GREENSBORO, N.C. — Tax Day seems a long way off, but the IRS starts processing returns in a week, on February 12th. While you can wait until April 15, it would be better for you to do taxes closer to the processing start date than the deadline. Why? Because the longer you wait, the more opportunity an identity thief has to take your refund.

When an identity thief gets your Social Security number and files a fake tax return under your name to collect your refund, you don't even realize it happened, until you try to file a return and the IRS rejects it as a duplicate filing.

It can take a lot of time to unravel tax ID Theft and really, who wants to spend any extra time going back and forth with the IRS? So file early and file online.

“The IRS is definitely behind in processing mail and things like that. Particularly those expecting a refund, electronic filing is definitely worthwhile,” said Mike Varner of Kruggel Lawton CPA.

E-filing is free for most Americans. You don't have to buy software to do your taxes. The IRS offers nine different free e-file options (and bonus, if you didn't get all the stimulus money, there's a way to do that when you file online).

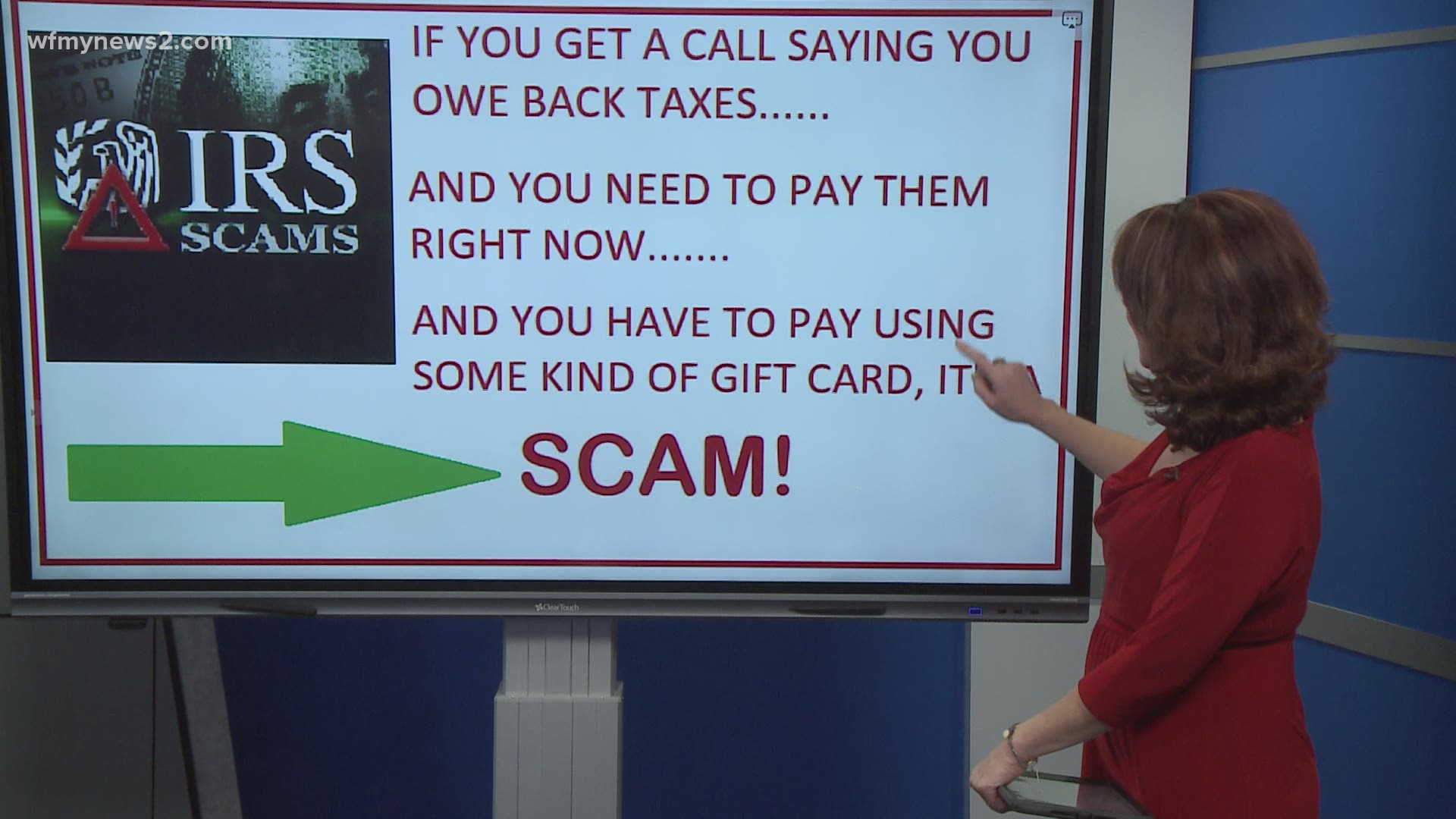

In the meantime, know this: scammers will be trying to get your money and pretend to be the IRS. If they tell you to pay your taxes right now with some kind of gift card, it's a scam!