GREENSBORO, N.C. — When a household loses a family member, there is the grief and sadness of missing that loved one. On top of that is the reality of living without that member's income or value to the family and that's where life insurance comes in.

“Most of the time I'm meeting with families that say, ‘I want to make sure that if I'm not here, my family can live in a similar standard of living, I still want my kids to go to college, I still want them to live in the house’ it’s what their focus is,” said Jeff Jackman of Northwestern Mutual in Greensboro.

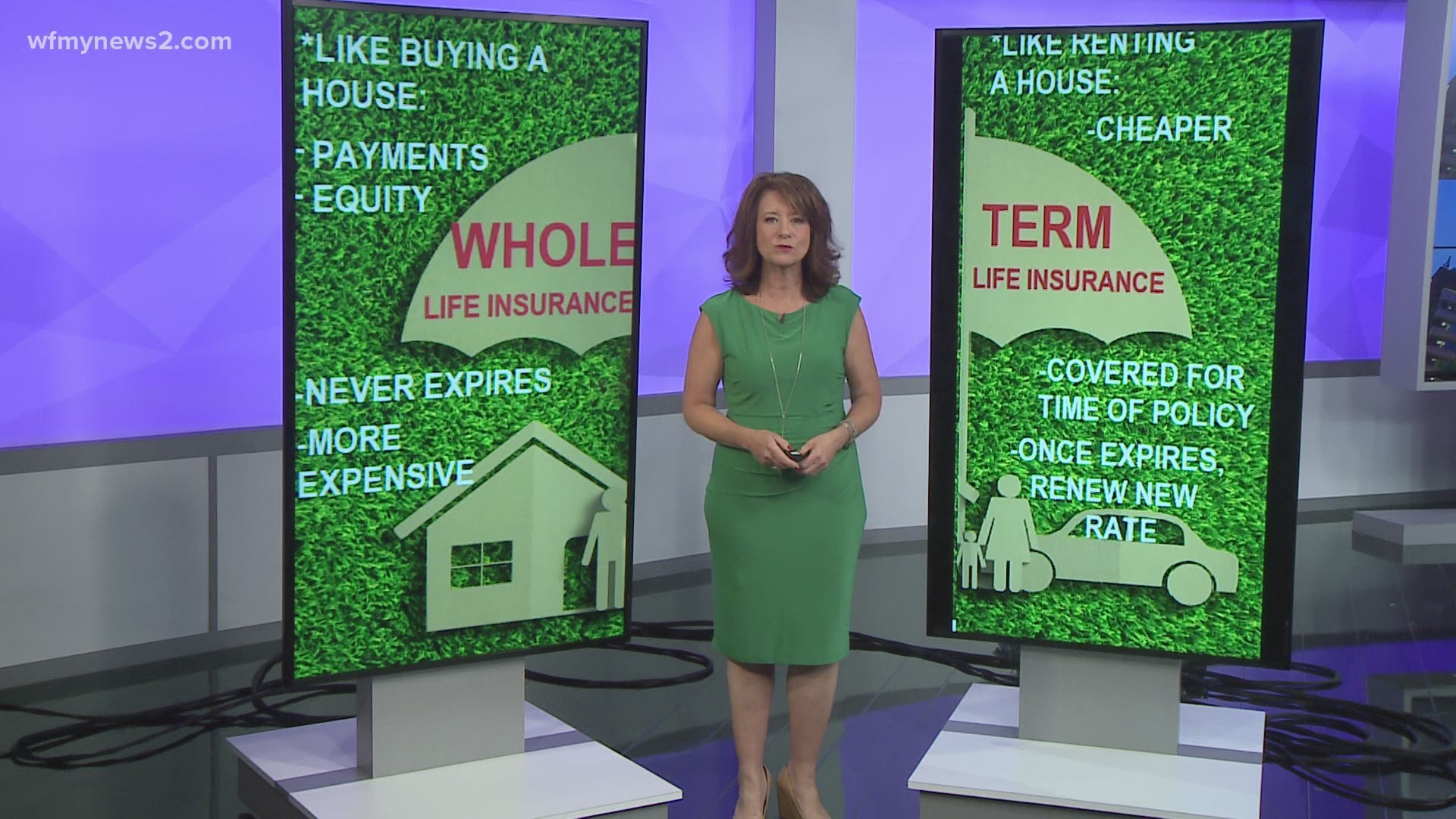

Jackman explained the difference between Whole and Term. Now, there are more details but in simple terms:

WHOLE LIFE INSURANCE

Whole life insurance is like buying a house. You make payments, you build equity, you can borrow against it. It never expires and your family gets a death benefit. Whole life insurance is more expensive.

TERM LIFE INSURANCE

Term life insurance is cheaper. It's like renting a house. You make payments for a period of time. You're covered for the time of the policy. Once the policy expires, you have to renew and that can be tricky.

That can be tricky.

“People overlook how fragile insurability is. My mom is a breast cancer survivor. She couldn't get a good rate when she was renewing because of pre-existing conditions,” said Jackman.

He says the best scenario is to have a mix of some whole insurance coverage some term insurance coverage.

"If a client's budget allows both Term and Whole, the majority comes from Term, but you also have something permanent so you don't have to take the risk of having to reapply when you're 50 years old. At least we know there is something that will be there permanently, " said Jackman.

The biggest takeaway he wants you to have though is that you need to talk to an insurance professional to see what your goals are and how the coverage matches up.