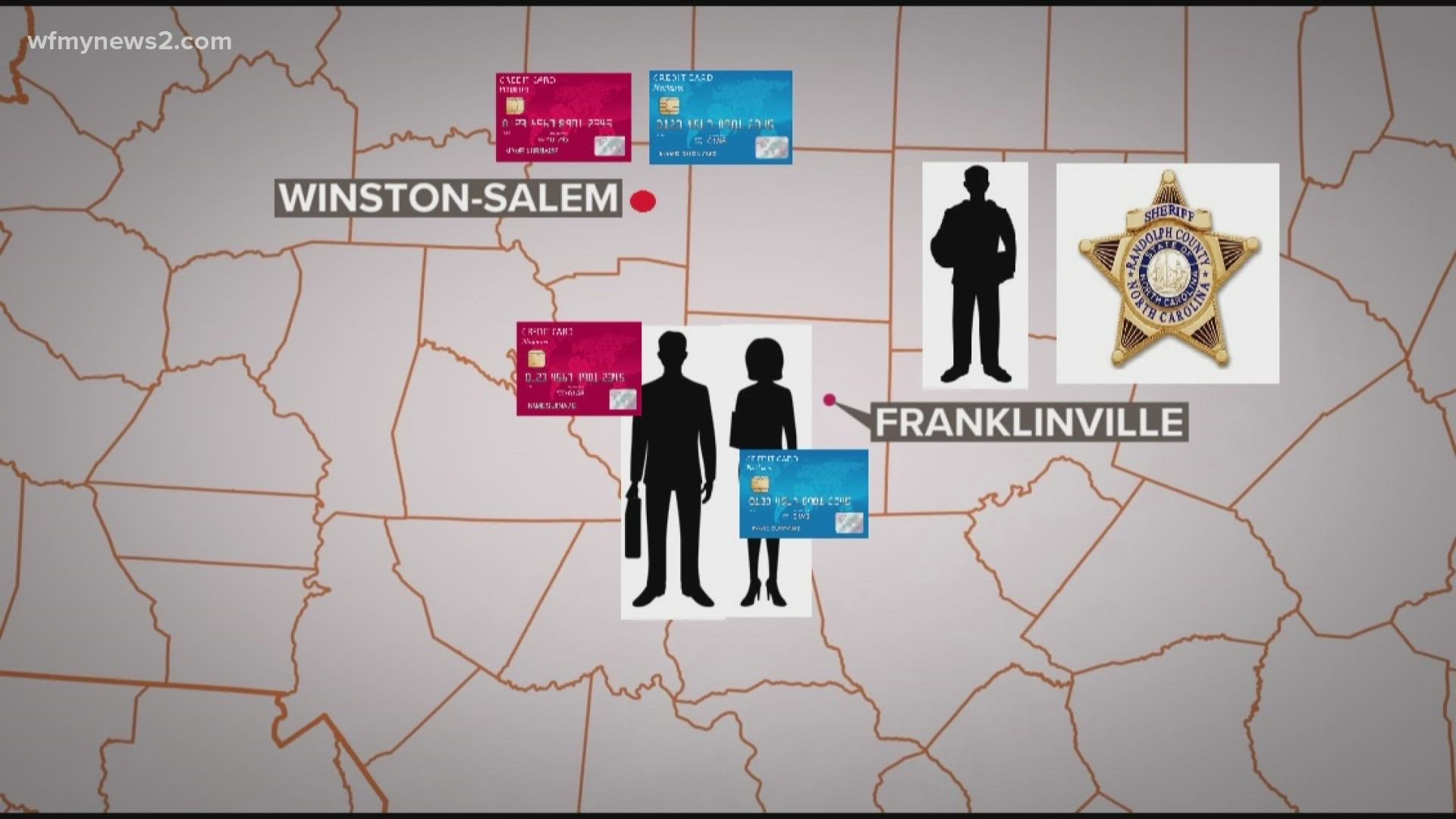

GREENSBORO, N.C. — Just when you think scammers never get caught, Randolph County deputies arrested a Triad man. Investigators believe he called a couple's credit card company, ordered duplicates of their cards, and had them mailed to a Winston-Salem address.

This kind of ID theft sounds too easy. Shouldn't the credit card company have asked for identifying information? Maybe they did, and the scammer stole it too.

“Even if the bank's fraud measures failed here, what ultimately happens, is the consumer should not be liable for those fraudulent charges,” said Tedd Rossman of Bankrate.com.

That's the good news. Fraud like this is reimbursed by the credit card company. The charges are reversed and your life goes on, but if this happens to your debit card, the charges are real money taken from your bank account. While they will be reimbursed, it often takes up to a week or more, and that is a real-life problem when you don’t have access to your money.

So, how do you guard yourself against this duplicate card scam? There's no fool-proof way to keep it from happening.

“This is a specifically hard one to guard against. Oftentimes when we talk about fraud I tell people to freeze their credit, that is a great way to prevent new account fraud, but this isn’t the same,” said Rossman.

While you may not be able to ward off the duplicate card scam, there are ways to catch it quickly. You’ll need to make sure you have online or app access to your accounts.

“Sign up for real-time alerts so you know every time something goes through on your account and that's something that could tip you off. Even if you're not great about reviewing a statement, but you get that text that you spent $200 at such and such store and you weren't there, at least you're going to know about it,” said Rossman.

In this day and age, you can't be looking at your statement once a month. You need to make it a habit of logging on to your mobile banking or credit card app at least once a week.