GREENSBORO, N.C. — April 15, we all know it as Tax Day, but this year Tax Day is Monday, April 18, 2022. You have the weekend to get your taxes done. You're not alone in waiting to do them.

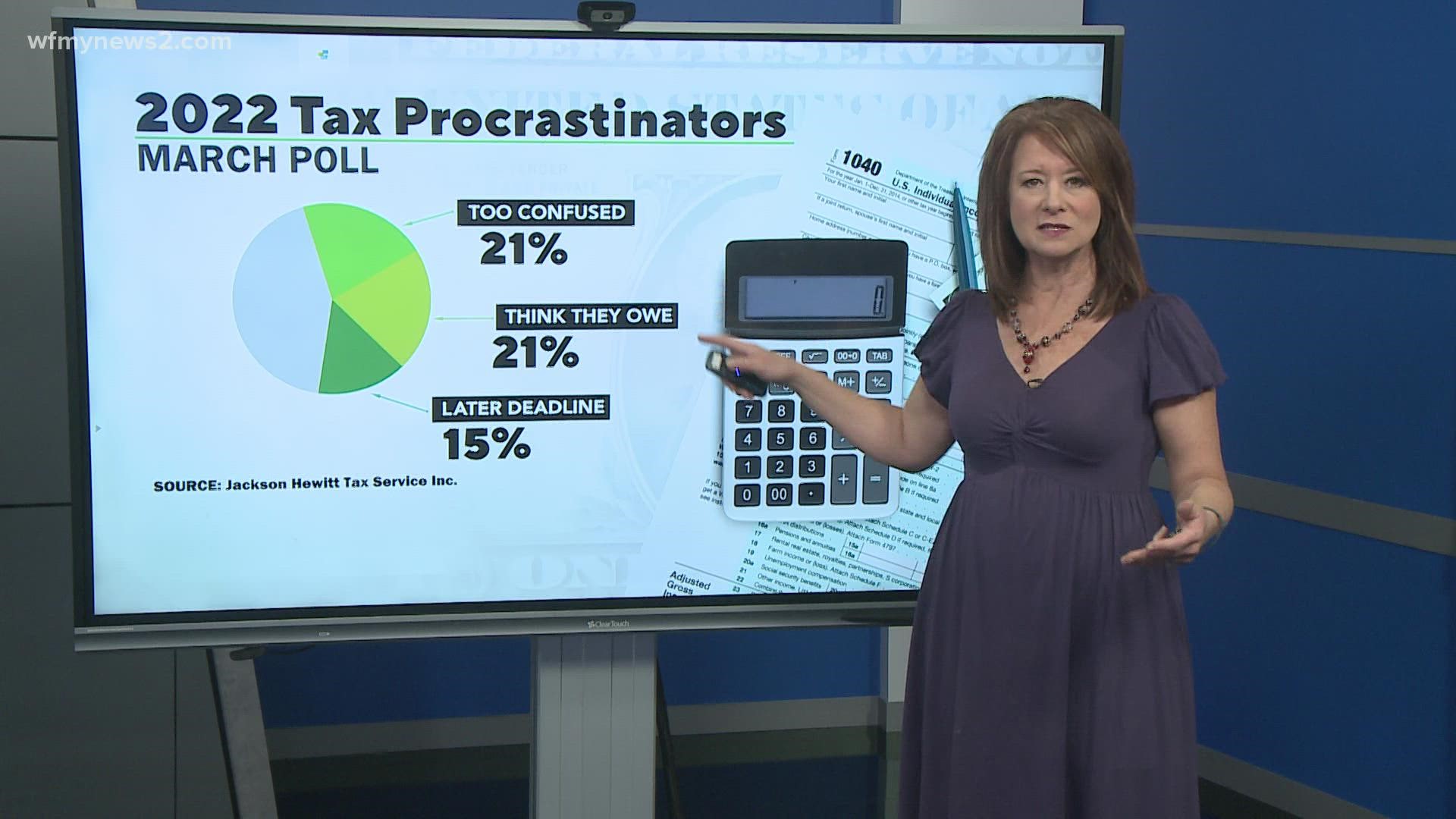

A Jackson Hewitt survey conducted last month found:

- 21% of respondents who waited to file are "too confused" about their personal tax situation.

- 21% think they owe money.

- 15% thought the deadline would be pushed back again.

Let's tackle all three of these.

First and foremost, Tax Day is Monday, April 18, it’s not being moved.

Now to the “owing money” part. Let’s be very clear, filing an extension will not delay your payment. You can request to file an extension by using Form 4868 and you find it right on the IRS website.

The extension gives you until October 17, 2022, to get all your paperwork together and file. The extension does not cover your payment. The estimated tax payment you owe is still due on April 18.

Taxes can be complicated and confusing. There are a lot of numbers and boxes to fill in.

“Child credit, dependent care credit, earned income credit, education credits - those are all big, all complicated, all very pro-taxpayer, but they're not automatic-check a box and get a big check," said Mark Steber, Jackson Hewitt

The answer to complications is tax preparing software. It prompts you and guides you and does the math. You can pay for it, but if you make under $73,000 AGI you can file for free through the IRS. The IRS gives you choices of about 10 different tax software systems. Again, this is guided tax software, much different than you just filling out the forms by yourself.