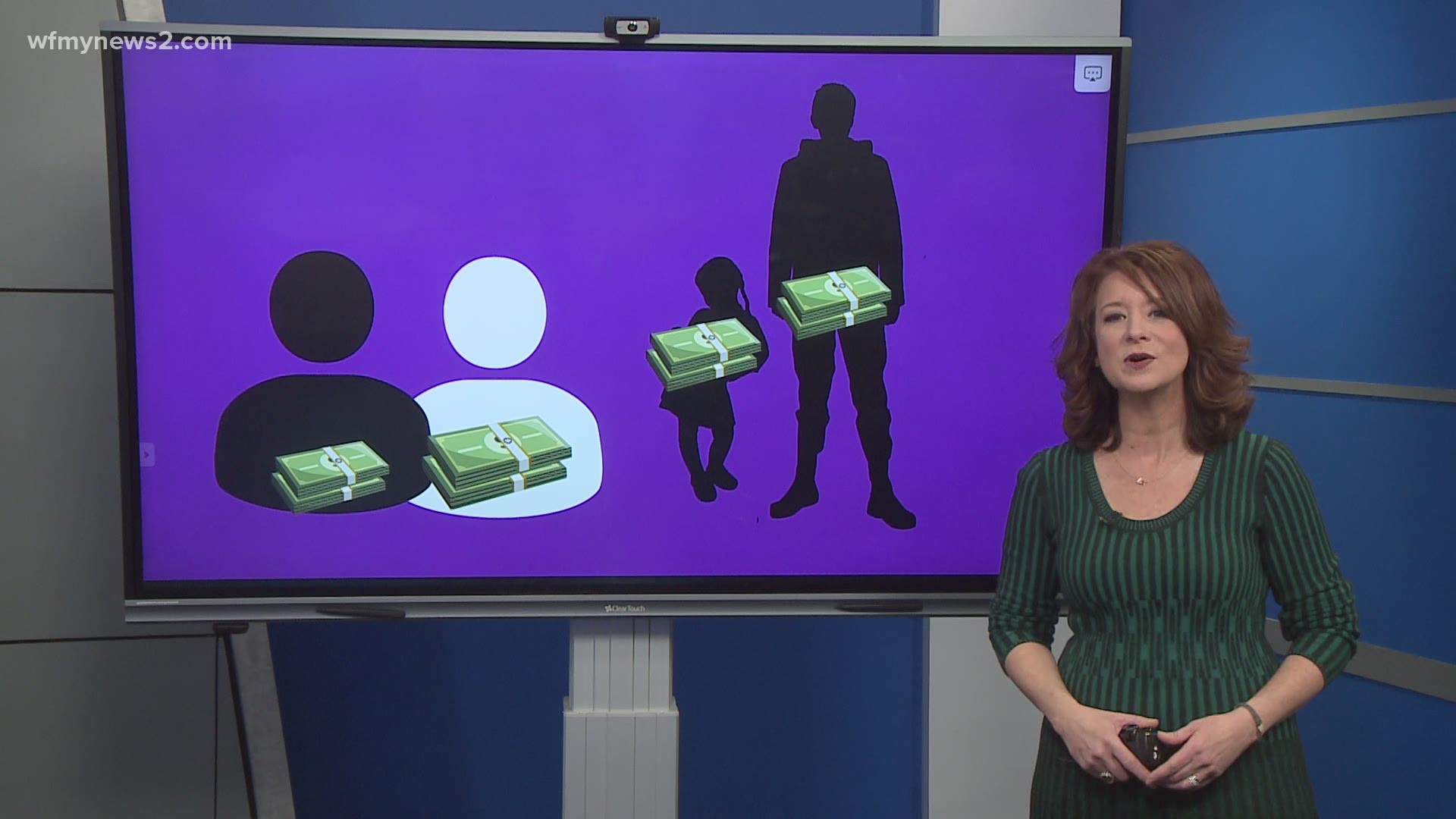

You get $1,400

Your spouse gets $1,400

Your kids, whether they are 3-years-old or 23-years-old, will get $1,400

Your Mom who lives with you will also get $1,400

Now, when we say the kids and mom get the $1,400, what we really mean is you, the taxpayer who claims them get the money.

“If this individual is counted as a dependent, they bring more money into the household, but they don't get the actual payment, the taxpayer who claims them does because that is the information the bank and IRS have, it's the not the dependent,” said Mark Hensley of AARP NC—Triad Region.

The taxpayer who claims the dependent gets the money.

Let me settle what could be a sticking point in your family. Does the taxpayer who gets the money owe the dependent that money? No. It's not the dependent's money, it's the taxpayer's money for taking care of the dependent.

YOU DIDN'T GET ALL OR ANY OF STIMULUS #1 OR #2?

There’s no amount of calling to the IRS that will get you your money. The only way to get it is to file a tax return. Period. Even if you don't normally file taxes, you will file taxes if you want this money.

“In some cases, there may be people who didn't get one or both stimulus payments, but by filing the 2020 tax return and making sure line 30 is completed, they may be able to get a refundable credit if they did not get a check in the mail or direct deposit,” said Kevin Robinsons of Robinson Tax and Accounting Services.

The 2020 tax return has a specific line for you to claim the stimulus money. It's line 30 and it reads Recovery Rebate Credit.

Here's the good news, you can file your taxes for free online. There are step-by-step guides for you to do it.

EVEN IF YOU DON'T FILE TAXES, YOUR 2020 RETURN MAY BE THE ONLY WAY TO GET YOUR STIMULUS MONEY

This is the ONLY way for you to possibly claim the rest of the stimulus money. The IRS has nine options for you to file for FREE electronically. In fact, any taxpayer or family making less than $72,000 a year can file for free.