GREENSBORO, N.C. — Are you still waiting on your money from your third stimulus check?

How will you get your money?

Maybe you've already filed taxes and you're wondering if you'll get paid based on this year's return.

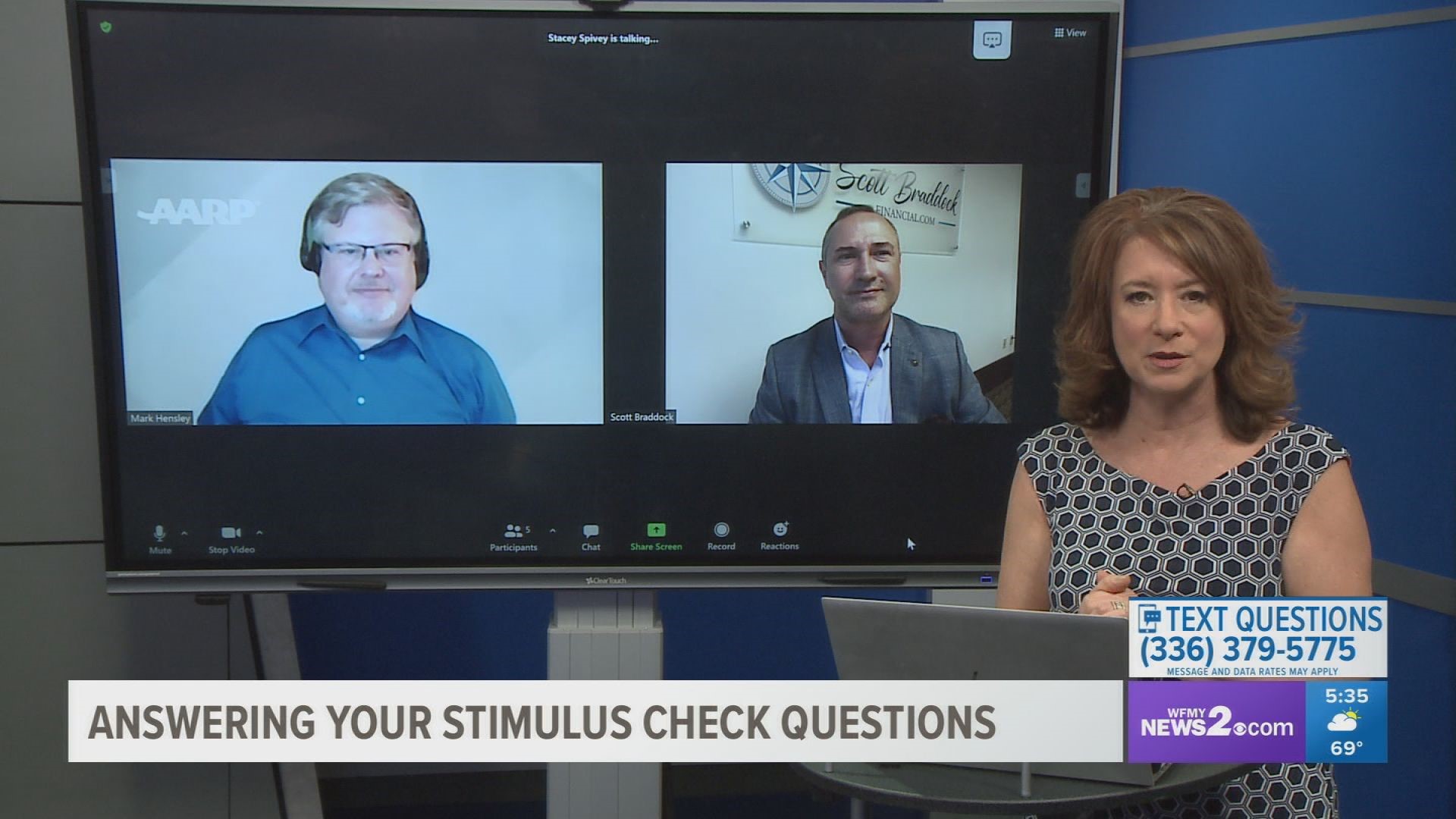

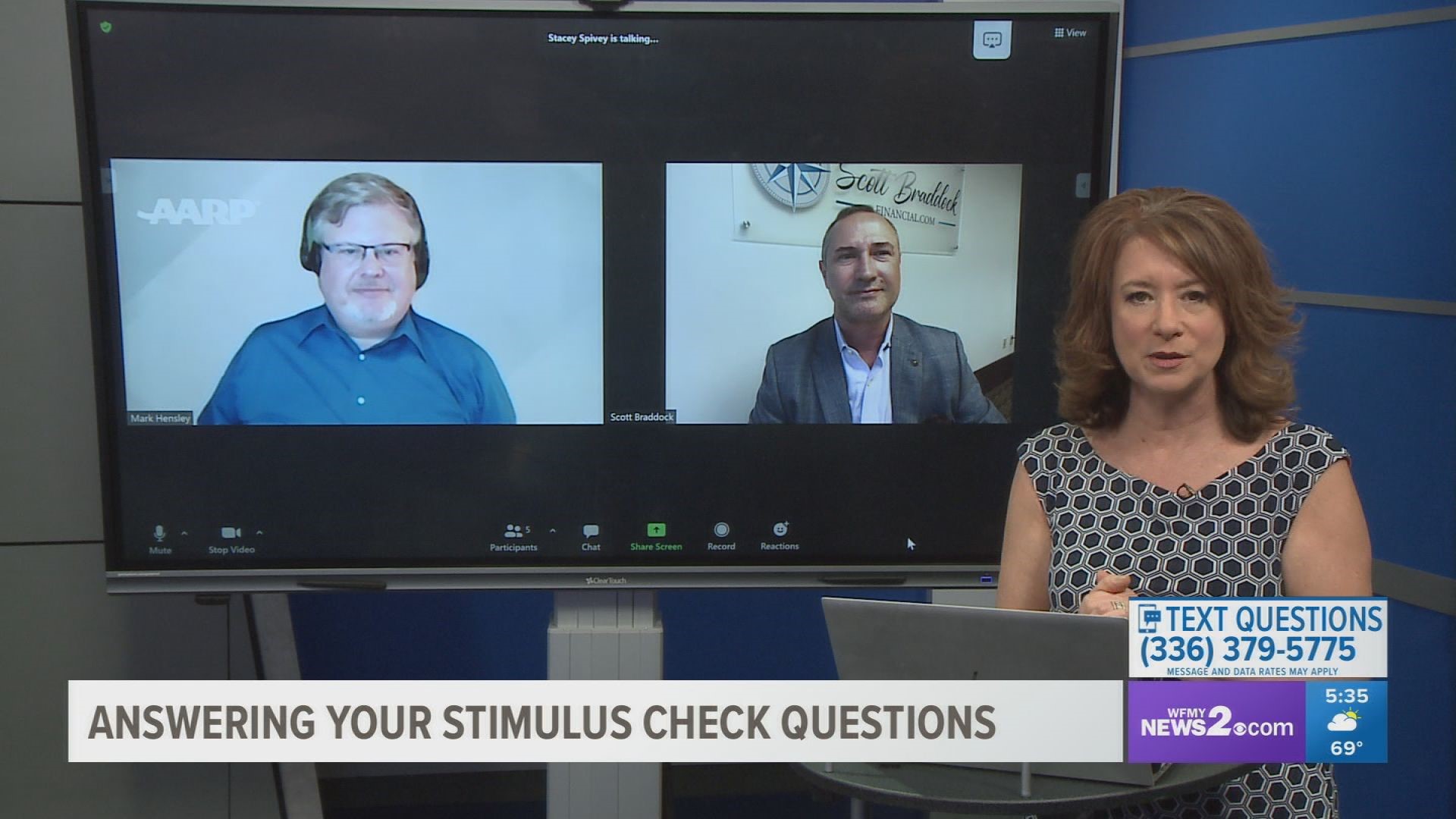

Scott Braddock with Scott Braddock Financial and Mark Hensley with AARP NC Triad Region joined us on 2 Wants to Know to answer your questions about stimulus payments.

WHEN WILL VA BENEFICIARIES GET THEIR MONEY?

The fourth batch of stimulus payments are expected to go out on Wednesday, April 14. VA beneficiaries who do not file taxes will be included in this round of payments. The majority of payments will be direct deposits. We'll find out on the 14th how many payments are being mailed.

WHAT IF I'M ON SOCIAL SECURITY, SSDI OR SSI?

If you get any of these benefits, and you didn't get a direct deposit on April 7th, keep an eye on the mail. About 1,000,000 stimulus checks were sent through the mail to recipients.

HOW CAN I SEE WHEN I'LL RECEIVE MY PAYMENT?

The IRS Get My Payment portal is active so you can check the status of your stimulus payment (also known as EIP, Economic Impact Payment). The portal will tell you:

-That the IRS sent your second Economic Impact Payment, also known as a stimulus payment.

-That the IRS sent your first payment. Some people received their first Economic Impact Payment in partial payments. If you received partial payments, the application will show only the most recent.

-Your payment type: direct deposit or mail.

Data is updated once per day overnight, so there's no need to check more than once per day.

The IRS says it could take three to four weeks for the check to get to you even though you're "mailed date" was a week or so ago. The reason? The date which showed a "mailed by" date, is more like the date your money was released so the check could be printed and mailed. So, when will your check get to your mailbox? You can know the day it is going to hit your mailbox if you use the USPS informed delivery service.

"STATUS UNAVAILABLE": HOW YOU GET YOUR STIMULUS

If your status says unavailable, that doesn’t mean you are totally out of getting or claiming the stimulus money. Your next step is to file taxes electronically and claim the stimulus money that way. Even if you don’t normally file taxes, you will need to file to see if there is any money through the Recovery Rebate Credit. There are several ways for you to file for free.

The credit is line 30 of all tax return forms.

EVEN IF YOU DON'T FILE TAXES, YOUR 2020 RETURN MAY BE THE ONLY WAY TO GET YOUR STIMULUS MONEY

This is the ONLY way for you to possibly claim the rest of the stimulus money. The IRS has nine options for you to file for FREE electronically. In fact, any taxpayer or family making less than $72,000 a year can file for free.

AARP Tax Aid can help you with e-filing. Volunteers and workers are being trained now. Operations open 2/12/2021.

WHAT IF I WANT TO SEND THE MONEY BACK?

There are only three situations where someone may want to send the stimulus check back to the IRS:

- If they are not a U.S. citizen

- If the person they received a check for is deceased

- If they don't want the money

At this time, however, the IRS has not released any guidelines on ways to send money back.

DEBIT CARDS

Did you throw out your debit card? Call MetaBank at 800-240-8100

What if I am still waiting on my other stimulus check?

The IRS finished sending out checks back in February. If you did not receive a check, you'll have to claim it on your 2020 tax return. When you're filing, whether that's on your own through a free service or having someone else assist, there will be a question asking if you received the stimulus payment. You'll answer "yes" or "no" and go from there. This will be line 30 when filing and it's called "Recovery Rebate Credit" on the standard tax return form.