GREENSBORO, N.C. — There are three things to know about this year's tax season that can affect your return: charitable giving expansion, claiming all of the child tax credit, and the NC refund timeline.

#3 A BIGGER REFUND BY: CHARITABLE GIVING, EVEN IF YOU DON’T ITEMIZE

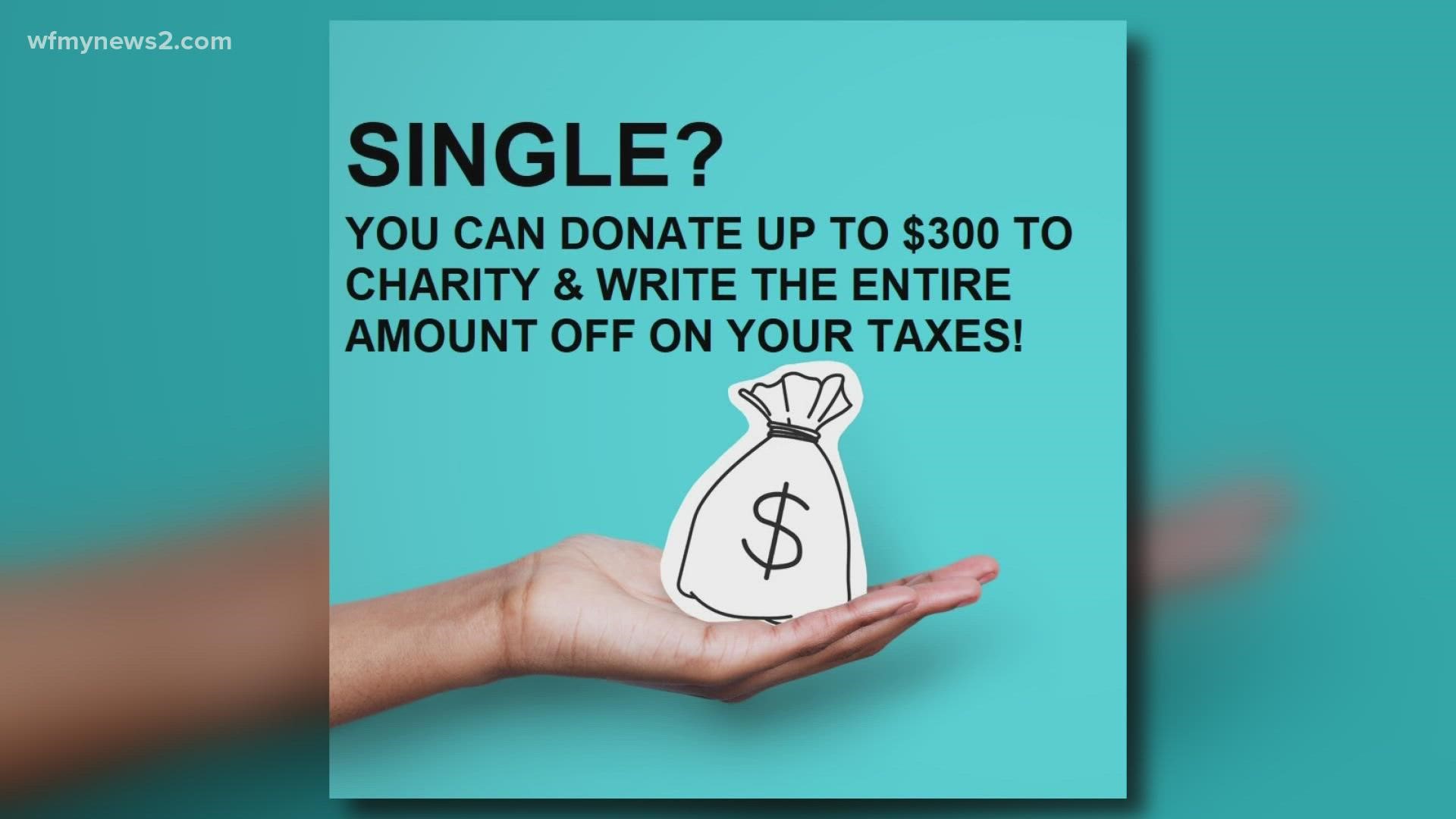

For the 2021 tax year, a special charitable donation/deduction is available for every taxpayer, regardless of how much you make or whether you itemize or not.

If you're single, you can donate up to $300 to charity. Married couples, you can each donate $300, that's a $600 total to charity, and that's on top of the standard deduction, no itemizing

“They can reduce their income by $600 much like when they make an IRA contribution they bring their income down $600. If you don't have enough to itemize but you're married filing jointly you can deduct up to $600 charitable contributions and still get the standard deduction,” said Kevin Robinson of Robinson Tax & Accounting Services.

#2 COLLECTING THE ENTIRE CHILD TAX CREDIT

If you got some of the advanced Child Tax Credit payments that were sent out from July 2021 to December 2021, the IRS sent you a letter that shows the amount you got. You’ll need the amount, so you can claim the rest of the credit. Total, it is $2,500 or $3,000 per child.

If you don’t normally file taxes, the only way to get the Child Tax Credit is to file taxes.

“If you are one of the more than 30 million families who have already received the child tax credit, you still need to file your taxes. So that is the only way to receive the second half of what you are owed. So, remember: you are owed more, but you still need to file your taxes,” said Vice President Kamala Harris.

#1 NC REFUND TIMELINE

This year, the NC Department of Revenue didn’t begin accepting and processing returns until the first week of March. The NC DOR is expecting refunds to be in early April.